Sony: Built for the Long Game

- Glenn

- Feb 13, 2021

- 21 min read

Updated: Dec 11, 2025

Sony is one of the world’s most well-known entertainment and technology companies, with strong businesses in gaming, music, movies, and image sensors. Its PlayStation platform continues to grow, and its anime and streaming services are reaching more fans than ever. Sony also leads in high-end camera sensors used in smartphones and other devices. With a mix of popular content, strong technology, and global reach, Sony is set up for long-term success. The question is: Should this entertainment and tech leader be part of your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in Keurig Dr Pepper at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Keurig Dr Pepper, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Sony Group Corporation is a diversified Japanese conglomerate with a global presence across entertainment, technology, and financial services. The company operates through several core segments: Game & Network Services, which includes the PlayStation gaming ecosystem; Music, covering recorded music, music publishing, and visual media; Pictures, which handles film and TV production through studios like Columbia Pictures and platforms such as Crunchyroll; Entertainment, Technology & Services, responsible for TVs, audio devices, cameras, and mobile phones; and Imaging & Sensing Solutions, which leads the market in CMOS image sensors used in smartphones, cameras, and increasingly in automotive and industrial applications. Sony also operates a Financial Services segment, offering insurance and banking in Japan, though this business is currently undergoing a spin-off. Sony’s competitive moat stems from its unique integration of world-class content, proprietary technology, global platform infrastructure, and a strong brand, giving it a defensible position across multiple industries. Sony’s strength lies in its ability to combine a wide array of businesses into a cohesive and synergistic group. It is one of the few global companies that connects world-class content, proprietary hardware, and platform infrastructure. Its vast library of intellectual property includes blockbuster films, popular video game franchises, and the world’s largest music publishing catalog. These assets not only generate recurring revenue through licensing and streaming but also provide a foundation for cross-media adaptations and experiences. The PlayStation ecosystem not only drives substantial profit through hardware and game sales but also serves as a powerful digital platform that strengthens fan engagement across Sony’s broader entertainment offerings, including games, movies, and music. Its content portfolio is among the deepest in the world. The company owns or controls rights to valuable franchises such as Spider-Man, The Last of Us, and Jumanji, along with a dominant position in music publishing through Sony Music Publishing and recorded music through Sony Music Entertainment. These assets generate steady income and form the basis for new revenue streams through remakes, spin-offs, streaming, and merchandising. Sony’s gaming division provides another powerful moat through its PlayStation ecosystem. With over 100 million monthly active users, PlayStation’s network services, subscription model, and strong lineup of first-party studios give it high engagement and switching costs. Sony’s recent push into live-service games and mobile gaming expands this moat by capturing more user time and spending across devices. In technology, Sony holds a dominant position in image sensors. It supplies leading smartphone manufacturers and is expanding into automotive and industrial imaging, where demand for high-performance sensors is growing. Sony’s decades of engineering expertise in consumer electronics also support leadership in professional audio-visual equipment and camera systems, further strengthening its relevance across sectors. A less tangible but equally important advantage lies in Sony’s ability to create synergy between its businesses. It has successfully turned gaming IP into TV and film hits, connected music artists to anime franchises, and is building shared digital infrastructure across its platforms. These bottom-up collaborative projects allow Sony to deepen engagement with fans while optimizing resources across the group. Sony also benefits from a global brand that is trusted across generations and geographies. Its distribution networks in electronics and media are extensive, and its long-standing customer relationships make it a preferred platform for both creators and consumers.

Management

Hiroki Totoki serves as the CEO of Sony Group Corporation, a position he formally assumed in 2024 after a long and influential career within the company. Known for his deep operational expertise and strategic clarity, Hiroki Totoki brings over three decades of experience across Sony’s core businesses, including electronics, finance, and entertainment. Prior to becoming CEO, Hiroki Totoki held several key leadership roles, including President, COO, and CFO of Sony Group Corporation, as well as CEO of Sony’s financial services arm and mobile communications division. These roles gave him an unusually comprehensive understanding of the company’s complex, multi-segment structure. Hiroki Totoki first joined Sony in 1987 and steadily rose through the ranks, developing a reputation as a steady-handed leader who could manage both turnaround efforts and long-term growth initiatives. As CFO, he was instrumental in strengthening Sony’s balance sheet and prioritizing investment in high-return areas such as image sensors, PlayStation services, and content IP. Under his financial leadership, Sony made bold yet disciplined capital allocation decisions, including key acquisitions and spin-offs that improved focus and profitability. In recent years, Hiroki Totoki has been a key architect of Sony’s strategy to strengthen cross-group collaboration, particularly between its technology platforms and entertainment businesses. He has publicly emphasized the importance of bottom-up innovation and long-term value creation over short-term gains. His leadership approach combines financial discipline with creative openness, fostering a culture that supports both artistic expression and technological advancement. With Sony now positioned as a unique entertainment and technology hybrid, Hiroki Totoki is expected to focus on unlocking synergies across the group, expanding the PlayStation platform into new services, and driving innovation in image sensing and mobility. Hiroki Totoki holds a degree in economics from the University of Tokyo. His management style is widely regarded as pragmatic, detail-oriented, and focused on long-term sustainability. As CEO of Sony Group Corporation, Hiroki Totoki is expected to continue building on Sony’s diverse strengths and guide the company through its next chapter of growth.

The Numbers

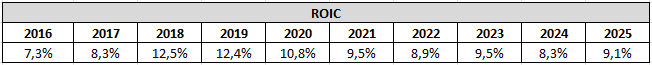

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Sony has had a relatively low ROIC over the past decade, only surpassing 10% in three of those years. At first glance, this might seem like a concern, especially when compared to more focused or asset-light companies. But it’s important to understand the reasons behind it. Sony operates a complex and diversified business. Some parts of the company, like image sensors and the PlayStation gaming platform, generate strong returns and high margins. Others, such as the film and television business under Sony Pictures, tend to have lower returns due to the nature of the industry. Making movies and producing TV shows involves large upfront costs, long production timelines, and financial outcomes that can be unpredictable. Management has acknowledged this, noting that the Sony Pictures segment currently delivers an ROIC of around 6%, making it one of the lowest-returning parts of the business. Even so, Sony Pictures still adds value to the group. It owns valuable content and platforms like Crunchyroll, and it plays a key role in Sony’s broader strategy. One of the company’s goals is to create stronger links between its content businesses and its technology platforms. For example, Sony is finding ways to connect PlayStation Network capabilities with video streaming and anime distribution. These kinds of synergies not only improve fan engagement but could also raise returns over time. CEO Hiroki Totoki has said that improving financial health is a top priority. The strategy is not to abandon lower-return businesses, but to help them contribute more by integrating them better into the overall group. This means using Sony’s strengths in data, user platforms, and technology to support content segments that are traditionally less efficient. So while Sony’s overall ROIC is not especially high, it reflects the diversity of its business model. Lower-return areas still play a meaningful role by supporting brand strength, IP development, and user engagement across the company. As long as Sony continues to allocate capital carefully and strengthen connections between its businesses, a modest ROIC is not something to worry about.

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Sony’s equity reached its highest level in fiscal year 2021 but then dropped in 2022. This decline was mainly due to changes in the value of some investments and other market-related factors. However, the drop was temporary. Since 2022, Sony’s equity has grown every year and by fiscal year 2025 it reached its second-highest level ever. This steady recovery shows that Sony is consistently earning money and reinvesting in its business while still managing its finances carefully. The fact that equity has grown again after the dip shows the company’s strength and stability. It also means Sony is in a good position to keep investing in new opportunities, even in areas that are more unpredictable like film or electronics. For long-term investors, the growth in equity over the past few years is a reassuring sign.

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins offer a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Sony’s free cash flow was negative in fiscal year 2023, which stood out because the company usually generates positive cash flow. The main reason for this was a sharp increase in spending on new investments, especially in its image sensor business. Sony put a lot of money into expanding its production capacity for image sensors, which are an important part of its future growth plans. On top of that, the company had to spend more on things like inventory and other short-term business needs, which also tied up cash. As a result, Sony spent more money than it brought in during that year. The situation improved quickly. By fiscal year 2025, free cash flow had not only recovered but reached a record high. This was thanks to strong earnings growth in areas like PlayStation, music, and image sensors. At the same time, Sony did not need to invest as heavily as it did in 2023, so more of its profit turned into free cash flow. Looking forward, Sony is expected to keep generating strong free cash flow, even if the exact number may go up or down from year to year. With growing contributions from its high-margin businesses and more efficiency across the company, Sony is in a good position to continue creating solid cash flow over the long term. Sony uses free cash flow on strategic investments such as expanding production capacity in image sensors and strengthening its content and gaming businesses. It is also returning capital to shareholders through dividends and buybacks, and management has stated that increasing dividends and buybacks is now a priority. Hence, investors can expect higher dividends and fewer shares outstanding in the future. The free cash flow yield is at its highest level since fiscal year 2020 and indicates that the shares are trading at an attractive valuation. However, we will revisit valuation later in the analysis.

Debt

Another important area to investigate is debt, and we want to see whether a business has a reasonable level of debt that could be paid off within three years. To assess this, we divide total long-term debt by earnings. When applying this measure to Sony, the result shows that it would take approximately 1.2 years of earnings to pay off its long-term debt. This is well below the three-year threshold, which means that debt is not a concern when investing in Sony. In fact, Sony has maintained a debt level under this threshold for more than a decade.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Risks

Competition is a risk for Sony. In every major segment, the company faces strong and often growing pressure from rivals. In gaming, Sony’s PlayStation competes directly with Microsoft’s Xbox and Nintendo. This battle is not only about hardware sales but increasingly about content, online services, and game studios. Microsoft’s acquisition of Activision Blizzard is a clear example of how aggressively competitors are moving to build their own content ecosystems, potentially threatening PlayStation’s content advantage. If Sony cannot maintain access to top game titles or innovate fast enough in areas like live services and mobile, it could lose user engagement and market share. In the film and television industry, Sony Pictures competes with major Hollywood studios and a growing number of global streaming platforms such as Netflix, Disney+, and Amazon Prime Video. These companies are spending heavily on original content, driving up the cost of acquiring talent, securing distribution, and attracting audiences. The result is a more crowded release calendar, tighter competition for theatrical screen time, and higher risk that content fails to break through. If Sony cannot consistently develop content that resonates, it may face margin pressure and less predictable cash flows in this segment. The music industry brings its own set of challenges. Sony Music competes with Universal Music Group and Warner Music, while also adapting to a market where streaming platforms like Spotify and Apple Music control distribution. As artists seek better deals and digital platforms shape pricing dynamics, labels like Sony must offer both competitive terms and global scale. The success of the music segment depends heavily on attracting and retaining top talent, which comes with high costs and no guarantee of commercial success. In consumer electronics and imaging, Sony faces intense global competition from companies such as Samsung, Apple, Canon, and Xiaomi. These rivals often have deep pockets and strong positions in local markets. In areas like image sensors, where Sony has a technological edge, there is always the risk that competitors will catch up. To stay ahead, Sony must continue investing in research and development, anticipate evolving customer needs, and launch new products quickly and effectively. Failure to do so could lead to lost market share and shrinking margins.

Macroeconomic conditions are a significant risk for Sony due to the company’s global reach and broad exposure to consumer spending, supply chains, and financial markets. Sony earns over 70 percent of its revenue outside Japan, which means fluctuations in global economic conditions, including in the United States, Europe, and China, can have a major impact on its performance. When the global economy slows or enters a recession, consumer demand for discretionary products like PlayStation consoles, televisions, music subscriptions, and movie tickets tends to decline. This can lead to lower sales and weaker profitability across several of Sony’s major business segments. Sony is also exposed to foreign exchange risk. As a Japanese company that reports in yen but generates most of its sales in other currencies, exchange rate movements can significantly influence reported earnings. A strong yen reduces the value of overseas revenue when converted back into yen, which hurts Sony’s financial results even if sales volumes remain stable. On the other hand, a weaker yen, like the one seen in recent year, boosts the yen value of foreign revenue and makes exports more competitive. This volatility in currency markets adds an extra layer of uncertainty to forecasting and financial planning. Inflation and rising interest rates present additional challenges. Higher costs for labor, components, energy, and transportation can squeeze Sony’s profit margins, especially in hardware-heavy segments like consumer electronics and gaming. At the same time, rising interest rates around the world can reduce consumer disposable income, making people more cautious about spending on non-essential goods and services. This affects not just product sales but also the performance of content-driven businesses like film and music, which depend on steady consumer engagement. Beyond economic factors, Sony’s operations are spread across many countries, which exposes the company to political risks, trade disruptions, and supply chain challenges. For example, much of Sony’s manufacturing and sourcing takes place in China and Southeast Asia. Disruptions in these regions, whether due to geopolitical tensions, public health issues, or changes in trade policy, can delay product availability, increase costs, or make it harder to respond to changing consumer demand.

Reliance on third-party distribution is a risk for Sony. Sony relies heavily on wholesalers, retailers, resellers, and third-party distributors to bring its products and content to market, and this dependency poses a structural risk. These partners handle everything from the sale of electronics and gaming hardware to the distribution of music, films, and television content across cable, satellite, and online platforms. Because many of these distributors also carry competing products, Sony has limited control over how its offerings are prioritized or promoted to end consumers. This risk is especially relevant in the Pictures segment, where Sony depends on theater chains for box office releases and on streaming and broadcast partners for television distribution. If licensing fees from these partners decline or if Sony is unable to renew broadcasting agreements on favorable terms, the company could see a drop in both advertising and subscription revenue. This risk extends to Sony’s television networks, which are carried by third-party platforms that may decide to renegotiate terms or even drop Sony channels altogether. In addition, many of Sony’s distribution partners face their own challenges, such as rising competition from e-commerce giants, shifting consumer behavior, and broader economic pressures. If these companies reduce their inventory, scale back marketing support, or exit the market entirely, Sony could face sudden disruptions in product availability and lower sales. While Sony does invest in incentive programs to encourage partners to prioritize its products, there is no guarantee that these efforts will result in meaningful sales growth or improved market positioning. The broader trend toward digital and direct-to-consumer channels helps reduce some of this reliance, but for now, third-party distributors remain an essential part of Sony’s global business. Any instability or underperformance among these partners could have a negative effect on Sony’s sales, margins, and overall financial performance.

Reasons to invest

Gaming is a reason to invest in Sony is one of the company’s key growth engines and a compelling reason to invest. At the heart of this segment is the PlayStation platform, which continues to grow both in terms of hardware sales and user engagement. PlayStation 5 is now well into its lifecycle, and rather than simply replacing the previous generation, it is expanding the overall user base. Millions of users are still active on PlayStation 4, while many new users are joining the PlayStation ecosystem directly through PlayStation 5. As a result, monthly active users have grown year over year for 14 consecutive quarters, and management expects this trend to continue. Sony’s strategy for the gaming business focuses not just on selling consoles and games, but on growing recurring revenue through its digital ecosystem. With the PlayStation Store and PlayStation Plus, Sony is able to monetize its large user base through subscriptions, digital downloads, add-on content, and cloud services. The company is now focusing on increasing average revenue per user by personalizing the user experience and optimizing pricing, which supports long-term profitability. Network services, in particular, are expected to provide stable and growing revenue as the installed base continues to expand. A strong pipeline of first-party titles is another reason to be optimistic. Upcoming sequels like Ghost of Yotei and Death Stranding 2 are expected to attract loyal fans, while live service games such as Marathon aim to capture new audiences and provide ongoing revenue through in-game purchases and content updates. Already released titles like Helldivers 2 and Destiny 2 are continuing to perform well, adding to the momentum. These first-party and third-party games help deepen user engagement and extend the lifecycle value of each console. Sony is also expanding its ecosystem through peripherals and new technologies. The PlayStation Portal, which allows cloud-based portable gaming, represents a step toward greater platform flexibility and more frequent user interaction. Hardware like this supports additional revenue while reinforcing user commitment to the PlayStation environment.

Anime is a reason to invest in Sony. Anime has become a strategic growth pillar for Sony, with rising global demand and strong internal integration across multiple business units. Through its ownership of both Aniplex and Crunchyroll, Sony has built a powerful end-to-end anime ecosystem that spans content creation, distribution, licensing, and fan engagement. As global interest in anime continues to expand, Sony is well-positioned to benefit across several of its segments. Crunchyroll, Sony’s anime-focused streaming platform, now has over 17 million paid subscribers and continues to grow. The broader anime streaming market is expected to grow at a compound annual rate in the double digits through 2030, and Sony’s scale and global reach give it a strong competitive edge. The company is actively investing in Crunchyroll’s growth by improving service offerings, expanding into e-commerce, mobile gaming, and manga, and increasing integration with other parts of the Sony Group. One example of this integration is the collaboration between Crunchyroll and PlayStation Network. As of early 2025, PlayStation 5 users can sign up for Crunchyroll subscriptions directly through their consoles, making it easier to acquire and retain paid members. This kind of synergy allows Sony to use its large gaming user bas, its most active fan community, to boost another fast-growing service within its ecosystem. The goal is to create a seamless experience that deepens engagement and drives monetization across platforms. Another area of opportunity is in adapting existing Sony IP into anime. An upcoming example is the anime adaptation of Ghost of Tsushima: Legends, a title originally developed by Sony Interactive Entertainment. This kind of cross-segment collaboration, between gaming, anime, streaming, and music, demonstrates Sony’s ability to recycle and extend the life of its intellectual property across formats. Looking ahead, Sony expects anime to remain a major growth driver, not just for the Pictures segment but for the entire group. Anime's appeal spans cultures, age groups, and platforms, and Sony’s strategy of connecting fan communities through its “engagement platform” initiative is designed to capture this momentum. As it expands Crunchyroll’s reach, strengthens production capabilities, and unlocks synergies with other businesses, Sony is building an anime ecosystem with high growth potential and strong recurring revenue.

Imaging and Sensing Solutions is a reason to invest in Sony. Sony’s Imaging and Sensing Solutions (I&SS) segment is a key long-term growth driver with strong competitive advantages in technology, scale, and market leadership. The business primarily focuses on image sensors, which are essential components in smartphones, cameras, industrial devices, and increasingly in cars and other smart infrastructure. Sony is the global leader in image sensors by market share and is deeply embedded in the supply chains of major smartphone manufacturers, especially in the premium segment where demand for high-performance sensors continues to rise. The core of Sony’s I&SS business is its mobile image sensor division. Even in a mature smartphone market, Sony is benefiting from structural trends such as the shift toward larger sensor sizes and higher-end photography capabilities. Mobile phone makers are pushing for improvements in resolution, low-light performance, power efficiency, and dynamic range, areas where Sony’s sensors are particularly strong. To stay ahead, Sony is introducing a new generation of manufacturing processes and investing in advanced sensor designs like the two-layer transistor pixel technology, which allows more light capture and higher image quality. These innovations give Sony a competitive edge in performance and help it maintain pricing power in a competitive field. Beyond mobile, Sony is also expanding in industrial and automotive applications. While these markets are smaller today, they offer steady profits and attractive long-term potential. Industrial image sensors are used in everything from factory automation to security systems, and Sony is already well-positioned in these segments. Automotive sensors are a promising frontier, especially with the rise of electric vehicles and autonomous driving. Looking ahead, Sony expects the image sensor business to evolve further, driven by the growing need for high-precision, miniaturized sensors in mobile, industrial, and automotive applications.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 1,26, which is from the fiscal year 2025. I have selected a projected future EPS growth rate of 8%. Finbox expects EPS to grow by 8% in the next five years. Additionally, I have selected a projected future P/E ratio of 16, which is double the growth rate. This decision is based on Sony's historically higher price-to-earnings (P/E) ratio. Finally, our minimum acceptable rate of return has already been established at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be $10,76. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Monster at a price of $5,38 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 15.482, and capital expenditures were 4.318. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 3.023 in our calculations. The tax provision was 2.093. We have 6.029 outstanding shares. Hence, the calculation will be as follows: (15.482 – 3.023 + 2.093) / 6.029 x 10 = $24,14 in Ten Cap price.

The final calculation is referred to as the Payback Time price. It is a calculation based on the free cash flow per share. With Sony's free cash flow per share at $1,85 and a growth rate of 8%, if you want to recoup your investment in 8 years, the Payback Time price is $21,25.

Conclusion

I believe that Sony is an intriguing company with a great management. It has built a competitive moat through a unique integration of world-class content, proprietary technology, global platform infrastructure, and a strong brand. While Sony’s return on invested capital has been underwhelming, this reflects the scale and complexity of its business, where certain lower-ROIC segments still contribute value in other strategic ways. Notably, Sony recently delivered its highest free cash flow and levered free cash flow margin ever, signaling strong underlying performance despite modest ROIC figures. Competition is a risk because Sony faces powerful rivals across all its core segments, including gaming, film, music, and electronics. These competitors invest aggressively in content, technology, and distribution, which forces Sony to continually innovate and defend its market position or risk margin pressure and slower growth. Macroeconomic conditions also pose a risk due to Sony’s global reach and reliance on consumer spending; slowdowns, inflation, and currency volatility can hurt demand, squeeze margins, and make earnings harder to predict. Sony’s dependence on third-party distributors is another vulnerability, as it limits the company’s control over how its products are promoted and sold. If these partners cut back support, face financial troubles, or renegotiate terms unfavorably, Sony’s sales and profitability could suffer. On the positive side, gaming is a key reason to invest, with the PlayStation platform driving user engagement, strong hardware sales, and growing digital revenue through subscriptions and in-game content. Anime is another growth engine, supported by Sony’s ownership of Aniplex and Crunchyroll and strengthened by rising global demand, internal synergies, and new monetization opportunities. Imaging and Sensing Solutions also stands out as a reason to invest, with Sony leading the global image sensor market and expanding into industrial and automotive segments that promise long-term growth and stable earnings. I believe Sony is a great company, and while I do not expect its shares to rise rapidly, buying below the Ten Cap price of $24 could offer a solid opportunity for long-term investors.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how to do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and in order to receive, you will have to give (Warren Buffett and Mohnish Pabrai are great examples). If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to Four Paws. They do a lot of great things for animals such as rescuing the world's loneliest elephant from a zoo in Pakistan and moved it to an elephant sanctuary in Cambodia. If you enjoyed my analysis and want some good karma, I hope that you will donate a little to Four Paws here. Even a little will do a huge difference for the animals around the world. Thank you.

Comments