Deckers Outdoor: Winning with Focused Growth

- Glenn

- Aug 2, 2025

- 19 min read

Updated: Dec 11, 2025

Deckers Outdoor is the company behind two popular footwear brands: UGG and HOKA. UGG is known for its comfortable, stylish boots and has been a reliable source of cash for many years. HOKA, on the other hand, is a fast-growing running shoe brand that’s gaining popularity around the world. Together, these brands give Deckers both stability and room to grow. The company also stands out for its strong execution, new product innovations, and increasing focus on international markets. The big question is: Should this global footwear company earn a place in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in Deckers at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Deckers, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Deckers Outdoor Corporation is a global footwear and apparel company that specializes in transforming niche products into dominant lifestyle and performance brands. Its business is anchored by two core brands: UGG, an iconic sheepskin-based casual footwear brand with broad demographic appeal, and HOKA, a premium performance running brand known for its lightweight, cushioned shoes. Together, these two brands made up more than 95 percent of sales in fiscal year 2025. The company also owns Teva, a sport sandal brand, and AHNU, a performance lifestyle brand, though it is phasing out Koolaburra and has sold Sanuk to concentrate on its strongest growth platforms. Deckers reaches consumers globally through a mix of wholesale partners and direct-to-consumer channels, including its own e-commerce websites and a network of branded retail stores. The company’s retail strategy includes concept and outlet stores for both UGG and HOKA, which help strengthen brand presence, improve inventory management, and maintain pricing discipline. Deckers’ moat lies in the strength and distinct positioning of its two leading brands, UGG and HOKA, which command strong customer loyalty, operate in separate and defensible niches, and support premium pricing through brand equity, innovation, and direct consumer engagement. Each brand has carved out a clear space in the market, enabling Deckers to serve multiple consumer segments without internal overlap, while maintaining pricing power and customer stickiness that are difficult for competitors to replicate. Innovation is another core part of Deckers’ advantage. HOKA’s signature cushioning technology and UGG’s continued focus on comfort and materials innovation help the brands remain relevant and justify premium price points. Deckers also benefits from a strong direct-to-consumer infrastructure that boosts margins, deepens consumer relationships, and provides valuable insights for product development. Deckers outsources all of its production to independent manufacturers, primarily located in Southeast Asia. This asset-light approach gives the company flexibility, scalability, and the ability to adapt quickly to changes in demand without the capital burden of owning and operating factories. It also allows Deckers to focus its resources on brand building, product design, and direct consumer engagement rather than manufacturing operations.

Management

Stefano Caroti serves as the CEO of Deckers Outdoor Corporation, a position he assumed in August 2024 after nearly a decade of senior leadership roles within the company. He was also elected to the Board of Directors in September 2024. With over 30 years of experience in the global footwear and apparel industry, Stefano Caroti brings deep expertise in general management, sales, retail, product, marketing, and brand strategy across both performance and lifestyle segments. Prior to becoming CEO, Stefano Caroti served as Deckers’ Chief Commercial Officer from April 2023 to July 2024, where he oversaw the company’s global commercial operations across wholesale, retail, and digital channels. Before that, he held the role of President of Omni-Channel from 2015 to 2023, during which he played a central role in shaping Deckers’ direct-to-consumer strategy and expanding its global retail presence, particularly for the HOKA and UGG brands. Before joining Deckers, Stefano Caroti held senior executive roles at major global sportswear companies. He was the Chief Commercial Officer and Managing Director at PUMA from 2008 to 2014, where he was responsible for global wholesale, retail, and e-commerce operations, as well as oversight of geographic business units. Prior to that, he spent over a decade at Nike, Inc., where he held multiple leadership roles spanning sales, marketing, and product. As Vice President of EMEA Commerce at Nike, he led the entire wholesale, retail, and digital business across Europe, the Middle East, and Africa. Stefano Caroti holds a Bachelor of Arts with honors from Middlebury College. Known for his global perspective and deep commercial acumen, he is seen as a leader who combines operational discipline with a strong commitment to brand building. As CEO of Deckers, Stefano Caroti is expected to continue driving the company’s strategy of focused brand investment, direct-to-consumer expansion, and disciplined capital allocation, positioning Deckers for continued long-term growth.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Deckers has consistently achieved a ROIC above 10% over the past ten years and above 20% in the past seven. The company has delivered strong returns because it runs a focused and efficient business. Rather than managing a wide range of brands, Deckers has concentrated on just two core ones, UGG and HOKA, which are both well known and popular in their own categories. These brands give the company pricing power, which supports healthy profits. Deckers also does not own any factories. Instead, all of its products are made by outside manufacturers, which helps keep costs low and avoids heavy investments in equipment or buildings. The company also spends carefully and avoids unnecessary complexity. It has grown by building up the brands it already owns rather than buying new ones. In the past two years, returns have reached new highs above 30%. This is partly because HOKA has grown very quickly without needing much extra spending to support that growth. At the same time, more customers are buying directly from Deckers through its websites and stores instead of through third-party retailers. These direct sales are more profitable and now make up a bigger part of the business. On top of that, strong demand and tight cost control have led to even better profit margins. Together, these factors mean that Deckers is now earning more from every dollar it puts into the business than ever before.

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Deckers has increased its equity every year since 2019 because it has consistently generated strong profits and retained a large portion of those earnings rather than paying them out as dividends. The company does not pay a regular dividend and instead uses its free cash flow to reinvest in the business and buy back shares. Since share buybacks reduce the number of shares outstanding but do not reduce equity in the same way dividends do, retained earnings have continued to accumulate on the balance sheet. This has steadily increased the company’s total equity over time. In addition to strong earnings, Deckers has managed its costs well and maintained high profit margins, especially as HOKA has grown and direct-to-consumer sales have become a larger part of the business. These trends have supported growing net income, which feeds directly into equity through retained earnings.

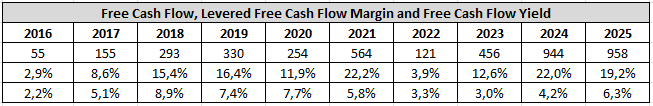

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins offer a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Deckers reached record-high free cash flow in the past two fiscal years mainly because of strong earnings growth, improved margins, and tight control over spending. The rapid expansion of HOKA, which is a high-growth and high-margin brand, played a big role. As HOKA became a larger part of the business, overall profits increased without a matching rise in costs. At the same time, Deckers kept capital spending low by sticking to its asset-light model, outsourcing all manufacturing and avoiding major investments in factories or infrastructure. The company also benefited from strong full-price selling and a growing share of direct-to-consumer sales, which helped push gross margins higher and allowed more of each dollar earned to flow through to cash. The slight decrease in free cash flow margin in fiscal year 2025, despite still being at a high level, reflects a few short-term factors. Deckers increased spending in areas like marketing, retail store expansion, and supply chain improvements to support long-term growth, especially for HOKA. There was also a modest rise in working capital needs, including higher inventory levels to meet global demand and timing differences in payments. These types of investments can temporarily reduce free cash flow margin, even when overall financial performance remains strong. Deckers does not pay regular dividends, but as free cash flow continues to grow, shareholders can expect more buybacks. The company has consistently used its strong cash generation to repurchase shares, reducing the share count and enhancing long-term shareholder value. Free cash flow yield is at its highest level since fiscal year 2020, suggesting that the shares are trading at an attractive valuation. However, we will revisit valuation later in the analysis.

Debt

Another important area to investigate is debt, and we want to see whether a business has a reasonable level of debt that could be paid off within three years. To assess this, we divide total long-term debt by earnings. However, it is not possible to make the calculation on Deckers as they have no long-term debt. This is a positive sign. A debt-free balance sheet gives the company more flexibility, lowers financial risk, and means they are not under pressure to make interest payments or refinance loans. It also allows more of the company’s cash to be used for growth, buybacks, or other shareholder returns.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Risks

Macroeconomic conditions are a risk for Deckers. The company’s core products, especially those under the UGG and HOKA brands, are premium-priced and rely heavily on consumer confidence and discretionary spending. When economic conditions worsen, consumers often reduce or delay non-essential purchases, which can directly affect Deckers’ sales. Rising interest rates, inflation, increased living costs, and higher consumer debt levels all make people more cautious with their money, and this is particularly important in the U.S., which remains Deckers’ largest market. Management has already expressed caution about the U.S. consumer heading into fiscal year 2026, citing low consumer sentiment and uncertainty about how purchasing behavior may change in the coming months. Economic uncertainty also makes it harder to predict demand, which complicates inventory planning and can lead to either missed sales or higher markdowns. In tougher conditions, Deckers may be forced to lower prices or increase promotional activity to keep demand steady, which would hurt profit margins. A large part of Deckers’ sales also goes through wholesale partners such as department stores, specialty retailers, and online marketplaces. In a weaker economy, these partners may reduce their orders, delay payments, or face financial challenges of their own, all of which could negatively impact Deckers’ revenue and cash flow. The company also faces external pressures such as tariffs, which could significantly raise costs and force pricing decisions that affect both demand and profitability. Although Deckers has pricing power and is working with factory partners to share costs, management expects that these efforts will not fully offset the impact.

Competition is a risk for Deckers. The company operates in a highly competitive industry where both large global players and smaller upstarts are constantly fighting for consumer attention and market share. The success of Deckers’ two core brands, UGG and HOKA, has attracted direct competition from both established footwear companies and new entrants looking to capitalize on their popularity. In performance running, for example, HOKA faces growing pressure from competitors like On Running, Nike, and Adidas, many of which are releasing their own maximalist or highly cushioned designs in response to HOKA’s success. Similarly, UGG continues to face competition from brands offering similar styles at lower prices or through faster fashion cycles. Many of Deckers’ competitors have significantly greater financial, marketing, and technological resources. This allows them to outspend Deckers on advertising, launch new products more quickly, or use advanced tools like AI and data analytics to better understand and target consumer preferences. Larger competitors also tend to have deeper relationships with key retailers and distributors, giving them leverage in negotiations and preferred shelf space. On top of that, the rise of e-commerce and easier access to offshore manufacturing has lowered the barrier to entry for smaller brands, increasing competition even further. This environment creates constant pressure on Deckers to maintain the relevance and appeal of its products while holding the line on pricing. If competitors discount aggressively to clear inventory or win market share, Deckers may be forced to lower its own prices or spend more on marketing to keep up. That could lead to shrinking margins and reduced profitability. In addition, many of Deckers’ retail partners, especially department stores and specialty retailers, are themselves facing intense competition, which can weaken their financial position and, in turn, impact their ability to stock and promote Deckers’ products.

Rapid changes in consumer preferences are a significant risk for Deckers. The company operates in the footwear and apparel industry, where trends shift quickly and unpredictably. What is fashionable or desirable one season may lose relevance the next, and consumer expectations, especially for premium brands like UGG and HOKA, are constantly evolving. Deckers’ success depends on its ability to accurately anticipate these shifts and deliver products that match what consumers want, both in terms of style and performance. If the company fails to do this, it risks declining sales, excess inventory, and a weakening of brand loyalty. This is particularly important for Deckers because its products are discretionary and often premium-priced. If styles fall out of favor or are priced too high for what the market is willing to pay, consumers may turn to alternatives. For example, UGG’s iconic winter boots have enjoyed long-standing popularity, but a change in fashion cycles could easily reduce demand. Similarly, while HOKA is currently gaining momentum in performance running, it could lose relevance if another brand captures attention with a new design or innovation. Deckers acknowledges that not all new releases will succeed, and missteps in design or pricing could hurt the perception of the brand. The risk is compounded by the fast-moving nature of digital culture. Social media trends, influencer endorsements, and online reviews can quickly shape consumer opinion, for better or worse. A poorly received product or controversy, even if based on misinformation, can spread quickly and damage brand image. Consumers are also increasingly attentive to broader issues like sustainability, ethical sourcing, and social values. Any misalignment between brand messaging and consumer expectations in these areas can hurt Deckers’ reputation and erode trust. Deckers must constantly stay ahead of shifting tastes, not only by innovating but also by making sure its marketing, pricing, and brand positioning stay relevant. Even strong brands are vulnerable if they fail to evolve with the consumer. This ongoing need to stay in tune with unpredictable preferences makes fashion and consumer perception one of the most persistent and difficult-to-control risks for the company.

Reasons to invest

A strong portfolio of brands is a reason to invest in Deckers. The company is built around two highly successful and complementary brands, UGG and HOKA, that each play a distinct role in driving growth and profitability. UGG continues to be a dependable cash generator with strong global demand and a loyal customer base. Its premium positioning, combined with disciplined inventory management and a scarcity-driven model, supports high margins and pricing power. Even after many years of success, UGG remains highly relevant and continues to perform well across regions and sales channels. At the same time, HOKA represents the company’s most exciting long-term growth engine. Originally known for performance running shoes, HOKA is now expanding its reach into adjacent categories like trail, hiking, fitness, and everyday comfort. The brand is gaining market share and building global awareness, and as more people discover it, Deckers is carefully expanding distribution to match that demand. Management views rising brand awareness as a turning point, creating opportunities to bring HOKA to more consumers through select retail partners and new markets. What makes this especially attractive is that HOKA’s growth is not coming at the expense of profitability, it contributes to strong margins and healthy cash flow. Together, UGG and HOKA give Deckers both stability and upside. UGG provides consistent earnings and brand strength, while HOKA drives expansion into new consumer segments and geographies. This combination creates a powerful foundation for long-term value creation. Deckers has also shown discipline in focusing its resources on these high-potential brands, exiting lower-margin businesses to sharpen its strategy. As these two brands continue to scale globally, backed by a lean operating model and strong cash generation, the company is well positioned to deliver sustainable growth and increasing shareholder returns.

Innovation is a key reason to invest in Deckers. The company continues to prove that it can stay ahead of consumer trends and expand its reach through continuous product development and thoughtful design upgrades. HOKA, in particular, has built its reputation not just on comfort and performance but on delivering cutting-edge footwear that appeals to both serious athletes and everyday consumers. Deckers has steadily expanded HOKA’s product lineup with new models designed for specific use cases, such as road racing, trail running, hiking, and fitness, each one featuring advanced materials, updated cushioning technologies, and unique design elements. This pipeline of innovation has allowed HOKA to grow its addressable market while maintaining momentum across multiple categories and price points. At the same time, UGG has quietly evolved from a seasonal winter boot brand into a more versatile lifestyle brand, offering sneakers, sandals, clogs, and hybrid products that reflect changing fashion tastes and year-round wearability. Deckers has been particularly successful in launching new UGG styles like the Tasman, Lowmel, and Goldenstar Clog, which maintain the brand’s signature look and feel while attracting new customer segments, including men. Collaborations, celebrity endorsements, and seasonal product extensions all reflect a deliberate strategy to keep the brand fresh and culturally relevant. What makes Deckers’ innovation strategy compelling is that it is grounded in consumer insight and focused on long-term brand equity. Rather than chasing short-lived trends, the company invests in platform updates, performance improvements, and new silhouettes that build on existing brand strengths. This approach not only supports growth, but also helps maintain pricing power, brand loyalty, and gross margin stability. Both HOKA and UGG are succeeding by putting the consumer first and continuously updating their product offerings in ways that feel authentic to each brand. For investors, this innovation-led approach adds confidence that Deckers can keep driving demand, expanding market share, and adapting to whatever comes next in the dynamic footwear space.

International growth is a reason to invest in Deckers. While the company has already built strong momentum in the U.S., its greatest long-term opportunity lies in expanding its global footprint. Both of Deckers’ core brands, HOKA and UGG, are gaining traction internationally, with sales outside the U.S. growing faster than in the domestic market. This is especially promising because Deckers remains less penetrated abroad than many of its global peers, giving it significant room to grow. HOKA is still in the early stages of its global expansion, and awareness is rising quickly across key regions like Europe and Asia. The company is building partnerships with specialty retailers, increasing its presence in performance and lifestyle channels, and launching local marketing initiatives to raise visibility. A key part of this international strategy is the opening of flagship HOKA stores in influential cities. These locations go beyond traditional retail, for example, the new HOKA Experience Center in Shanghai includes a high-tech testing lab, product personalization stations, and space for community events, all designed to immerse visitors in the full HOKA brand. These efforts not only support sales but also create strong emotional connections with consumers in new markets. UGG, while more established globally, still has room to grow. Shifting fashion trends toward casual, comfortable footwear favor UGG’s product offering, and the brand is seeing success with new styles and year-round products that broaden its appeal. Deckers is applying its proven U.S. playbook to grow UGG abroad, including direct-to-consumer expansion, inventory discipline, and strategic marketing aimed at building brand strength. As international sales grow and make up a larger share of the business, Deckers becomes more diversified and resilient. Its ongoing investments in brand building, local partnerships, and premium retail experiences position the company well to capture global demand and deliver sustained long-term growth.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 6,33, which is from the fiscal year 2025. I have selected a projected future EPS growth rate of 7%. Finbox expects EPS to grow by 7% over the next five years. Additionally, I have selected a projected future P/E ratio of 14, which is double the growth rate. This decision is based on Deckers' historically higher price-to-earnings (P/E) ratio. Finally, our minimum acceptable rate of return has already been established at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be $43,09. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Deckers at a price of $21,55 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 1.045, and capital expenditures were 86. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 60 in our calculations. The tax provision was 277. We have 151,8 outstanding shares. Hence, the calculation will be as follows: (1.045 – 60 + 277) / 151,8 x 10 = $83,14 in Ten Cap price.

The final calculation is referred to as the Payback Time price. It is a calculation based on the free cash flow per share. With Deckers' free cash flow per share at $6,31 and a growth rate of 7%, if you want to recoup your investment in 8 years, the Payback Time price is $69,27.

Conclusion

I believe Deckers is an intriguing company led by strong management, with a defensible moat built around its two core brands, UGG and HOKA. These brands occupy distinct, premium segments, benefit from strong customer loyalty, and support attractive margins. The company has consistently delivered a high and rising ROIC, reaching record levels in recent years, alongside record-high free cash flow in fiscal year 2025. While free cash flow margins decreased slightly, they remain high. Macroeconomic conditions pose a risk because Deckers relies on discretionary consumer spending, which can decline in downturns, especially in its largest market, the U.S. Economic uncertainty can also impact wholesale partners and increase cost pressures, including from tariffs, potentially hurting sales and margins. Competition is another concern, as Deckers’ success has attracted larger, well-funded rivals and new entrants, which could pressure pricing, innovation pace, and distribution relationships. Additionally, the fast-changing nature of consumer preferences is a structural risk in the footwear and apparel industry; a misstep in trend forecasting or product development could weaken brand momentum. Still, a strong portfolio is a clear reason to invest: UGG offers consistent profitability and brand strength, while HOKA brings scalable growth with solid economics. Both brands benefit from Deckers’ innovation strategy, which focuses on consumer-driven design upgrades and platform extensions that deepen engagement and widen appeal. International expansion adds another compelling layer to the story, with both brands gaining traction in underpenetrated markets across Europe and Asia, supported by retail investments, local partnerships, and rising awareness. Overall, there’s a lot to like about Deckers, and buying shares below the Ten Cap price of $83 could represent a good long-term investment opportunity.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how to do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and to receive, you will have to give. If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to Oceans Alive. It is an organization that does a lot of great work to ensure a healthy and sustainable future for our oceans that will benefit us all. If you have a few Euros/Dollars/Pounds or whatever to spare, please donate here. Even one or two Euros will make a difference. Thank you.

Comments