Nike: Strength in the Swoosh

- Glenn

- Aug 14, 2021

- 19 min read

Updated: Dec 11, 2025

Nike is the world’s biggest sportswear brand, known for its famous Swoosh logo, athlete partnerships, and global presence. It sells everything from high-performance shoes to everyday clothing, combining strong branding with global scale. Today, Nike is focused on getting back to growth by creating better products for specific sports, rebuilding relationships with retailers, and speeding up innovation. The question is: Does Nike still deserve a place in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in Nike at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Nike, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Nike, Inc. is the world’s largest designer, marketer, and distributor of athletic footwear, apparel, and equipment. Founded in 1967 and headquartered in Oregon, the company operates under three major brands: Nike, Jordan, and Converse. It serves a wide range of customers, from elite athletes to everyday consumers, across more than 190 countries. Nike's products include performance-specific footwear and apparel as well as lifestyle and "athleisure" offerings. Sales are made through both direct-to-consumer channels, including its digital platforms and owned retail stores, and a vast wholesale network. The company maintains a large global presence, with more than 1.000 owned stores and around 40.000 points of distribution. Nike’s competitive moats are broad and durable. Its most powerful asset is its brand, which is instantly recognizable and associated with performance, innovation, and style. This gives Nike strong pricing power and customer loyalty across generations. As the largest player in the industry, Nike enjoys scale benefits in product development, marketing, and supply chain efficiency. Its size and global reach are difficult for competitors to replicate. The company’s culture of innovation continues to set it apart, with technologies like Flyknit and ZoomX combining performance and fashion appeal in a way few can match. Nike also benefits from deep consumer relationships through its membership programs and digital ecosystem, which provide valuable data and help foster brand loyalty. Financially, Nike is strong. It generates significant cash flow, maintains high margins, and holds an AA- credit rating. This allows it to invest consistently in product innovation, marketing, and technology regardless of market conditions. Its supply chain, built over the past 50 years, is global, responsive, and resilient. The company partners with a large network of contract manufacturers and raw material suppliers to maintain flexibility and quality. With its ability to scale innovation, maintain premium positioning, and adapt to consumer trends across channels and geographies, Nike has built a wide and sustainable competitive moat that continues to support its leadership in the global athletic market.

Management

Elliott Hill serves as the CEO of Nike, a role he assumed on October 14, 2024. A Nike veteran with over three decades of experience at the company, Hill brings a deep understanding of the brand, the consumer, and the global sportswear industry. His leadership journey at Nike began in 1988, and over the years he held numerous senior roles across geographies, including Europe and North America. Prior to his retirement in 2020, Elliot Hill served as President of Consumer and Marketplace, where he led global commercial and marketing operations for both the Nike and Jordan brands. During his tenure in that role, he was instrumental in driving the company’s growth to over $39 billion in annual revenue. Before joining Nike, Elliot Hill began his career in sports as an assistant athletic trainer with the Dallas Cowboys. He holds a bachelor's degree in Kinesiology from Texas Christian University and a master’s degree in Sports Administration from Ohio University. His unique combination of frontline sports experience and business leadership has contributed to his reputation as a values-driven, people-first executive. Elliott Hill is widely respected within Nike for his leadership style, which emphasizes inclusivity, innovation, and a strong connection to both employees and consumers. He has long been an advocate of Nike’s mission to bring inspiration and innovation to every athlete in the world, guided by the belief that “if you have a body, you are an athlete.” His personal story is shaped by his upbringing in a diverse, sports-oriented community, which aligns closely with the company’s ethos of empowerment and perseverance. “What drives me to this day are the values instilled in me by my mother: Hard work, compassion, and treating every human being like they matter,” Elliot Hill has said. Since stepping into the CEO role, Elliot Hill has been tasked with realigning Nike around its core values, product excellence, and consumer connection. The Board of Directors has expressed strong confidence in his ability to guide Nike through its next phase of global growth. As Executive Chairman Mark Parker stated, “Elliott’s global expertise, leadership style, and deep understanding of our industry make him the right person to lead Nike’s next stage of growth.” With his long history at the company and track record of results, Elliott Hill is well-positioned to lead the brand into the future.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Nike has historically maintained a ROIC consistently above 10% and often above 20%. It has achieved this through a powerful brand, an efficient business model, and strong execution. The strength of the Nike brand means customers are willing to pay higher prices, which allows the company to earn strong profits without needing to invest heavily in physical assets. Instead of owning factories, Nike relies on third-party manufacturers, reducing the need for large capital investments and making the business more flexible. Its global presence allows it to spread costs across many markets, supporting profitability. Over the past decade, Nike has expanded its direct-to-consumer business through its own stores and digital platforms, which has improved profit margins and strengthened customer relationships. The company also manages its inventory efficiently and keeps tight control over pricing, which limits the amount of cash tied up in products and supports healthy returns on capital. In fiscal 2025, however, Nike’s ROIC fell to its lowest level in a decade. This was due to a mix of external challenges and internal investments. Margins came under pressure as Nike used more discounts to clear excess inventory, while rising costs in areas like shipping and labor reduced profitability. Growth also slowed in key markets like Greater China and North America because of weaker consumer demand and stronger competition. At the same time, Nike increased spending on digital tools, supply chain improvements, and new product development. While these investments are likely to pay off in the future, they temporarily lowered ROIC by increasing the amount of capital without an immediate return. Still, investors may not need to worry if they believe in the long-term plan. Nike’s management sees this as a transition period focused on strengthening the business. In 2025, the company launched a $2 billion cost-saving plan to simplify its product offering and improve its structure. These efforts are expected to improve margins over time. As costs come down and the benefits of new products and digital sales begin to show, Nike’s ROIC could start to recover.

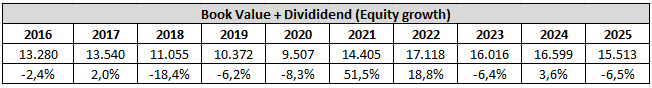

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Nike’s equity has moved up and down over the past decade, depending on how the company has managed its profits and share repurchase activity. In years when Nike earned strong profits and kept more of those earnings in the business, equity increased. But in other years, equity declined because Nike spent more on buying back its own shares than it added through net income. Share repurchases reduce equity because they are recorded as a reduction in shareholders’ capital on the balance sheet. In fiscal 2025, equity decreased even though Nike remained profitable. This was mainly due to continued large-scale share buybacks combined with lower earnings, as the company faced margin pressure and rising costs. When a company returns more to shareholders through buybacks than it earns, equity can decline even in a positive year. In Nike’s case, the decrease reflects a choice to use its strong balance sheet and cash flow to support long-term shareholder value during a period of slower growth.

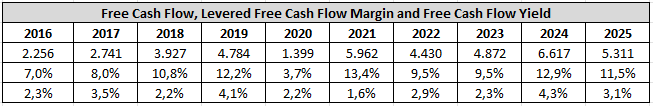

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Nike delivered its highest free cash flow ever in fiscal year 2024. This happened not just because the company earned solid profits, but also because it made big improvements in how it managed its inventory. In earlier years, Nike had built up too much unsold product, which tied up a lot of cash. In 2024, the company successfully reduced those inventory levels, and that released a large amount of cash back into the business. At the same time, Nike kept its spending on new stores, equipment, and other long-term investments steady, which allowed more of its cash earnings to flow through. In fiscal year 2025, free cash flow dropped from the record high the year before, but it was still Nike’s third highest ever. The levered free cash flow margin was also the fourth best in its history. The decline was mainly because profits were lower, as Nike faced higher costs and offered more discounts to clear remaining products. Also, since most of the inventory clean-up had already happened in 2024, there was less of a boost from that this time around. Even so, Nike’s ability to keep generating strong cash in a tougher year shows how resilient and efficient its business really is. Nike uses its free cash flow on both share repurchases and dividends. Hence, shareholders can expect fewer shares outstanding and higher free cash flow in the future as Nike continues to grow its free cash flow. The free cash flow yield is among its highest levels in the past decade, but sitting just above 3% still indicates that the shares are trading at a premium valuation. However, we will revisit valuation later in the analysis.

Debt

Another important aspect to consider is the level of debt and whether it is manageable within a three-year repayment period. This is typically assessed by dividing the total long-term debt by current earnings. For Nike, this calculation shows that the company has 2,5 years of earnings in debt, indicating that its debt level is manageable. Therefore, debt does not appear to be a concern from an investment perspective. In addition, Nike has not had more than three years of earnings in debt at any point over the past twenty years, which suggests that it is unlikely for debt to become a significant risk in the future.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Risks

Competition is a significant risk for Nike because it operates in a crowded and fast-changing industry where consumer preferences, technology, and brand loyalty are constantly shifting. While Nike remains the largest seller of athletic footwear and apparel globally, it faces pressure from both long-standing rivals and fast-growing new entrants. Companies like Adidas, Puma, and Under Armour continue to compete across key categories, and Adidas in particular is working to regain market share through brand resets and strategic launches. At the same time, newer players like On Running and Hoka have quickly gained popularity in the running segment, appealing to consumers with fresh designs and strong performance claims. These brands are winning over younger and niche audiences, especially in areas where Nike once had a stronger hold. Lululemon is also emerging as a serious competitor, particularly in women’s athletic apparel, where it has built a strong lifestyle brand that overlaps with Nike’s target market. In addition, Nike faces rising competition from private label brands and multi-brand digital retailers, which can offer similar products at lower prices and respond more quickly to trends. The competitive landscape is also shifting beyond products to include digital services, apps, and online experiences, where consumers expect seamless engagement and personalized offerings. With lower barriers to entry, smaller and more agile brands are entering the market more easily, using social media and influencer marketing to build strong followings and react faster to trends. If Nike fails to keep up with changing consumer expectations or loses relevance in key categories, it could face market share losses, pricing pressure, and reduced brand strength.

Macroeconomic conditions pose a meaningful risk to Nike’s business because the company is highly exposed to global consumer trends, exchange rates, inflation, and geopolitical developments. As a consumer discretionary brand, Nike’s sales depend on people having the confidence and ability to spend on non-essential items like athletic footwear and apparel. During times of economic uncertainty, such as recessions or periods of high inflation and interest rates, consumers tend to cut back on these types of purchases. This can lead to lower demand, excess inventory, more discounting, and weaker margins. In fiscal 2025, Nike already faced some of these pressures, which impacted profitability. In addition, Nike operates on a global scale, which means it is exposed to currency fluctuations. Most of its sales and expenses outside the U.S. are in foreign currencies, and when the U.S. dollar strengthens, the value of those revenues and profits declines once converted back. Currency swings can also affect the cost structure of Nike’s suppliers and manufacturers, making raw materials more expensive or harder to finance. While Nike does use currency hedging to reduce volatility, it cannot eliminate these risks entirely. On top of that, broader macroeconomic shifts, such as rising commodity prices, supply chain disruptions, and increased tariffs, can lead to higher costs. For example, Nike pays some of the highest average U.S. duties on footwear, and tensions around U.S.-China trade have added to those pressures. Although Nike is working to shift sourcing away from China, about 16 percent of its U.S. footwear imports still come from there, making it vulnerable to policy changes and additional tariffs. Finally, the financial health of retailers and manufacturers also matters. If Nike’s partners face funding difficulties during economic downturns, it can lead to canceled orders, delayed payments, or disruptions in product delivery. All of these factors make macroeconomic conditions a persistent risk that can impact Nike’s sales, margins, and overall financial performance.

Failure to maintain its brand image is a significant risk for Nike because the strength of its brand is one of the company’s most valuable assets, and a key driver of pricing power, consumer loyalty, and long-term growth. Nike’s global reputation is built not only on product innovation and athletic performance but also on cultural relevance, marketing, and values. If any of these pillars weaken, the business could face serious consequences. Nike relies heavily on its ability to stay relevant in a fast-changing market, particularly with younger consumers who drive trends and demand constant innovation. If Nike fails to consistently release products that feel fresh, exciting, or culturally aligned, it risks losing consumer interest and brand cachet. This is especially important in an era where new, more agile competitors can use social media and influencer partnerships to capture attention quickly. Falling behind in design, storytelling, or cultural connection could weaken Nike’s brand heat, leading to softer sales and reduced pricing power. Brand image is also tightly linked to Nike’s endorsements and partnerships. The company works with high-profile athletes and public figures, which brings visibility but also carries reputational risk. Scandals or controversies involving endorsers can reflect poorly on the brand, even if Nike is not directly involved. The same applies to geopolitical issues, such as past boycotts in China linked to Nike’s stance on ethical sourcing. In such cases, Nike can find itself caught between differing political or social expectations across global markets. Another area of risk is Nike’s supply chain. While the company does not own the factories that make its products, it is still held responsible in the eyes of the public for how those partners operate. Any reports of labor violations or environmental misconduct can damage consumer trust and harm Nike’s brand, regardless of legal responsibility. On top of this, Nike’s involvement in or silence on social and political issues can influence brand perception. In a socially aware consumer environment, decisions to support or distance itself from certain causes or figures can trigger backlash from one side or another, amplified quickly through social media.

Reasons to invest

Innovation is a key reason to invest in Nike because it drives long-term growth, strengthens brand loyalty, and helps the company stay ahead in a highly competitive and fast-moving industry. Nike consistently reinvests in research, design, and product development to create high-performance and culturally relevant products that resonate with both athletes and lifestyle consumers. This focus on innovation allows Nike to command premium pricing, maintain market leadership, and respond quickly to evolving consumer trends. The company is accelerating its product pipeline through initiatives like Speed Lane, which uses digital tools and cross-functional teams to reduce development time and bring new products to market faster. Recent successes include the Vomero 18, which became a 100 million dollar franchise within three months of launch, with more versions like Vomero Plus and Vomero Premium on the way. In basketball, the release of A'ja Wilson’s signature shoe sold out in minutes, showcasing Nike’s ability to align innovative product design with powerful storytelling and athlete partnerships. In running, models like the Alphafly, Vaporfly, and Pegasus Turbo have demonstrated Nike’s continued dominance in high-performance footwear, while the company also brings energy to its sportswear segment through fresh takes on classic models like the Air Max 95 and P-6000. Nike’s innovation strategy goes beyond individual products, combining advanced materials, sustainability, and consumer engagement through digital platforms and personalized experiences. The product pipeline continues to improve season by season, and management remains confident in its ability to fuel demand and regain momentum through new product launches. This commitment to consistent and meaningful innovation not only reinforces Nike’s brand strength but also provides a solid foundation for future sales growth and long-term value creation.

Reigniting brand momentum through sport is a compelling reason to invest in Nike because it strengthens the company’s emotional connection with consumers, reinforces its competitive positioning, and sharpens execution across categories. Nike is reorganizing its teams to focus on specific sports rather than consumer segments like men’s, women’s, and kids’. This shift, known internally as the sport offense, is designed to create deeper relationships with athletes, develop more sport-specific products, and tell stories that resonate in real time with fans and participants. Rather than taking a one-size-fits-all approach, Nike is now tailoring product assortments, marketing campaigns, and retail experiences to the distinct culture and consumer behavior of each sport. The company is also integrating this strategy across its own channels and wholesale partners, allowing for sharper segmentation and greater control over how its brands show up in the marketplace. Recent activations, such as a major women's running event in Los Angeles and Nike’s presence at global tournaments like the French Open and the Champions League Final, show how the brand can leverage key sport moments to drive engagement and sales. These efforts are helping Nike show up with greater clarity and cultural relevance, especially in fast-growing categories like women’s sports and global football. By focusing its energy on sport-first storytelling, Nike is playing to its historical strengths and reconnecting with consumers in a way that is likely to fuel both brand heat and long-term growth.

Rebuilding wholesale partnerships is an important reason to invest in Nike because it reflects a strategic shift aimed at restoring balanced growth and reconnecting with a broader consumer base. Under the previous CEO, Nike placed a strong emphasis on direct-to-consumer sales, which improved margins but led to strained relationships with key wholesale partners. By pulling product from many stores, Nike unintentionally opened the door for competitors to gain shelf space and market share. This contributed to a loss of brand presence in physical retail environments where many consumers still discover and interact with the brand. With Elliott Hill as CEO, Nike is actively working to reverse this trend by re-engaging wholesale accounts and tailoring assortments to better serve each retail partner’s specific customer base. The company is hiring dedicated retail marketing and account management teams, expanding distribution through strategic partners like Dick’s, JD Sports, and Urban Outfitters, and even launching a selective partnership with Amazon to increase reach across digital channels. These actions reflect a broader marketplace strategy that focuses on segmentation and differentiation, ensuring Nike shows up in the right places with the right product and storytelling. Early signs are promising, with order books improving and holiday orders rising across North America, EMEA, and Asia-Pacific. This renewed focus on wholesale not only strengthens Nike’s retail footprint and brand accessibility but also supports more profitable and sustainable growth as the company aligns its product flow, marketing, and distribution more effectively.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 2,16, which is from fiscal year 2025. I have selected a projected future EPS growth rate of 15%. Analysts expect EPS to grow by 17,10% in the next five years, but 15% is the highest number I use. Additionally, I have chosen a projected future P/E ratio of 30, which is twice the growth rate. This decision is based on the fact that Nike has historically had a higher P/E ratio. Lastly, our minimum acceptable rate of return is already set at 15%. Doing the calculations, we come up with the sticker price (some call it fair value or intrinsic value) of $64,80. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Nike at a price of $32,40 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is called the Ten Cap price. The rate of return that an owner of a company (or stock) receives on the purchase price of the company is essentially its return on investment. The return should be at least 10% annually, and I calculate it as follows: The operating cash flow last year was 3.698. Capital expenditures were 430. I attempted to review their annual report to ascertain the proportion of capital expenditures allocated for maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated for maintenance purposes. This means that we will use 301 in our calculations. The tax provision was 666. We have 1.476 outstanding shares. Hence, the calculation will be as follows: (3.698 – 301 + 666) / 1.476 x 10 = $27,53 in Ten Cap price.

The final calculation is called the Payback Time price. It is a calculation based on the free cash flow per share. With Nike's Free Cash Flow Per Share at $2,21 and a growth rate of 15%, if you want to recoup your investment in 8 years, the Payback Time price is $34,89.

Conclusion

I believe that Nike is an intriguing company with strong management. It has built a moat through its brand strength, global scale, and solid balance sheet. The company has consistently delivered a high return on invested capital, and although ROIC fell to its lowest level in a decade in fiscal year 2025, it is expected to improve going forward. Even in a challenging year, Nike still generated its third-highest free cash flow ever, which speaks to the resilience of its business model. Competition remains a key risk because Nike operates in a fast-moving industry where both established players and newer brands are targeting its core segments. As consumer tastes evolve and barriers to entry decline, Nike must continually innovate to maintain relevance and defend market share. Macroeconomic conditions also pose a risk, as Nike’s sales depend on discretionary spending, which typically declines during periods of inflation, high interest rates, or economic uncertainty. As a global business, Nike is exposed to currency fluctuations, tariffs, and shifting supply chain costs, which can impact margins. The company’s brand is one of its most valuable assets, and any misstep in product relevance, marketing, social positioning, or partnerships could weaken consumer trust and erode its competitive advantage. On the positive side, innovation is a major reason to invest in Nike, as the company continuously develops performance-driven and culturally resonant products that command premium prices and reinforce brand loyalty. Nike is also reigniting brand momentum through sport by reorganizing teams around specific athletic categories, allowing for sharper execution, deeper athlete connections, and more impactful storytelling. This renewed focus on sport enhances Nike’s identity and supports long-term growth. Additionally, the decision to rebuild wholesale partnerships marks a strategic reset that expands distribution, strengthens relationships with key retailers, and supports a more balanced go-to-market strategy. While I see Nike as a high-quality company, I believe there are more attractive opportunities elsewhere. Therefore, I will only consider buying shares at a significant discount, specifically at my Payback Time price of $34.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how to do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and in order to receive, you will have to give. If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to the Lemur Conservation Foundation. It is an organization that does a lot of great work for this wonderful, endangered animal. If you have a few Euros/Dollars/Pounds or whatever to spare, please donate here. Even one or two Euros will make a difference. Thank you.

Comments