Microsoft: The greatest stock in the world?

- Glenn

- Jul 19, 2021

- 19 min read

Updated: Dec 11, 2025

Microsoft is one of the most important technology companies in the world, offering products and services that millions of people and businesses use every day. From familiar names like Windows and Office to fast-growing areas such as Azure cloud services, Xbox gaming, and AI tools like Copilot, Microsoft combines long-standing market leadership with constant innovation. Its products work closely together, creating an ecosystem that keeps customers coming back. The question is: Should Microsoft be part of your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do own shares in Microsoft at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Microsoft, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Microsoft is one of the world’s largest technology companies, founded in 1975 by Bill Gates and Paul Allen. It operates through three core segments: Productivity and Business Processes, which includes Microsoft 365 (Office, Teams, security and compliance tools), Dynamics 365 business applications, and LinkedIn; Intelligent Cloud, anchored by Azure cloud services alongside server products such as Windows Server and SQL Server, as well as GitHub and Nuance Healthcare AI solutions; and More Personal Computing, which encompasses Windows OS licensing, Surface devices, Xbox gaming hardware and content, and Bing and Copilot-powered advertising. Microsoft holds a dominant position in PC operating systems with over 80% market share and is the second-largest global cloud infrastructure provider via Azure. Its portfolio spans software, cloud services, hardware, and AI platforms, serving both consumers and enterprises worldwide. Microsoft’s competitive advantage is built on an entrenched ecosystem with high switching costs, as Windows and Office are deeply embedded in enterprise workflows and consumer habits. Its integrated product portfolio enables extensive cross-selling, with solutions like Office 365, Teams, Azure, Dynamics, and security tools reinforcing customer dependence. In cloud computing, Microsoft leverages its long-standing enterprise relationships and on-premise software footprint to win Azure clients, particularly in hybrid cloud environments. Its scale and financial resources, including more than 20 billion dollars in annual R&D spending, allow it to invest heavily in AI, cloud infrastructure, and acquisitions, outpacing most rivals. The strength of its brand, global reach, and extensive distribution through OEMs, resellers, and direct sales further enhance its market position. Its leadership in AI, with advanced models embedded across Microsoft 365, Azure, and developer tools, increases product stickiness and positions it at the forefront of AI-driven productivity. Overall, Microsoft’s moat lies in a combination of widespread software adoption, deep product integration, vast cloud infrastructure, and sustained investment, creating a self-reinforcing advantage that competitors find difficult to challenge.

Management

Satya Nadella serves as the Chairman and CEO of Microsoft, having been appointed CEO in 2014 and Chairman in 2021. He joined Microsoft in 1992 after working at Sun Microsystems, and over the next two decades, he held leadership roles across multiple divisions, including spearheading the company’s move into cloud infrastructure as head of the Server and Tools division. Satya Nadella holds a BA in Electrical Engineering from Mangalore University, an MS in Computer Science from the University of Wisconsin–Milwaukee, and an MBA from the University of Chicago Booth School of Business. Since becoming CEO, Satya Nadella has been credited with transforming Microsoft’s culture, championing empathy, collaboration, and a growth mindset. He repositioned Microsoft from a company centered on Windows and Office to a cloud-first, mobile-first technology leader, driving the rise of Microsoft Azure into a global powerhouse rivaling Amazon Web Services. Under his leadership, the company has executed some of the largest and most strategic acquisitions in its history, including LinkedIn for $26 billion, GitHub for $7,5 billion, and Activision Blizzard for $68 billion, expanding Microsoft’s presence in professional networking, software development, and gaming. The results have been extraordinary. Microsoft’s market value has increased more than sevenfold since Satya Nadella took the helm, with nearly 90% of its current value generated under his leadership. He is widely regarded as one of the most effective and value-generating corporate leaders of the modern era, with Barron’s ranking him among the best CEOs in the world. His leadership style blends strategic vision with operational discipline, supported by a deep belief in the role technology can play in empowering individuals and organizations. Given his track record of driving growth, fostering innovation, and executing bold strategic moves, I believe Satya Nadella is exceptionally well-positioned to guide Microsoft through its next era of growth in cloud computing, artificial intelligence, and beyond.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Microsoft’s strong and consistent ROIC comes from having a business that is both profitable and efficient to grow. Most of its revenue comes from software and cloud services, which cost little to expand once the main systems are built. Products like Windows, Office, Azure, and LinkedIn bring in steady, recurring income through long-term contracts, giving the company reliable cash flow and the ability to charge premium prices. Because Microsoft’s products are deeply embedded in how businesses and consumers work, switching to competitors is difficult, and customers often buy more products from the same ecosystem. This combination of high margins, loyal customers, and low ongoing capital needs allows Microsoft to earn much more profit for every dollar it invests compared to most large companies. Microsoft’s ROIC moved to a higher level, staying above 20% from 2019 onwards, because several things came together at the same time. Azure had grown large enough to deliver high-margin revenue on top of Microsoft’s long-standing relationships with enterprise customers. The switch from selling software licenses once to selling ongoing Office 365 subscriptions increased profitability and freed up cash, since customers now pay regularly instead of in big one-off purchases. Acquisitions like LinkedIn and GitHub were fully integrated and adding to profits without needing big new investments. On top of that, Microsoft became more efficient under Satya Nadella, so it could keep growing without needing much extra capital. The small drop in Microsoft’s ROIC over the past three years, while still at very high levels, is likely due to a combination of heavier spending and short-term profit pressures. The company has been investing heavily in new data centers around the world, building custom AI infrastructure, and integrating big acquisitions like Activision Blizzard. These projects cost a lot upfront, but the full benefits in revenue and profit will take time to show. Microsoft has also sharply increased spending on AI research and development, which is important for the future but temporarily lowers ROIC until those innovations start generating significant income.

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Microsoft has managed to increase its equity every year since fiscal year 2019, reaching a record high in 2025, thanks to strong profits, smart use of capital, and a business model that produces large amounts of free cash flow. The move toward steady, recurring revenue from Microsoft 365 subscriptions, Azure cloud services, and LinkedIn has created predictable and growing earnings. These profits have consistently been higher than what the company pays out in dividends and share buybacks, allowing retained earnings to steadily build equity. Big acquisitions like LinkedIn, GitHub, and Activision Blizzard have also added to Microsoft’s assets and long-term earning potential once fully integrated. The company has avoided taking on excessive debt, so equity growth has mainly come from reinvesting its profits. Even with heavy spending on data centers, AI, and gaming, those investments have delivered strong enough returns to keep equity rising year after year.

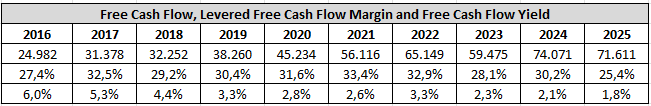

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Microsoft has generated record free cash flow over the past two years because its high-margin software and cloud businesses have continued to grow without a matching increase in operating costs. Strong performances from Azure, Microsoft 365, and LinkedIn have driven cash generation to record levels, while careful cost management has helped keep profitability high. Even though free cash flow in fiscal year 2025 was slightly lower than in 2024, it was still the second-highest in the company’s history, showing the strength of its business model. The decline in free cash flow margin in fiscal 2025 was mainly due to a significant rise in capital spending. Much of this investment went into long-lived assets and expanding Microsoft’s data center capacity, including servers, GPUs, CPUs, and networking equipment, to meet surging demand for AI and cloud services. Management has made it clear that this spending is closely linked to delivering on a very large contracted backlog across its cloud business. In other words, the lower margin is the result of front-loading investments to secure future growth, not a sign of weakness in the core business. As Microsoft’s free cash flow grows over time, shareholders are likely to see more returns through higher dividends and larger share buyback programs. Once major projects like data centers are built, the company doesn’t need to spend as much to keep the business running, which means more of its future cash flow can be returned to investors. With a strong balance sheet and steadily rising earnings, Microsoft can reward shareholders while still investing heavily in innovation and future growth. The free cash flow yield is at its lowest level in ten years, indicating that Microsoft’s shares are currently trading at a premium. We will revisit the valuation later in the analysis.

Debt

Another important aspect to examine is the level of debt, particularly whether a company carries a manageable amount that could be paid off within three years of earnings. This is calculated by dividing total long-term debt by annual earnings. For Microsoft, the result is just 0,4 years of earnings, well below the three-year threshold. With its AAA credit rating, debt was never expected to be a concern, but it is still reassuring to confirm such a low level of debt. Given its strong cash generation and conservative balance sheet, debt is unlikely to be an issue for Microsoft in the foreseeable future.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Risks

Competition is a risk for Microsoft because it faces rivals in nearly every product category, from global technology giants to niche software developers. In productivity software, Office competes with other global and local application vendors, web- and mobile-based tools, and AI-first applications. Windows contends with alternative operating systems, mobile platforms, and device ecosystems, while Azure goes head-to-head with other major cloud providers and open-source offerings. In gaming, Xbox competes against other consoles, cloud gaming services, and broader entertainment platforms, and LinkedIn faces pressure from professional networks, recruitment firms, and online advertising providers. This intense competition extends into security, developer tools, business applications, and emerging areas like AI, where hyperscalers, startups, and open-source communities all vie for market share. The threat is amplified by the fact that barriers to entry in many of Microsoft’s markets are low, and technology evolves rapidly. Competitors can introduce disruptive products, adopt new business models, or leverage open-source software to reduce costs. Platform-based competition is particularly challenging, firms that control both hardware and software can create tightly integrated ecosystems, drawing developers and users away from Microsoft’s platforms. In addition, some of Microsoft’s largest customers, particularly in AI, are fast-growing startups that could eventually in-source their infrastructure needs or develop competing offerings. While partnering with these companies helps Microsoft shape and optimize its platforms, their success could also lead to them becoming significant competitors over time. This constant pressure forces Microsoft to keep investing heavily in innovation, infrastructure, and developer ecosystems to defend its market position. Failure to adapt quickly enough to shifting technologies, changing customer needs, or aggressive pricing strategies from competitors could erode market share, compress margins, and slow growth, even for a company of Microsoft’s scale.

Laws and regulations are a significant risk for Microsoft because the company operates in multiple highly regulated industries, software, cloud computing, AI, and online services, across nearly every major market in the world. Governments and regulators in the U.S., EU, UK, China, and elsewhere closely scrutinize its business practices, often through competition and antitrust laws. For example, the EU’s Digital Markets Act imposes restrictions on products like Windows and LinkedIn, limiting activities such as certain data uses. These rules can reduce Microsoft’s flexibility to integrate services, potentially making its products less competitive. Microsoft’s growing role in artificial intelligence and cloud services brings additional layers of regulation. Emerging laws like the EU’s AI Act and existing frameworks such as GDPR could require changes to how products operate, increase compliance costs, and slow the rollout of new features. Regulators are also paying closer attention to Microsoft’s bundling practices, such as including Teams with Office, and cloud licensing terms that some competitors argue disadvantage them. Antitrust actions in these areas could result in forced product unbundling, altered licensing, or limits on how Microsoft leverages its ecosystem. Beyond competition and AI rules, Microsoft must comply with anti-corruption laws, trade sanctions, export controls, and cybersecurity regulations. Trade policies and geopolitical events, such as conflicts in Ukraine or the Middle East, can rapidly trigger new sanctions or export restrictions, affecting Microsoft’s ability to operate or sell in certain regions. Supply chain regulations and AI-related export rules could also raise costs or limit access to key markets. The challenge is compounded by the fact that laws vary widely by jurisdiction, are subject to change, and are often interpreted differently by different authorities. Compliance often requires significant operational adjustments, product modifications, or even withdrawing services from some markets. Non-compliance can lead to fines, operational restrictions, or reputational harm. As Microsoft’s market influence grows, so does the likelihood of future regulatory action, meaning that legal and compliance risk is an ongoing and potentially costly challenge to the company’s operations and growth.

Cyberattacks and security vulnerabilities are a risk for Microsoft because they can cause financial losses, damage customer trust, and harm the company’s reputation and market position. As one of the world’s largest technology providers, Microsoft is a prime target for a wide range of threat actors, including nation-states, state-sponsored groups, organized cybercriminals, and independent hackers. These attackers use increasingly sophisticated methods, such as exploiting software flaws, launching coordinated campaigns, or using social engineering, to gain unauthorized access to Microsoft’s systems, customer environments, and sensitive data. The popularity of Microsoft’s products makes them especially attractive targets, as compromising widely used platforms like Windows, Office, Azure, or LinkedIn can have broad impact. The risk is not only external but also internal. Security breaches can result from inadequate account controls, human error, insider threats, or weak security practices at acquired companies and third-party partners. Attackers may also target Microsoft’s supply chain by inserting malware into software updates or hardware components. As the company adopts new technologies like generative AI, its attack surface grows, creating new potential entry points. Even after security patches are issued, vulnerabilities can persist if customers fail to apply them promptly, leaving systems exposed. A successful cyberattack could disrupt Microsoft’s services, delay product development, lead to theft of intellectual property, and result in regulatory scrutiny, liability claims, and reputational damage. This could erode customer confidence and make it harder to retain or win business. The financial impact can be substantial, ranging from incident response costs to the long-term loss of trust. Customers in sensitive sectors like government, healthcare, and finance have heightened security requirements, and any failure to meet these could result in lost contracts. Because threats are constantly evolving, Microsoft must invest heavily in security infrastructure, threat detection, and defensive measures, which increases costs and can pressure margins. Even with these investments, there is no guarantee that all attacks will be detected or prevented in time. Maintaining a strong security track record is therefore critical to protecting Microsoft’s business, reputation, and customer relationships.

Reasons to invest

Cloud is a major reason to invest in Microsoft because it has become the company’s fastest-growing and most strategically important business segment. Microsoft Cloud generated over $168 billion in annual revenue, growing 23% year-over-year, with Azure alone surpassing $75 billion, up 34% in fiscal year 2025. This growth is driven by three reinforcing factors. First, large-scale enterprise migrations such as Nestlé moving hundreds of SAP instances, thousands of servers, and petabytes of data to Azure with minimal disruption. These migrations deepen customer reliance on Microsoft’s ecosystem and create long-term recurring revenue streams. Second, Microsoft is attracting new customers running modern, cloud-native applications. Many come to Azure for its AI capabilities but then expand their usage to other workloads, which increases platform stickiness. Third, Microsoft leads in AI-optimized infrastructure, scaling its data center footprint faster than competitors, with over 400 data centers in 70 regions and more than two gigawatts of new capacity added in just 12 months. Every Azure region is now AI-first, equipped with advanced cooling and infrastructure optimizations that deliver up to 90 percent more inference output per GPU compared to a year ago. On top of this, Microsoft is investing in long-term innovations such as quantum computing, highlighted by the deployment of the world’s first operational Level 2 quantum computer. This positions Azure to capture future technology waves beyond current AI demand. With strong revenue growth, unmatched infrastructure scale, high switching costs for customers, and a clear roadmap for future innovation, Microsoft’s cloud business is both a high-margin cash generator today and a powerful long-term growth engine.

Copilot is a strong reason to invest in Microsoft because it represents the company’s most visible and widely adopted application of AI across its ecosystem, creating new revenue streams while strengthening the stickiness of existing products. More than 100 million people now use Copilot apps each month, with over 800 million users engaging with AI features embedded across Microsoft’s portfolio. Adoption of Microsoft 365 Copilot has been faster than any previous suite, with strong retention and record seat additions from major global companies Customers are not only buying more seats but are also extending functionality by building their own agents through Copilot Studio, which allows them to tailor AI to their specific workflows, data, and language. The breadth of Copilot’s reach is unmatched, GitHub Copilot has 20 million users, including 90% of the Fortune 100, while healthcare-focused Dragon Copilot has documented over 13 million patient encounters in a single quarter, dramatically reducing administrative work for doctors. In security, Copilot agents help automate high-volume IT and cyber defense tasks, while in consumer markets, Copilot is being integrated into Windows 11, Edge, and other Microsoft services, creating a unified AI assistant across devices and platforms. This deep integration into daily work and life increases Microsoft’s pricing power, reduces customer churn, and provides a foundation for long-term monetization as usage expands. Because Copilot is layered on top of Microsoft’s existing subscription products, much of its revenue comes with high margins and minimal incremental capital requirements. As adoption grows across commercial, consumer, and developer segments, Copilot not only drives direct revenue growth but also reinforces the value of Microsoft 365, Dynamics, GitHub, Windows, and Azure, strengthening the company’s ecosystem and competitive moat.

Gaming is a compelling reason to invest in Microsoft because it combines a massive and growing audience with a powerful portfolio of content, platforms, and technologies that position the company for long-term growth. Microsoft now reaches over 500 million monthly active users across devices, making it one of the largest gaming ecosystems in the world. Game Pass has become a central pillar of this strategy, offering a library of popular titles for a recurring fee and enabling cloud gaming so players can access games on consoles, PCs, and mobile devices without high-end hardware. This expands Microsoft’s addressable market, particularly in regions or segments where consoles are less common. The acquisition of Activision Blizzard significantly strengthens Microsoft’s presence across PC, console, and mobile gaming. It adds iconic franchises like Call of Duty, which boasts tens of millions of active players and billions of hours of engagement, as well as mobile hits like Candy Crush. These IPs can be monetized through premium sales, in-game purchases, subscriptions, and cross-platform releases, increasing both revenue streams and customer loyalty. Microsoft’s other blockbuster titles like Minecraft and Forza Horizon continue to perform strongly, with Minecraft recently hitting record engagement in part due to the success of the Minecraft Movie. The gaming industry itself is larger than film, TV, and music combined, generating over $180 billion annually with more than 3 billion players worldwide, a number that is still growing. Trends toward social, community-driven gameplay and live-service models mean that owning strong IP and delivering fresh, engaging content is increasingly valuable. Microsoft’s pipeline of nearly 40 games in development, combined with its ability to distribute across Xbox, PC, mobile, and the cloud, ensures a steady flow of high-quality content to keep players engaged. Cloud gaming is also a strategic advantage, with over 500 million hours streamed via the cloud in the past year. This technology lowers the barrier to entry for gaming, enables instant access to new titles, and supports more flexible business models. As subscription revenues climb, Game Pass annual revenue recently reached nearly $5 billion, Microsoft is building a recurring, high-margin revenue base that complements traditional game sales.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 13,64, which is the one from fiscal 2025. I have selected a projected future EPS growth rate of 14%, which is in line with the analysts' consensus at Finbox. Additionally, I have chosen a projected future P/E ratio of 28, which is twice the growth rate. This decision is based on the fact that Microsoft has historically had a higher P/E ratio. Lastly, our minimum acceptable rate of return is already set at 15%. Doing the calculations, we come up with the sticker price (some call it fair value or intrinsic value) of $349,98. We want to have a safety margin of 50%, so we will divide it by 2. This means that we want to buy Microsoft at a price of $174,99 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 136.200, and capital expenditures were 64.551. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 45.186 in our calculations. The tax provision was 21.795. We have 7.433 outstanding shares. Hence, the calculation will be as follows: (136.200 – 45.186 + 21.795) / 7.433 x 10 = $151,77 in Ten Cap price.

The final calculation is referred to as the Payback Time price. It is a calculation based on the free cash flow per share. With Microsoft's free cash flow per share at $9,63 and a growth rate of 8%, if you want to recoup your investment in 8 years, the Payback Time price is $145,27.

Conclusion

I believe Microsoft is a fantastic company with excellent management. It has built a durable moat through widespread software adoption, deep product integration, vast cloud infrastructure, and sustained investment. The company consistently achieves a high ROIC and recently delivered its second-highest free cash flow ever despite increased capital expenditures, which should support even higher free cash flow in the future. Competition remains a risk as Microsoft faces strong rivals across nearly all its markets, from cloud and productivity software to gaming and AI, with rapid technological change, low barriers to entry, and even some customers evolving into potential competitors. Laws and regulations also pose a challenge, as Microsoft’s global operations are subject to varying and rapidly changing rules on competition, data privacy, AI, trade, and more, which can increase costs, limit product integration, or restrict market access, with the likelihood of regulatory action growing alongside the company’s market influence. Cyberattacks and security vulnerabilities are another risk, given Microsoft’s position as a prime target for increasingly sophisticated attackers; a successful breach could disrupt operations, expose sensitive data, erode customer trust, and cause financial and reputational damage, requiring ongoing heavy investment in security. On the upside, cloud is a major growth driver, benefiting from enterprise migrations, adoption of cloud-native and AI workloads, and unmatched infrastructure scale, while high switching costs, leadership in AI-optimized data centers, and long-term bets like quantum computing position it for sustained growth. Copilot is another powerful growth engine, as Microsoft’s most widely adopted AI product, embedded across Microsoft 365, GitHub, Windows, and other services, driving high-margin revenue while deepening customer reliance and strengthening its competitive moat. Gaming adds further potential, with over 500 million monthly active users across console, PC, mobile, and cloud, a strong pipeline of nearly 40 games in development, blockbuster IP like Call of Duty, Minecraft, and Candy Crush, and the recurring revenue power of Game Pass in an industry larger and faster-growing than film, TV, or music. If I could only invest in one stock, it would probably be Microsoft, and I believe buying shares at the intrinsic value Margin of Safety price of $349 would be a strong long-term investment.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how to do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and to receive, you will have to give. If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to Humane Society International. They do a lot of good things for animals around the world, such saving dogs from the dogmeat trade in South Korea and actions against animal testing. If you have a few Euros/Dollars/Pounds or whatever to spare, please donate here. Even one or two Euros will make a difference. Thank you.

Comments