L'Oréal: Investing in Timeless Beauty

- Glenn

- Jul 6, 2024

- 17 min read

Updated: Jun 9

L’Oréal is the world’s largest beauty company, with a diverse portfolio of globally recognized brands across skincare, makeup, haircare, and fragrances. With over a century of expertise, L’Oréal has built a strong competitive moat through innovation, consumer insights, and an extensive distribution network. The company has consistently expanded through strategic acquisitions, while its focus on research and development ensures it stays ahead of evolving beauty trends. As the beauty industry continues to grow amid shifting consumer preferences and economic uncertainties, the question remains: Should L’Oréal have a place in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should start by mentioning that at the time of writing this analysis, I do own shares in L'Oréal. If you would like to see the stocks in my portfolio or copy my portfolio, you can do so on eToro, You can find instructions on how to do this here. If you want to purchase shares (or fractional shares) of L'Oréal, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started with investing with as little as $50.

The Business

L'Oréal is the world's largest beauty company, dedicated exclusively to cosmetics and personal care products. Founded in 1909 in Clichy, France, the company operates in more than 150 countries and owns 36 global brands across mass-market, luxury, dermatological, and professional beauty segments. Its four core divisions—Consumer Products, Luxe, Dermatological Beauty, and Professional Products—enable it to serve a diverse consumer base, from affordable skincare to high-end fragrances. The company leads in six key categories: skincare, makeup, haircare, fragrances, hair coloring, and hygiene products. Europe remains L'Oréal’s largest market, followed by North America, North Asia, SAPMENA-SSA, and Latin America. Some of its most recognized brands include L'Oréal Paris, Garnier, Maybelline, Lancôme, Yves Saint Laurent, Biotherm, La Roche-Posay, Vichy, CeraVe, Helena Rubinstein, and Kérastase. L'Oréal’s enduring success is built on a strong competitive moat, driven by its century-long expertise in cosmetics, its deep understanding of consumer preferences, and its extensive brand portfolio. The company’s specialization in beauty allows it to consistently refine its formulations, marketing strategies, and distribution channels to maintain a leadership position across all price points. Its global scale, combined with a diversified mix of mass-market, premium, and dermatological brands, provides resilience against shifting consumer trends. Unlike competitors that expand into adjacent industries, L'Oréal remains fully dedicated to beauty, ensuring that its innovation and resources are entirely focused on advancing product performance and enhancing brand desirability. With strong brand equity, a widespread retail presence, and a decentralized structure that enables fast adaptation to local markets, L'Oréal continues to strengthen its position as the world’s leading beauty company. The beauty industry thrives on innovation, and L'Oréal's ability to anticipate trends and deliver cutting-edge formulations keeps its brands at the forefront. Its leadership in high-growth categories, particularly skincare and dermatological beauty, positions it for sustained long-term expansion. With a combination of scientific research, strong brand equity, and an agile operational model, L'Oréal continues to strengthen its position as the global leader in beauty.

Management

Nicolas Hieronimus serves as the Chief Executive Officer of L'Oréal, a position he has held since May 1, 2021, making him the sixth CEO in the company's 113-year history. He graduated from ESSEC Business School in 1985 with a degree in marketing. Nicolas Hieronimus began his career at L'Oréal in 1987 as a Product Manager for Garnier. In 1993, as Marketing Director at Garnier Laboratories, he developed and launched the Fructis haircare range. By 1998, he advanced to General Manager of the Garnier Maybelline Division in the UK, where he successfully introduced the Fructis line and the Maybelline brand to the British market. In 2000, Nicolas Hieronimus was appointed General Manager of L'Oréal Paris France and later became the International General Manager for L'Oréal Paris. During this tenure, he repositioned the brand as "accessible luxury" and developed key skincare lines such as Dermo-Expertise, Solar Expertise, and Men Expert. From 2005 to 2008, Nicolas Hieronimus served as General Manager of L'Oréal Mexico. He then became General Manager of the L'Oréal Professional Products Division, strengthening its global leadership, particularly through the launch of the Inoa hair color line. In January 2011, Nicolas Hieronimus was appointed President of L'Oréal Luxe, a role he held until the end of 2018. In this capacity, he transformed the division by modernizing major brands and focusing on consumer experience, service, and retail. He led the acquisitions of Urban Decay, IT Cosmetics, and Atelier Cologne, while also securing the Valentino license and extending the Armani license. On July 1, 2013, Nicolas Hieronimus took on the additional role of President of Selective Divisions (Luxury, Active Cosmetics, Professional Products), and on May 1, 2017, he was named Deputy CEO in charge of Divisions. His leadership is characterized by a deep understanding of consumer needs, a strong emphasis on product innovation, and a strategic vision that has consistently strengthened L'Oréal’s market position. I believe that Nicolas Hieronimus’s extensive experience within L'Oréal and the beauty industry makes him well-suited to lead the company into the future.

The Numbers

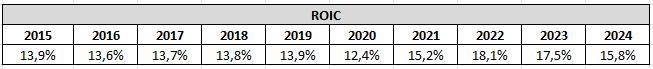

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. L'Oréal has consistently maintained a ROIC above 10% over the past decade, reflecting the company's strong operational efficiency and competitive positioning. Between 2015 and 2020, ROIC remained stable, fluctuating between 12% and 14%, demonstrating resilience across different market conditions. Even during the pandemic, L'Oréal managed to sustain a ROIC above 12%, underscoring the quality of the business. Since 2021, under the leadership of Nicolas Hieronimus, L'Oréal has achieved a higher ROIC, surpassing 15% each year and reaching 17% in two of those years. In 2024, ROIC declined compared to 2023 but remained above 15%. Given that L'Oréal continues to face challenges in China, this slight decline is not a concern.

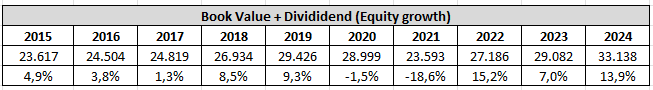

The following numbers represent the book value + dividend. In my previous format, this was referred to as the equity growth rate. It was the most important of the four growth rates I used in my analyses, which is why I will continue to use it in the future. As you are accustomed to seeing numbers in percentage form, I have decided to provide both the actual numbers and the year-over-year percentage growth. L'Oréal has grown its equity in every year except for a slight decline in 2020 and a more significant drop in 2021, both of which were impacted by the pandemic. Since 2022, the company has resumed consistent equity growth, reaching a new all-time high in 2024. Notably, L'Oréal has recorded its two highest year-over-year growth rates in two of the past three years, reinforcing its strong financial momentum.

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. It is not surprising that L'Oréal has generated positive free cash flow every year over the past decade. Free cash flow has increased year over year in most years, signaling strong financial health. While free cash flow declined significantly in 2022, the company rebounded by delivering its highest-ever free cash flow in 2023, surpassing that record again in 2024 despite record-high capital expenditures. This is an encouraging sign of L'Oréal's ability to generate strong cash flows while continuing to invest in growth. The levered free cash flow margin remains below previous peaks but has reached its highest level since 2021, indicating steady improvement. If this trend continues, L'Oréal should be able to return to previous highs in the coming years. The company primarily allocates its free cash flow toward dividends, acquisitions, and share buybacks. As L'Oréal continues to expand its free cash flow, investors can expect higher dividends over time. The free cash flow yield is at its highest level since 2017. While this does not suggest that L'Oréal is trading at a discount, it does indicate that the stock is currently priced more attractively than usual. However, we will revisit valuation later in the analysis.

Debt

Another important aspect to consider is debt. It is crucial to assess whether a business has a manageable level of debt that can be repaid within a period of three years, which is determined by dividing total long-term debt by earnings. Upon analyzing L'Oréal's financials, it is evident that the company has no debt, making this a non-issue for potential investors. Management has also emphasized its commitment to maintaining financial flexibility by prioritizing debt repayment to preserve room for acquisitions. When L'Oréal sold part of its stake in Sanofi, a portion of the proceeds was used to pay off debt, reinforcing this approach. Given this disciplined financial strategy, I do not expect debt to become a concern for L'Oréal in the future.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Risks

L'Oréal's operations in China face significant risks due to economic challenges and regulatory actions that impact consumer behavior and sales channels. China's economic growth has slowed, leading to weaker consumer confidence and reduced spending on luxury goods. In 2024, L'Oréal reported a decline in sales in North Asia, primarily driven by sluggish demand in China. The beauty market in the country contracted by 4% over the year, and while L'Oréal had initially expected stabilization, the anticipated recovery did not materialize. The company's luxury segment, which has traditionally been a key growth driver in China, was particularly affected as consumers became more price-sensitive and shifted toward mass-market alternatives. The Chinese government's intensified crackdown on Daigou activities has added further pressure on L'Oréal’s performance. Daigou refers to individuals or groups who purchase luxury goods overseas and resell them in China, often to avoid higher domestic prices and import restrictions. This practice has long been an important distribution channel for luxury brands, with many Daigou sellers acquiring products from duty-free zones such as Hainan and Korea. However, stricter enforcement by Chinese authorities has significantly reduced these transactions, leading to a decline in L'Oréal’s Asian Travel Retail segment. In 2024, travel retail in Asia declined by 10% for the full year, with Hainan and Korea seeing a combined 35% drop from 2022 levels. In response, L'Oréal reduced its stock levels in these markets to adjust to weaker demand. The contraction in Daigou-driven sales has also impacted L'Oréal's ability to move inventory efficiently, prompting a strategic adjustment in its supply chain. Management has indicated that the resizing of the travel retail business in Asia is now largely complete, and inventory levels have been aligned with current market conditions. Despite these adjustments, the long-term implications of the crackdown remain uncertain. L'Oréal has historically benefited from Daigou demand supporting its luxury brands, and the reduction of this channel could continue to weigh on growth in the region.

Competition is a significant risk for L'Oréal. The company operates in a highly competitive beauty industry, facing challenges from major conglomerates such as Moët Hennessy Louis Vuitton (LVMH), Procter & Gamble, Estée Lauder, and Unilever. These companies, with their extensive brand portfolios and global reach, compete aggressively across various beauty segments, making market share retention increasingly difficult. In recent years, the rise of indie beauty brands has further disrupted the industry. These smaller, more agile companies are quick to capitalize on emerging trends and appeal to niche consumer demands, posing a growing challenge to traditional beauty giants. Brands like e.l.f. Beauty have gained significant traction by offering innovative, affordable products that resonate with younger consumers. The increasing influence of these independent brands underscores the need for L'Oréal to continuously adapt and innovate to maintain its leadership position. Consumer preferences in the beauty industry are evolving rapidly, with growing demand for natural ingredients, health-conscious products, personalized services, connected beauty devices, and sustainability. Failure to anticipate and respond to these shifting trends could weaken L'Oréal’s relevance and erode its market share. Competition in China presents additional challenges. L'Oréal’s Consumer Products Division has struggled against local Chinese brands, leading to market share losses. While flagship brands like L'Oréal Paris have performed well, others, such as Maybelline and Stylenanda, have faced difficulties in gaining traction. With China’s beauty market becoming increasingly competitive, L'Oréal must continue investing in innovation and localization efforts to defend its position.

Product safety and recalls pose a risk for L'Oréal. Recently, the company has faced safety concerns that led to product recalls, which could harm its reputation and financial performance. In March 2025, L'Oréal recalled all U.S. batches of its La Roche-Posay Effaclar Duo acne treatment after concerns that it contained benzene, a chemical linked to cancer. Benzene can sometimes form when one of the product’s key ingredients, benzoyl peroxide, breaks down due to heat or sunlight. The recall followed an independent lab’s discovery of high benzene levels in several acne treatments using benzoyl peroxide. Although L'Oréal's own tests only found small traces in one batch, the company decided to remove the product from shelves as a precaution. In early 2023, L'Oréal also faced regulatory issues in Europe over the use of lilial, a fragrance ingredient banned in the EU due to concerns about its possible effects on reproductive health. In Portugal, health authorities ordered L'Oréal to stop selling any products that still contained lilial and ensure they were removed from stores. These incidents highlight the risks associated with product safety failures. A recall can damage consumer trust, making people hesitant to buy L'Oréal products if they perceive them as unsafe. Recalls can also lead to financial costs, including lost sales, legal claims, and potential regulatory fines. Additionally, as safety standards evolve, L'Oréal must continuously reformulate products to stay compliant, which can increase costs and disrupt production. If product safety concerns continue to arise, L'Oréal risks losing its strong reputation in the beauty industry, which is built on consumer confidence and brand loyalty.

Reasons to invest

L’Oréal is well-positioned to benefit from several favorable trends that support long-term growth in the beauty industry. One favorable trend is the demographic shift in developed markets, particularly in the United States. Unlike many other mature markets, the U.S. is experiencing population growth, with an expected increase of 12 million potential consumers over the next five years. This includes a younger, beauty-conscious Latino population that is driving higher demand for makeup and fragrances - two categories where L’Oréal holds a strong market position. Generational shifts also present a significant opportunity. Gen Z, already a major consumer segment, is set to expand further, with an additional 150 million people joining this demographic in the next five years. By 2030, 370 million Gen Z consumers will be over the age of 25, entering a stage of life with higher disposable income and more sophisticated beauty routines. Meanwhile, Gen Alpha will begin coming of age, adding another 200 million potential beauty consumers. L’Oréal is actively targeting these younger generations through brand ambassadors, digital engagement, and product innovations tailored to their needs, such as acne treatments and skincare regimens. The men’s grooming market is another area of opportunity. While men account for a quarter of global beauty product usage, male-focused beauty products contribute to less than 10% of the overall market. Fragrances already attract strong male demand, and L’Oréal is capitalizing on this with successful launches like YSL Myself and Valentino Born in Roma. The company is also expanding its offerings in men’s skincare and haircare, providing solutions for the increasing number of men adopting regular grooming routines. The aging population is another key growth driver for L’Oréal. By the end of the decade, the 60-plus age group will reach over one billion people, with two-thirds of them in developed markets, where consumers tend to spend more on beauty as they age. Currently, individuals over 60 account for 21% of the population but represent 28% of beauty demand. The average baby boomer spends nearly twice as much on beauty products as a millennial and more than double what Gen Z consumers spend. L’Oréal is well-positioned to capture this market with targeted anti-aging skincare solutions and premium beauty offerings tailored to older consumers.

Emerging markets are a key reason to invest in L'Oréal. These regions are becoming an increasingly important driver of the company's expansion, accounting for over 16% of total sales in the latest year, up from 14% five years ago, and contributing to 36% of overall growth. Notably, sales in emerging markets have doubled over the past four years. The opportunity in these regions is vast. Emerging markets are home to two billion of L’Oréal’s potential consumers, with another 500 million expected to be added in the next five years, half of whom will come from India. These consumers are not only increasing in number but are also becoming more affluent, digitally connected, and beauty-conscious, supporting long-term demand for beauty products. L’Oréal is capitalizing on this trend by expanding its brand presence, e-commerce capabilities, and retail partnerships across Latin America, Africa, the Middle East, India, and Southeast Asia. Several competitive advantages strengthen L’Oréal’s ability to succeed in these markets. The expansion of modern trade and e-commerce has created a more level playing field, allowing L’Oréal to compete more effectively against both local and global brands. The company’s six regional research and innovation hubs enable it to develop products tailored to local beauty preferences, while its 36 manufacturing plants ensure proximity to local markets, improving supply chain efficiency and cost management. With emerging markets now making up a larger share of L’Oréal’s total business and continuing to grow at a faster pace than developed markets, the company is increasing its investments in these regions. By leveraging its scale, innovation capabilities, and market expertise, L’Oréal is well-positioned to capture long-term growth in these high-potential markets.

Acquisitions are a reason to invest in L'Oréal. L’Oréal’s strategic approach to acquiring and scaling promising beauty brands has been a key driver of its long-term growth. Instead of focusing on acquiring already dominant brands, L’Oréal identifies high-potential brands with room to expand. It then leverages its global distribution network, marketing expertise, and research and development capabilities to accelerate their growth while maintaining their unique brand identities. A prime example of this strategy is Kiehl’s, which L’Oréal acquired in 2000 when the brand had annual sales of $40 million. By 2016, Kiehl’s had surpassed $1 billion in revenue. CeraVe is another success story, with sales now exceeding €2 billion - 14 times more than at the time of its acquisition. More recently, L’Oréal’s acquisition of Aesop in August 2023 underscores its ability to scale premium brands. Management has set a clear goal of making Aesop another billion-dollar brand by expanding into new categories such as skincare and fragrances, areas where L’Oréal has extensive expertise. L’Oréal’s acquisition strategy extends beyond existing beauty categories into emerging opportunities. The company has taken minority stakes in brands to diversify its exposure and test potential investments. For example, L’Oréal acquired a stake in Galderma, a leading company in the aesthetics market, to gain insights into medical beauty. It has also invested in the Middle Eastern fragrance house Amouage, recognizing the growing demand for prestige fragrances in the region. Beyond these high-profile acquisitions, L’Oréal actively scouts for emerging brands in untapped markets. The company has invested in Chinese fragrance startups, Documents and Two Summer, as part of a broader effort to understand evolving consumer trends in China. This approach enables L’Oréal to establish an early presence in fast-growing segments and maintain its competitive edge in an industry that is constantly evolving. Acquisitions have played a crucial role in L’Oréal’s success, contributing to both revenue growth and its leadership position in the global beauty industry. With management signaling that more acquisitions are in the pipeline, L’Oréal’s ability to continuously expand its portfolio with high-potential brands remains a compelling reason to invest in the company.

Exclusive Discounts on Seeking Alpha – Elevate Your Investing Today!

For those serious about investing, here's your chance to upgrade your strategy with exclusive offers you won't find anywhere else. These special discounts are available only through the links below—don’t miss out!

Seeking Alpha Premium: Access comprehensive financial data, earnings transcripts, in-depth analysis, market news, and more. Perfect for investors who want an edge in making informed decisions.

Special Price: $269/year (originally $299) + 7-day free trial.

Alpha Picks: Get stock recommendations from a portfolio that gained +177% compared to the S&P 500's +56% from July 2022 through the end of 2024.

Special Price: $449/year (originally $499).

Alpha Picks + Premium Bundle: The ultimate investment package with a $159 discount!

Special Price: $639/year (originally $798).

I use Seeking Alpha daily for its reliable insights and actionable strategies. These deals are available exclusively through my links, so take advantage of them now to level up your investment journey!

Act quickly - these prices won't last forever!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 11,95, which is from 2024. I have selected a projected future EPS growth rate of 9%. Finbox expects EPS to grow by 9% in the next five years. Additionally, I have selected a projected future P/E ratio of 18, which is twice the growth rate. This decision is based on L'Oréal's historically higher price-to-earnings (P/E) ratio. Finally, our minimum acceptable rate of return has already been established at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be €125,87. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy L'Oréal at a price of €62,94 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 8.286, and capital expenditures were 1.642. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 1.149 in our calculations. The tax provision was 2.015. We have 535 outstanding shares. Hence, the calculation will be as follows: (8.286 – 1.149 + 2.015) / 535 x 10 = €171,07in Ten Cap price.

The final calculation is called the Payback Time price. It is a calculation based on the free cash flow per share. With L'Oréal's Free Cash Flow Per Share at €12,42 and a growth rate of 9%, if you want to recoup your investment in 8 years, the Payback Time price is €149,30.

Conclusion

I believe that L’Oréal is an intriguing company with strong management. It has a durable competitive advantage through its century-long expertise in cosmetics, deep understanding of consumer preferences, and extensive brand portfolio. The company has consistently delivered a high return on invested capital (ROIC), demonstrating its quality and operational efficiency, with ROIC increasing under the current CEO. Free cash flow is at an all-time high, though the levered free cash flow margin remains below previous peaks. L’Oréal’s operations in China present risks due to slowing economic growth, weaker consumer confidence, and shifting spending habits that have impacted its luxury segment. Additionally, the Chinese government's crackdown on Daigou activities has significantly reduced a key sales channel, leading to a decline in travel retail. Competition is another challenge, with L’Oréal facing pressure from both global beauty conglomerates and agile indie brands that quickly adapt to trends. Growing competition from local Chinese brands further increases the need for continuous innovation. Product safety and recalls also pose a risk, as they can erode consumer trust, lead to financial losses, and result in regulatory scrutiny. Recent recalls highlight the importance of strict quality control, as repeated issues could harm L’Oréal’s reputation. Despite these challenges, L’Oréal is well-positioned to benefit from favorable global trends. The rising beauty-conscious Gen Z and Gen Alpha consumers, the expansion of the men’s grooming market, and the growing demand from an aging population - all support long-term growth. Additionally, L’Oréal’s expansion in emerging markets provides strong growth potential, driven by a rising, beauty-conscious consumer base and increasing e-commerce adoption. With strategic investments in key regions, the company is well-positioned to capitalize on these opportunities. L’Oréal’s acquisition strategy has been a major driver of its success, enabling it to scale brands like Kiehl’s, CeraVe, and Aesop into billion-dollar businesses. By leveraging its global distribution, marketing expertise, and research capabilities, L’Oréal continues to expand its portfolio and strengthen its leadership in the beauty industry. I believe that L’Oréal is a fantastic company, and purchasing shares at the intrinsic value of the Ten Cap price at €342 could be a strong long-term investment.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how I do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and to receive, you will have to give (Warren Buffett and Mohnish Pabrai are great examples). If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to the Botswanan cheetah. Botswana is home for 30 % of the earth's remaining cheetahs, and as there are less than 100.000 cheetahs left in the world, they need your help. If you have enjoyed the analysis and want some good karma, I hope that you will donate a little to the Botswanan cheetah here. Even a little will make a huge difference to save these wonderful animals. Thank you.

Comments