Deere & Company: A Potential Investment in Regenerative Agriculture

- Glenn

- Jul 23, 2022

- 25 min read

Updated: Jan 10

Regenerative agriculture is emerging as a powerful force in global food production, offering a way to improve soil health, reduce emissions, and make farming more resilient and profitable over time. As environmental pressures grow and ESG commitments move from ambition to requirement, large corporations are increasingly pushing regenerative practices deeper into their supply chains. While it is often difficult to identify which companies will benefit most from this transition, one name stands out as a critical enabler rather than a direct producer: Deere & Company. With its scale, technology, and deep integration into how farms operate, Deere is uniquely positioned to profit from the shift toward regenerative agriculture. The question is whether this quiet beneficiary of a major structural change deserves a place in your portfolio.

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in Deere & Company at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Deere & Company, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Deere & Company, commonly known as John Deere, was founded in 1837 and is the world’s leading manufacturer of agricultural machinery, with significant operations in construction, forestry, turf care, and financial services. The company designs, manufactures, and supports a broad portfolio of equipment and digital solutions used across farming, infrastructure, and land-management activities worldwide. Deere’s business is organized into four segments: Production and Precision Agriculture, Small Agriculture and Turf, Construction and Forestry, and Financial Services. The Production and Precision Agriculture segment is Deere’s largest and most strategically important business. It serves large-scale growers of corn, soybeans, small grains, cotton, and sugarcane with high-horsepower tractors, harvesters, planters, sprayers, and soil-preparation equipment. These machines are increasingly embedded with precision technologies such as satellite-guided navigation, telematics, automation software, onboard sensors, and advanced analytics. All of this is connected through the John Deere Operations Center, which allows customers to monitor equipment performance, manage agronomic operations, and improve decision-making. The Small Agriculture and Turf segment focuses on dairy and livestock producers, specialty and high-value crop growers, and turf and property-maintenance customers. Its product range includes compact and utility tractors, hay and forage equipment, commercial mowing equipment, utility vehicles, and golf-course machinery. The Construction and Forestry segment provides machinery for earthmoving, roadbuilding, material handling, and timber harvesting. Its portfolio includes excavators, loaders, dozers, graders, compact construction equipment, forestry harvesters, and roadbuilding systems, including those from the Wirtgen Group. The Financial Services segment supports equipment sales by offering retail and wholesale financing, leasing solutions, revolving charge accounts, and extended warranties. While smaller than the equipment operations, this segment is strategically important. It improves customer affordability, supports dealer inventory management, and deepens long-term customer relationships. By embedding financing into the sales process, Deere strengthens loyalty and reduces friction in purchasing decisions, particularly during cyclical downturns. Deere’s competitive moat rests on a combination of brand strength, scale, technology integration, and ecosystem lock-in. The John Deere brand is globally recognized and closely associated with reliability, durability, and performance. This reputation, built over nearly two centuries, has created deep customer loyalty and a massive installed base of equipment, giving Deere pricing power and strong repeat-purchase dynamics that are difficult for competitors to disrupt. A critical barrier to entry is Deere’s extensive global dealer network. Thousands of dealer locations across more than 100 countries provide sales, service, parts availability, financing support, training, and precision upgrades. In industries where equipment downtime can be extremely costly, this proximity to customers and the ability to deliver fast, reliable support is a decisive competitive advantage that reinforces long-term relationships. Deere’s most powerful moat lies in its integrated technology ecosystem. Hardware, software, connectivity, and data platforms are tightly linked through the John Deere Operations Center. As customers adopt guidance systems, telematics, automation, and digital tools, their operational data and workflows become embedded within Deere’s ecosystem. This creates high switching costs, as moving to another provider would require not only replacing equipment but also rebuilding data histories, operational processes, and decision systems. Lifecycle solutions further strengthen this advantage. Deere supports equipment throughout its entire lifespan with proprietary parts, maintenance programs, software updates, aftermarket precision upgrades, and digital subscriptions. This extends the useful life and value of each machine, generates recurring revenue, and deepens customer dependence on Deere long after the initial sale.

Management

John C. May is the CEO of Deere & Company. He joined Deere and Company in 1997 and became CEO in November 2019. John C. May was appointed Chairman of the Board in May 2020. Before becoming CEO, John C. May held a series of operating and technology leadership roles that help explain why the company’s current strategy is so centered on software, data, and integrated solutions. John C. May led Deere & Company’s China operations for a period of significant growth, served as a factory manager at the Dubuque Works, and held roles including vice president of the turf and utility platform. John C. May later became part of the senior management team as president of agricultural solutions and chief information officer, and then served as President of the Worldwide Agriculture and Turf Division before being named President and COO in 2019. John C. May holds a bachelor’s degree from the University of New Hampshire and a master’s degree in business administration from the University of Maine. Prior to joining Deere & Company, John C. May worked as a management consultant at KPMG Peat Marwick. In addition to his responsibilities at Deere and Company, John C. May serves on the board of the Ford Motor Company. Under John C. May’s leadership, Deere & Company accelerated its shift from a pure equipment manufacturer toward a technology enabled industrial model. John C. May has been closely associated with Deere & Company’s Smart Industrial Operating Model, which focuses on aligning products around customer production systems, building a scalable technology stack across hardware, software, connectivity and data platforms, and expanding lifecycle solutions that support customers over the full ownership experience. His leadership has been externally recognized, including being named one of Barron’s top CEOs in 2022. Taken together, John C. May’s operational discipline, technology focus, and strategic clarity position him well to lead Deere & Company through its transition from a traditional equipment manufacturer into a Smart Industrial enterprise with durable competitive advantages.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Deere & Company has historically shown a relatively low ROIC mainly because of the kind of business it is in, not because it has been poorly run. Making tractors, harvesters, and construction equipment requires a lot of expensive factories, machinery, inventory, and parts. Once those assets are in place, they stay on the balance sheet for many years, even when demand slows. On top of that, Deere includes its financing business in its numbers. This business helps customers buy equipment but adds a lot of assets like loans and leases, which naturally earn lower returns and pull the overall ROIC down. Another important reason is that Deere’s business moves in cycles. When farmers are doing well and commodity prices are high, they buy more equipment and Deere’s profits rise quickly. But when farm income falls or interest rates rise, customers delay purchases. During those weaker periods, profits drop, but Deere still owns the same factories, inventory, and dealer support network. This mismatch causes ROIC to look weak even though the company’s long-term position has not changed. The strong jump in ROIC between 2020 and 2023 came from unusually favorable conditions. Farmers had strong incomes, equipment pricing was firm, and Deere managed costs well. At the same time, the company started to benefit from its Smart Industrial strategy, which focuses on smarter machines, digital tools, and better service over the life of the equipment. These factors pushed returns to unusually high levels in 2022 and 2023, which should be seen as a high point in the cycle rather than normal conditions. The decline in ROIC in 2024 and especially in 2025 mainly reflects a return to more normal conditions. Farm incomes have come under pressure, demand for new equipment has slowed, and higher interest rates have made financing more expensive. Profits have fallen faster than Deere’s asset base, which naturally pushes ROIC down. This is why 2025 looks like the weakest year since 2017, even though Deere’s competitive position and long-term strategy remain intact. This drop is not something to be overly concerned about on its own. Deere is still investing in automation, precision farming, and digital services, which are meant to make each machine more valuable over time and reduce dependence on pure equipment sales. As agricultural markets stabilize and demand recovers, ROIC should improve from 2025 levels, though it is unlikely to reach the unusually high levels seen in 2023 on a consistent basis.

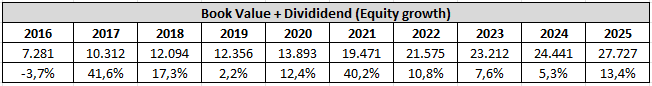

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Deere & Company’s equity has increased every year since fiscal year 2016 mainly because the company has continued to earn money year after year, even when market conditions were not ideal. Deere operates in cyclical industries, but it has avoided major losses during downturns. As a result, the value of the business has steadily grown instead of moving up and down with short-term changes in demand. One important reason for this steady growth is Deere’s diversified business. The company is not only exposed to large-scale farming but also to construction, forestry, turf equipment, and financing activities. When one area slows, others often provide some stability. This reduces the risk of sharp declines in overall results and helps protect the company’s equity over time. Another factor is Deere’s disciplined approach to reinvesting in the business. The company regularly spends money on improving factories, developing smarter machines, and expanding digital and automation capabilities. These investments are aimed at making equipment more productive and valuable for customers. Over time, this has helped Deere strengthen its position and grow the underlying value of the company rather than just increasing short-term profits. The financial services business also plays a stabilizing role. By helping customers finance equipment purchases, Deere supports sales during weaker periods and generates steady income. This reduces volatility and helps prevent large setbacks that could otherwise slow or reverse equity growth. The years with stronger equity growth reflect periods when market conditions were especially favorable or when the business rebounded after softer years. Slower growth years tend to line up with more normal conditions rather than problems with the business itself. Taken together, the pattern shows a company that continues to build value over time, even though growth is not evenly spread across years. Looking forward, it is reasonable to expect equity to keep growing over the long term. Deere’s focus on smarter equipment, digital services, and long-term customer relationships supports continued value creation. That said, growth will likely slow during weaker agricultural or construction cycles, and faster growth during strong periods should be seen as the exception rather than the rule.

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Deere & Company’s free cash flow history looks uneven at first glance, but that pattern is very typical for a highly cyclical, capital-intensive business like Deere. The swings say more about how the business operates across cycles than about underlying weakness. The years with negative free cash flow between 2016 and 2019 were not caused by Deere losing money. Instead, they were mainly about timing. Deere often has to build machines, stock parts, and support dealers before customers actually buy the equipment. When demand slows or becomes uncertain, more machines sit in the system for longer, and cash is tied up temporarily. At the same time, Deere continues to spend on factories, product development, and new technology, even during weaker periods. This combination can push free cash flow into negative territory without hurting the long-term health of the business. Free cash flow jumped sharply in 2020 and 2021 because the opposite happened. Demand recovered strongly, farmers and contractors bought equipment that had already been built, and cash came in quickly. These years benefited from strong farm incomes, good pricing, and better cost control, making them unusually strong compared with a normal year. The lower free cash flow in 2022 reflects a return to more normal conditions after that surge. Deere increased production again to meet demand and continued investing in the business, which reduced cash generation compared with the peak years. Free cash flow improved again in 2023 and 2024 as sales held up and the business adjusted. The drop in free cash flow in fiscal year 2025 is not a major red flag. Demand weakened, uncertainty increased, and Deere chose to keep investing in new products, automation, and digital tools rather than cutting back sharply. This reduced cash generation in the short term. Even so, free cash flow stayed clearly positive, which is an improvement compared with earlier downturns when it often turned negative. What is encouraging is that Deere generated solid cash in 2025 despite a weaker environment. Management has pointed out that cash generation during this downturn was stronger than in past cycles. This suggests the business is now more resilient, with better pricing, better cost discipline, and more stable contributions from services and technology. Looking ahead, free cash flow will likely continue to rise and fall with conditions in agriculture and construction. It should improve as markets stabilize, but it is unrealistic to expect the exceptionally high levels seen in 2021 to repeat regularly. Over time, free cash flow should be more reliable than it was a decade ago. Deere uses its free cash flow in three main ways. First, it reinvests in the business by developing smarter machines, expanding digital and automation capabilities, and improving factories. Second, it returns cash to shareholders through dividends and, when conditions allow, share buybacks. Third, it maintains financial flexibility so it can continue investing even during weaker periods. The free cash flow yield indicates that Deere is currently valued at a premium, although valuation will be discussed in more detail later in the analysis.

Debt

Another important aspect to consider is the level of debt. It is crucial to evaluate whether a business has manageable debt that can be repaid within a three-year period. This can be assessed by calculating the ratio of long-term debt to earnings. Based on my analysis of Deere & Company, the company has a debt-to-earnings ratio of 1,74 years, which is well below the three-year threshold. This indicates that Deere’s debt level is manageable and does not appear to be a concern.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Risks

Macroeconomic factors are a risk for Deere & Company because demand for its products is closely tied to economic conditions that are largely outside the company’s control. Deere sells high-value agricultural, construction, and turf equipment that customers typically purchase only when income visibility is strong and financing conditions are favorable. When economic uncertainty rises, these purchases are often delayed rather than made in smaller quantities, which makes demand more volatile. The most significant exposure is to the agricultural business cycle. Farmers’ willingness and ability to invest in new equipment depends heavily on farm income, which is influenced by commodity prices, crop yields, weather conditions, input costs such as fertilizer and fuel, and global supply and demand dynamics. When commodity prices fall or weather conditions reduce yields, farm income declines and farmers tend to postpone equipment purchases. Because these factors can change quickly, demand for Deere’s equipment can swing sharply from year to year. Financing conditions can make these cycles even stronger. When interest rates rise, it becomes more expensive for farmers and contractors to borrow money, and the value of farmland can decline, which makes it harder to secure loans. As financing becomes tighter or more costly, customers are more likely to delay buying new equipment. In fiscal year 2025, this led to lower sales volumes for Deere, greater use of sales incentives to support demand, and more customer payment issues. Management has indicated that some of these challenges are likely to continue into fiscal year 2026. Global trade and government policy add additional uncertainty. Changes in trade relationships, tariffs, or export demand can quickly affect commodity prices and farm profitability. Government farm programs, subsidies, and renewable fuel policies can either support or weaken farm income depending on how they change, and differences across regions can create uneven competitive conditions for multinational manufacturers like Deere. Macroeconomic weakness also affects Deere’s construction and turf businesses. High inflation, elevated unemployment, cautious consumer spending, and reduced business investment can slow construction activity, housing development, and infrastructure spending. This reduces demand for construction, roadbuilding, and turf equipment, meaning economic downturns can impact multiple segments of Deere’s business at the same time. Another challenge during weaker periods is the availability of used equipment. When markets soften, used machinery remains in circulation longer and competes with new equipment sales, which can delay a recovery even after conditions begin to improve.

Laws and regulations are a meaningful risk for Deere & Company because the company operates a highly global, technology-enabled manufacturing business that is directly affected by trade policy, government regulation, and political decisions across many regions. Changes in these rules can quickly alter costs, pricing, supply chains, and even how Deere is allowed to interact with its customers. Trade laws and tariffs are one of the most direct risks. Deere sources parts and components globally and exports a large share of its equipment from the United States. New import tariffs increase the cost of components and finished products, while retaliatory tariffs can reduce the profitability of exports or make Deere’s products less competitive in overseas markets. In fiscal year 2025, newly imposed U.S. tariffs raised Deere’s costs by roughly $600 million, and management expects tariff-related pressure to continue into 2026. Because tariffs are set by governments and can change quickly, Deere has limited ability to fully offset them through pricing or cost cuts in the short term. Export controls and sanctions create additional uncertainty. Restrictions on selling products, software, or technology to certain countries or entities can limit Deere’s ability to operate in foreign markets, collect payments, or provide parts and warranty support for existing equipment. These rules can also disrupt manufacturing in regions where Deere relies on local suppliers or assembly operations. Restricted access to global markets is another concern. Trade barriers can slow or block the movement of goods, limit access to key raw materials, or delay the delivery of high-quality components. This can lead to higher costs, production delays, or missed sales opportunities. Over time, reduced access to emerging markets could also limit Deere’s long-term growth, especially in regions where rising living standards and food demand would otherwise drive increased equipment adoption. Regulatory pressure related to right-to-repair is another important risk. Proposed or enacted laws could require Deere to share diagnostic software, tools, or technical information with third parties. This could weaken Deere’s control over its technology ecosystem, reduce pricing power in aftermarket parts and services, and potentially compromise equipment performance or safety. Given that parts, services, and precision upgrades are a growing and higher-margin part of Deere’s business, unfavorable outcomes in this area could weigh on long-term profitability. Deere’s construction, roadbuilding, and forestry businesses face similarly intense competition. In these segments, the company competes with global heavyweights such as Caterpillar, Komatsu, Volvo Construction Equipment, Hitachi, and SANY, among others. These companies compete aggressively on product performance, pricing, dealer coverage, and technology features. Infrastructure spending cycles and construction downturns can quickly intensify competition, as manufacturers fight to keep factories running and protect market share.

Competition is a risk for Deere & Company because it operates in global markets that are both highly competitive and constantly evolving. Deere does not compete in a stable or protected environment. Instead, it faces pressure from large, well-capitalized rivals, smaller regional players, and an increasing number of technology-focused entrants, all of which can affect pricing, margins, and long-term growth. In agricultural equipment, Deere competes with global manufacturers such as AGCO, CNH Industrial, Kubota, and CLAAS, alongside many regional and specialty producers. These competitors differ in product focus, geographic strength, and cost structures. In periods of strong demand, competition is often based on technology, reliability, and service. However, during downturns, competition tends to shift toward price. When farm incomes are under pressure, customers become more price-sensitive, and competitors may use aggressive discounting or financing incentives to win market share. This can force Deere to respond with its own incentives, which can weigh on margins and profitability. Regional competition adds another layer of complexity. In emerging markets such as Brazil and Argentina, Deere must contend with local manufacturers that often have lower cost bases and a deep understanding of local customer needs. Economic volatility in these regions can amplify competitive pressure, as weaker demand encourages customers to favor lower-priced alternatives or delay purchases altogether. To remain competitive, Deere must tailor products, pricing, and financing solutions to each market, which increases operational complexity and risk. Competition is also intensifying as agriculture becomes more technology-driven. Precision farming, automation, connectivity, and data analytics are increasingly central to productivity gains. This has attracted non-traditional competitors, including technology companies and startups that focus on software, sensors, autonomy, and data platforms. These players are often more agile and unburdened by legacy manufacturing structures. While Deere has invested heavily to build an integrated technology ecosystem, the pace of innovation in this space creates the risk that competitors could develop solutions that reduce Deere’s technological edge or weaken customer loyalty. Across all segments, competition spans multiple dimensions, including product quality, innovation, sustainability, distribution networks, financing options, customer service, and total cost of ownership. While John Deere’s brand and dealer network are important advantages, competitors continue to invest heavily to narrow these gaps. As the industry evolves, maintaining leadership requires continuous investment in new products, technology, and services, which increases costs and execution risk.

Reasons to invest

Tech and automation is a reason to invest in Deere & Company because they directly address some of the most pressing and structural challenges facing agriculture, construction, and land-based industries. Across these sectors, customers are being forced to operate with fewer resources, higher costs, and persistent labor shortages, while demand for food, fuel, and infrastructure continues to grow. Deere’s strategy is built around helping customers do more with less, and technology is the core tool enabling that outcome. Labor availability is one of the clearest drivers of adoption. Skilled labor shortages are widespread and worsening, especially during peak seasons when timing is critical. Deere’s automation and autonomy solutions reduce dependence on labor by allowing machines to perform tasks more consistently and efficiently, even when workers are unavailable. Autonomous tillage, automated harvesting, and smart spraying systems give customers the flexibility to get work done on time rather than waiting for labor, which directly improves productivity and reduces operational risk. Rising input costs further strengthen the case for Deere’s technology. When prices for seed, fertilizer, chemicals, fuel, and energy increase, small efficiency gains can have a large impact on profitability. Deere’s precision technologies are designed to apply inputs only where and when they are needed. Solutions like See and Spray, ExactRate, and automated harvest optimization reduce waste, lower costs, and protect yields. When customers can clearly see savings, such as cutting herbicide use by roughly half or increasing harvest throughput, adoption tends to increase and usage deepens over time. A key advantage for Deere is that its technology is not limited to one product or one type of customer. The company has built a centralized technology stack that spans basic precision, digital tools, automation, and full autonomy. This allows innovations developed in one production system to be reused and scaled across others. Connectivity solutions, retrofit kits, and the John Deere Operations Center bring technology into older machines and even non-Deere equipment, expanding the addressable market well beyond new equipment sales. Automation and autonomy also create a powerful long-term growth runway. Early results show high take rates, strong usage levels, and increasing adoption year over year as customers add more machines and cover more acres or job sites. Importantly, autonomy is not just about convenience. It changes how operations are planned and executed by removing labor as a bottleneck and allowing resources to be allocated to higher-value tasks. This kind of structural productivity improvement is difficult for customers to give up once experienced. From an investment perspective, tech and automation also support a shift in Deere’s business model. Software-enabled features, digital tools, and autonomy are increasingly offered through subscriptions and usage-based pricing. This lowers upfront costs for customers while creating recurring, higher-margin revenue for Deere. As adoption and utilization grow, these recurring revenues become a larger and more stable part of the business, reducing reliance on purely cyclical equipment sales.

International growth is a reason to invest in Deere & Company because the company has built a global platform that allows it to grow beyond its traditional reliance on North American large agriculture and capture long-term demand across multiple regions, production systems, and customer types. Over the past decade, Deere has deliberately raised profitability and operational performance outside North America, making the business more balanced and resilient across cycles. A key part of this opportunity lies in Europe and South America, where agricultural fundamentals remain supportive over the medium term despite near-term volatility. In Europe, improving crop yields, stable dairy margins, and easing financial conditions are creating a more constructive environment for farmers to resume investment after a period of caution. Deere is well positioned in these markets with a broad product lineup and technology solutions tailored to arable, dairy, and mixed farming operations, allowing it to benefit even in modest industry growth scenarios. South America, particularly Brazil, represents one of Deere’s most compelling long-term growth opportunities. Brazil’s agricultural system is structurally different from North America, with multiple harvests per year, tight operating windows, and very high input usage. These conditions make productivity, precision, and uptime especially valuable. Deere has invested heavily in local manufacturing, product development, and dealer capabilities in Brazil, enabling it to deliver machines and technologies designed specifically for local terrain, climate, and farming practices. What makes international growth especially attractive is the scale of the opportunity. Agriculture operates on an enormous global footprint, with trillions of plants grown each year and hundreds of millions of acres farmed across continents. Deere views this as a large incremental addressable market, where even small improvements in productivity or cost efficiency can translate into meaningful value for customers and significant revenue potential for the company. By expanding full production system solutions geographically, Deere can reuse the same equipment platforms, software, and digital tools across regions at relatively low incremental cost. Emerging markets further strengthen the international growth story. In countries such as India, Deere is addressing agriculture through a different customer model, serving contractors who operate across many small farms. Connectivity, fleet management, and digital job tracking are becoming core tools for these customers, and Deere is embedding them directly into new equipment. Given the sheer size of the tractor market in India, even modest increases in market share or technology adoption can drive meaningful long-term growth. Importantly, international expansion today looks very different from a decade ago. Deere is no longer simply selling machines into overseas markets at lower margins. Instead, it is exporting a complete ecosystem of equipment, technology, services, and dealer support.

Regenerative agriculture is a reason to invest in Deere & Company because it represents a structural shift in how food is produced and because Deere is one of the few companies with the scale, technology, and product breadth required to enable that shift in a practical and profitable way for farmers. Regenerative agriculture focuses on improving soil health, increasing biodiversity, capturing carbon in the soil, and reducing dependence on chemical inputs such as synthetic fertilizers and pesticides. These practices are not only environmentally beneficial but increasingly economically attractive. Farms that adopt regenerative methods often lower input costs, improve long-term yields, and become more resilient to weather volatility, making them more profitable over time. As profitability improves, farmers are more willing to invest in equipment and technology that supports these practices. This transition is being accelerated by large food and consumer companies such as PepsiCo, Walmart, and Unilever, which are pushing regenerative standards throughout their supply chains to meet sustainability and ESG targets. These commitments place direct pressure on growers to document practices, reduce emissions, and improve soil outcomes. As a result, demand is rising for equipment and digital tools that can both enable regenerative practices and verify them. Deere benefits from this because it sells not just machines, but integrated solutions that combine equipment, precision technology, and data tracking. Deere’s product portfolio is well aligned with regenerative farming needs. Equipment such as no-till and strip-till implements help farmers reduce soil disturbance, preserve organic matter, and improve water retention. Precision seeding and application systems allow inputs like seed, fertilizer, and crop protection products to be applied only where needed, reducing waste and runoff. Manure spreaders and nutrient management tools support recycling of organic nutrients, lowering reliance on synthetic fertilizers and improving soil health. Technology is a key differentiator in this space. Deere’s precision agriculture tools, including ExactApply and ExactRate systems, help farmers manage inputs with a high degree of accuracy, which is essential for regenerative systems where over-application can undermine soil improvements. Digital platforms such as the John Deere Operations Center allow farmers to track field activity, document practices, and generate data that can be shared with buyers, lenders, or carbon programs. This ability to measure and verify outcomes is becoming increasingly important as regenerative agriculture moves from concept to requirement. Regenerative agriculture supports both growth and durability. It encourages farmers to upgrade equipment, adopt precision technologies, and engage with digital platforms over many years, creating recurring demand rather than one-off purchases. It also aligns Deere with long-term global priorities around food security, sustainability, and climate resilience.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 18,50, which is from 2025. I have selected a projected future EPS growth rate of 15%. Finbox expects EPS to grow by 15,1% a year in the next five years. Additionally, I have selected a projected future P/E ratio of 30, which is twice the growth rate. This decision is based on Deere & Company's historically higher price-to-earnings (P/E) ratio. Finally, our minimum acceptable rate of return has already been established at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be $555,50. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Deere & Company at a price of $277,50 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 7.459, and capital expenditures were 4.228. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 2.960 in our calculations. The tax provision was 1.259. We have 270,3 outstanding shares. Hence, the calculation will be as follows: (7.459 – 2.960 + 1.259) / 270,3 x 10 = $213,02 in Ten Cap price.

The final calculation is called the Payback Time price. It is a calculation based on the free cash flow per share. With Deere & Company's Free Cash Flow Per Share at $11,95 and a growth rate of 15%, if you want to recoup your investment in 8 years, the Payback Time price is $188,64.

Conclusion

I believe that Deere & Company is an intriguing company with strong management and a durable competitive position built on brand strength, scale, technology integration, and ecosystem lock-in. Both ROIC and free cash flow naturally fluctuate over time due to the cyclical nature of the business, which is why their decline in fiscal year 2025 is not a major concern. Macroeconomic factors remain a risk because demand for Deere’s high-value equipment depends heavily on farm income, financing conditions, and overall economic confidence, meaning that lower commodity prices, higher interest rates, or increased uncertainty can lead customers to delay purchases across agriculture, construction, and turf markets. Laws and regulations also pose a risk, as changes in trade policy, tariffs, export controls, and technology rules can raise costs, disrupt supply chains, and limit access to key markets, while regulatory pressure such as right-to-repair could weaken Deere’s control over its technology ecosystem and reduce the profitability of parts, services, and digital solutions. Competition is another risk given the highly competitive global markets Deere operates in, where pricing pressure intensifies during downturns and rapid technological change attracts both traditional rivals and new technology-focused entrants, potentially pressuring margins and market share. At the same time, tech and automation are a compelling reason to invest because they help customers deal with labor shortages and rising input costs by improving productivity and efficiency, while also supporting higher adoption, recurring revenue, and a more resilient business model through software and subscription-based solutions. International growth further strengthens the investment case, as Deere has built a scalable global platform that reduces reliance on North America and expands into large, underpenetrated agricultural markets by offering a full ecosystem of equipment, technology, and services tailored to regions such as Europe, Brazil, and India. Regenerative agriculture adds another long-term tailwind, as the shift toward more profitable and sustainable farming increases demand for precision equipment, digital tools, and data-driven solutions, positioning Deere to benefit from recurring upgrades and deeper customer engagement over time. Overall, there are many things to like about Deere & Company, but given the cyclical nature of the business, I would require a margin of safety and would only consider buying shares at a Margin of Safety price of $277.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how to do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and to receive, you will have to give. If you appreciated my analysis and want to get some good karma and show your appreciation, I would kindly ask you to donate a bit to Rolda. It is an organization that helps the animals in Ukraine. Animals are the forgotten souls in a war, and they need all the help they can get. If you have a few bucks to spare, it doesn't matter how little, I will kindly ask you to donate a bit here. Thank you.

Comments