Hormel: Is it a recipe for success?

- Glenn

- Feb 17, 2024

- 23 min read

Updated: Dec 29, 2025

Hormel Foods is a long-established food company with a wide range of well-known brands across packaged foods and protein products. From everyday staples like SPAM, Jennie-O, and Skippy to its high-margin Foodservice business supplying restaurants and institutions, Hormel combines brand recognition with scale and reach. With a growing focus on protein-based products, convenience, and practical innovation, the company is working to adapt to changing consumer habits. The question remains: Does Hormel Foods deserve a place in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in Hormel at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Hormel, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Hormel Foods Corporation is a global branded food company founded in 1891 and headquartered in Austin, Minnesota. What began as a meat processor has evolved into a diversified food company, with products sold in all 50 U.S. states and across more than 80 countries. Hormel operates through three core segments: Retail, Foodservice, and International. The Retail segment is the largest by revenue and focuses on branded consumer products sold through grocery stores, mass merchandisers, club stores, natural food chains, dollar stores, and e-commerce platforms in the U.S. Hormel holds the #1 or #2 market share position in over 40 retail categories, supported by a portfolio of iconic brands such as SPAM, Jennie-O, Applegate, Skippy, Wholly Guacamole, Hormel Black Label, and Planters. These brands span a wide range of price points, eating occasions, and consumer preferences, from value-oriented staples to premium and organic offerings. The Foodservice segment supplies products to restaurants, convenience stores, hospitality, healthcare, education institutions, and other food-away-from-home operators across the U.S. While smaller in revenue terms, this segment generates nearly half of company profits due to structurally higher margins, scale advantages, and deep customer relationships. Hormel’s broad portfolio allow it to serve national chains as well as regional and independent operators. The International segment distributes Hormel’s products through retail and foodservice channels outside the U.S., with a presence in markets such as China, Japan, Australia, Brazil, and South Korea. International growth is supported by a mix of wholly owned operations, joint ventures, minority equity stakes, and royalty arrangements, allowing Hormel to scale globally while limiting capital intensity and risk. Hormel’s competitive moat is built on a combination of brand strength, portfolio breadth, channel reach, and structural advantages in foodservice. At the core of the moat is its brand portfolio. Hormel owns more than 30 well-established brands, many of which hold leading market positions and benefit from decades of consumer trust. Brands such as SPAM, Skippy, Jennie-O, Applegate, and Planters have strong household penetration, and pricing power. This brand depth reduces reliance on any single product and provides protection against shifting consumer preferences. A second key moat element is Hormel’s balanced protein-centric portfolio. Unlike many food peers that are concentrated in a single category, Hormel combines fresh, refrigerated, shelf-stable, premium, and value-added protein products across multiple channels. This gives the company flexibility to allocate capital and innovation toward the fastest-growing or most profitable categories over time. Foodservice represents a particularly important advantage. Hormel’s scale, product range, and long-standing relationships with foodservice distributors and operators create high switching costs and durable demand. This segment delivers outsized profitability and acts as a stabilizing force during periods when retail demand softens, giving Hormel a more resilient earnings profile than retail-only peers. Distribution and scale further reinforce the moat. Hormel’s nationwide U.S. distribution network and established international partnerships ensure broad market access and efficient logistics. Its use of joint ventures, minority stakes, and royalty models internationally allows Hormel to expand globally without sacrificing returns on capital.

Management

Jeffrey M. Ettinger serves as the Interim CEO of Hormel Foods Corporation, a role he assumed in 2024 following a long and distinguished career with the company. Jeffrey M. Ettinger brings decades of experience in branded food manufacturing, global operations, and corporate leadership, having previously served as Hormel’s CEO from 2005 to 2016. During his tenure as CEO, Jeffrey M. Ettinger led Hormel through a period of significant transformation, expanding the company beyond its traditional meat-centric roots into higher value branded and prepared foods while strengthening its international footprint. Under his leadership, Hormel completed several strategic acquisitions, broadened its product portfolio, and delivered consistent revenue growth, margin expansion, and shareholder returns. Prior to becoming CEO, Jeffrey M. Ettinger held a series of senior leadership roles within Hormel, including President and COO, where he oversaw day-to-day operations across Retail, Foodservice, and International segments. Earlier in his career, he worked in finance and corporate development roles that gave him deep insight into capital allocation, brand strategy, and operational efficiency. Jeffrey M. Ettinger holds a bachelor’s degree from UCLA and an MBA from the University of Minnesota. His leadership style is often characterized as disciplined, values-driven, and long-term oriented, with a strong emphasis on brand stewardship, operational excellence, and corporate culture. As Interim CEO, Jeffrey M. Ettinger provides continuity, institutional knowledge, and steady leadership at a pivotal moment for Hormel Foods Corporation. Given his prior success in navigating industry cycles, managing acquisitions, and delivering long-term value, Jeffrey M. Ettinger is well-positioned to guide Hormel through this transitional period while maintaining strategic focus and financial stability.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Hormel’s ROIC has clearly trended down over the past decade, falling from roughly 22% in 2016 to below 7% in 2025. That decline is not the result of one bad year or poor execution in isolation, but rather reflects a gradual structural shift in the business. Hormel used to look like a classic high-ROIC branded food company with strong pricing power and capital efficiency. Today, it still earns returns above its cost of capital, but ROIC has decreased meaningfully. One of the main reasons for the decline is that Hormel has invested a lot of money faster than its profits have grown. Over the past decade, the company spent heavily on acquisitions and expanding its operations, most notably with the purchase of the Planters brand. Strategically, this made sense, but it also increased the amount of money tied up in the business. When a company puts much more money to work without seeing profits rise at the same pace, its ROIC naturally falls, even if the business itself is still solid and well run. At the same time, Hormel has made less money on its core protein products. Meat and poultry businesses tend to be more unstable than many packaged food categories, and Hormel has been hit by higher animal feed costs, rising wages, more expensive transportation, and several years of too much turkey supply at Jennie-O. These issues squeezed profits, especially from 2019 onward. When a business with large factories and equipment earns less on each product it sells, overall returns naturally decline. Hormel has also deliberately expanded beyond its traditional meat products. It has invested in plant-based foods, organic and premium brands, international partnerships, and a larger foodservice business. These moves make the company more resilient over the long term, but they usually take time to pay off. In the early years, these newer areas tend to be less profitable than Hormel’s established brands, which has pulled down overall returns while the business was being built out. The foodservice business adds another challenge. Even though it is Hormel’s most profitable segment and generates a large share of overall profits, it still requires significant investment in production and logistics. During COVID, demand from restaurants and institutions dropped sharply, and the recovery afterward was uneven. As a result, factories and distribution systems were not used as efficiently as planned, which hurt returns. On top of that, between 2021 and 2023, costs rose faster than prices. Hormel chose to raise prices cautiously in order to protect its brands and long-term customer relationships, which was sensible strategically but reduced profits in the short term. From an investor’s point of view, the decline in ROIC is something to keep an eye on, but it is not a serious warning sign yet. Hormel is still earning more on its business than it costs to run it, meaning it continues to create value. However, the company no longer has the strong buffer it once did. If returns stay stuck at low levels for many years, Hormel would start to look more like a commodity food processor rather than a high-quality branded food company. Looking ahead, some improvement in returns is reasonable to expect. The Planters brand is growing again, Jennie-O is recovering after years of too much supply, pricing pressure has eased as inflation cools, and the foodservice business should continue to normalize. Importantly, most of Hormel’s heavy investment phase is likely behind it, which reduces the risk that returns keep getting diluted. That said, it is unrealistic to expect returns to climb back to the very high levels seen a decade ago. Protein businesses are expensive to run and naturally volatile, and many of Hormel’s newer growth areas are simply less profitable than its most established brands.

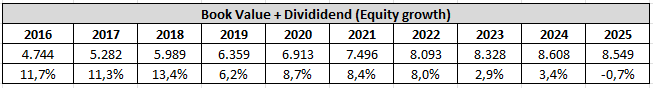

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Hormel’s equity increased steadily for most of the past decade, which reflects a business that consistently earned money and retained profits while maintaining a relatively conservative balance sheet. That long track record is important, because it shows that equity growth has been the norm rather than the exception. The drop in equity in fiscal year 2025 stands out, but it does not automatically mean something is fundamentally wrong with the business. Equity mainly fell because Hormel had a weaker profit year while also making some balance sheet adjustments. Lower profits, caused by pressure in its protein businesses, disruptions in foodservice, and still-elevated costs, meant the company added less to its equity than in previous years. On top of that, accounting items such as writing down assets, restructuring costs, or changes in the value of investments can reduce reported equity even when the company is still generating cash. A one-year decline in equity can happen without signaling that the business itself is getting worse. The key question is whether this decline is temporary or the start of a longer-term problem. So far, it looks more like a temporary setback than a lasting issue. Hormel continues to generate cash, its balance sheet remains healthy, and there are no signs of financial stress that would put long-term equity growth at risk. Looking forward, equity should start growing again if profits improve. A recovery at Jennie-O, continued growth at the Planters brand, easing cost pressures as inflation slows, and a more stable foodservice business should all help earnings. Just as importantly, Hormel has largely completed its major investment phase, meaning future profits are more likely to build up on the balance sheet rather than being tied up in large new projects.

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Hormel’s free cash flow history over the past decade shows a business that is normally quite consistent, but with noticeable swings in recent years. From 2016 through 2023, free cash flow generally moved within a fairly stable range, reflecting the defensive nature of food demand and the company’s disciplined operations. Fiscal year 2024 stands out as an exceptionally strong year, while fiscal year 2025 represents the opposite extreme, with the lowest free cash flow in a decade. The drop from a record high in 2024 to a low point in 2025 looks dramatic, but it does not mean the business suddenly broke down. In 2024, Hormel had several things going in its favor at the same time. Sales volumes improved, pricing was better, and cash flowed in faster than usual because of timing effects in areas like inventories and customer payments. This made 2024 an unusually strong year for free cash flow. In 2025, many of these factors moved in the opposite direction. Profits were weaker due to ongoing pressure in meat products, lower profitability in foodservice, and still-high costs. As a result, the business generated less cash. The very low free cash flow margin in 2025 supports this explanation. It reflects a difficult operating year rather than a broken business model. Hormel chose not to fully pass higher costs on to customers through aggressive price increases. This helped protect its brands and long-term customer relationships, but it also meant less cash was generated in the short term. By itself, one weak year is not a major concern, especially when it follows an exceptionally strong one. What would be worrying is if free cash flow and margins kept falling year after year. So far, the numbers point to short-term ups and downs rather than a lasting decline. Even in a tough year, Hormel still produced positive free cash flow, which shows the business remains fundamentally sound. Looking ahead, free cash flow should improve as conditions stabilize. Jennie-O is recovering, the Planters brand is growing again, cost pressures are easing as inflation slows, and the foodservice business should continue to normalize. Just as importantly, Hormel has largely finished its heavy investment phase, so more of the cash it earns should stay in the business rather than being spent on large projects. Hormel mainly uses its free cash flow to return cash to shareholders. The company has paid a dividend for more than 95 years and has increased it for 60 consecutive years, which highlights how central steady cash generation is to its strategy. At the same time, management aims to preserve enough financial flexibility to continue investing in its brands, improve operations, and pursue selective acquisitions when attractive opportunities arise. The free cash flow yield is lower than it has been in the past, but it is based on a year in which Hormel generated its lowest free cash flow in a decade, so it may not say much about the current share price. We will revisit valuation later in the analysis.

Debt

Another important aspect to consider is debt. I assess whether a company’s debt is manageable by looking at how many years of earnings it would take to repay long-term debt, calculated by dividing total long-term debt by earnings. Based on this approach, Hormel currently has debt equal to 5,92 years of earnings, which is above my three-year threshold. However, this figure is influenced by unusually low earnings in the most recent fiscal year and therefore may not fully reflect the company’s true debt capacity. Over the past five years, Hormel’s debt-to-earnings ratio has typically ranged between three and four years. While this is higher than I would prefer, it is not alarming.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Risks

Commodity prices is a risk for Hormel because a large part of its business depends on raw agricultural inputs whose prices can change quickly and unpredictably, while Hormel often cannot fully pass those changes on to customers in the short term. Fiscal 2025 is a good illustration of this risk. During the year, Hormel faced much higher costs for key inputs such as pork, beef, turkey, and nuts. Pork bellies rose around 25%, pork trim about 20%, and beef remained elevated across the industry. These cost increases put significant pressure on profitability across the retail segment and were a major reason earnings fell well short of management’s expectations. The core issue is timing and pricing power. Even though Hormel sells branded, value-added products, many of its costs move faster than its prices. Grocery retailers and foodservice customers typically require notice periods before price increases can be implemented, and Hormel often chooses to raise prices gradually to protect long-term relationships and brand strength. When commodity costs spike quickly, margins are squeezed until pricing catches up, if it catches up at all. This was especially visible in 2025, when value-added growth could not offset the impact of higher input costs. Protein markets add another layer of volatility. Hormel relies heavily on pork, beef, and turkey, all of which are influenced by supply and demand cycles, feed costs, weather, trade flows, and disease outbreaks. Turkey is a clear example. In recent years, Hormel has faced both oversupply and undersupply, each with different but equally damaging effects. In fiscal 2025, avian illnesses, including highly pathogenic avian influenza, reduced turkey supply across the industry. Lower supply drove up turkey prices and input costs, hurting margins, particularly in the first half of the year. Beyond proteins, Hormel is also exposed to commodity risk in other parts of its portfolio. Nut costs, for example, have been volatile, with sharp increases in cashew prices leading consumers to trade down to cheaper alternatives.

General risks in the food industry is a risk for Hormel because the company operates in a sector where even rare incidents can have immediate financial, legal, and reputational consequences. Food production involves handling raw agricultural products that naturally carry bacteria and pathogens, which means the risk of contamination can never be fully eliminated, only managed. Hormel processes large volumes of meat and prepared foods, exposing it to pathogens such as Listeria monocytogenes, Salmonella, and E. coli. These organisms can enter the production process at multiple points, including during slaughter, processing, packaging, transportation, or storage. Even with strict quality controls, testing, and sanitation procedures, contamination can still occur due to human error, equipment failures, or supplier issues. Importantly, risks also arise outside Hormel’s direct control, such as improper handling by distributors, retailers, foodservice operators, or consumers. When contamination is suspected, Hormel may choose or be required to initiate a product recall. Even voluntary recalls can be costly and disruptive. They lead to direct costs from destroying inventory, halting production, and correcting processes, as well as indirect costs such as lost sales and damaged customer relationships. Recent examples, including the voluntary recall of Planters products due to potential Listeria contamination and a Class I recall involving chicken products sold through foodservice channels, show how quickly these risks can translate into real financial impact, even when no illnesses are reported. Beyond contamination, mislabeling presents another meaningful risk. Errors involving allergens are particularly serious, as they can cause severe or life-threatening reactions for consumers. Mislabeling can trigger lawsuits, regulatory penalties, and mandatory recalls, while also undermining consumer trust. Reputational damage is often the most lasting consequence. Trust is critical in the food industry, particularly for long-established brands like Hormel and Planters. Even isolated incidents can lead to negative publicity, strained retailer relationships, or consumer boycotts, which may take years to fully reverse.

Customer concentration is a risk for Hormel because a meaningful share of its sales is tied to a relatively small number of very large customers, which gives those customers significant influence over pricing, volumes, and commercial terms. In fiscal 2025, sales to Walmart and its subsidiaries accounted for about 16% of Hormel’s total revenue, and the company’s top five customers together represented roughly 38% of sales. This level of concentration means that changes in the purchasing behavior of just one or two customers can have a noticeable impact on Hormel’s financial results. Walmart is particularly important because it is a major customer across both the Retail and International segments. Large retailers like Walmart have substantial bargaining power and are often able to demand lower prices, higher promotional spending, or more favorable contract terms. In an industry where input costs are volatile and pricing flexibility is already limited, this pressure can make it harder for Hormel to protect margins, especially during periods of rising commodity costs or weak consumer demand. Customer concentration also increases the risk of volume volatility. If a major customer decides to reduce shelf space, shift purchases to private-label alternatives, change suppliers, or alter its merchandising strategy, Hormel could see an immediate decline in sales. These decisions are often driven by the retailer’s own priorities rather than the performance of Hormel’s brands, which limits Hormel’s ability to control outcomes. The impact of losing or downsizing a large customer goes beyond lost revenue. Hormel operates large-scale production and distribution systems that are designed around high volumes. A sudden reduction in orders from a top customer could lower capacity utilization at factories, increase per-unit production costs, and reduce overall profitability. In the Retail segment, this could require production adjustments or increased promotional activity to move excess inventory. In the International segment, the loss of a key customer could weaken distribution networks and slow growth in important markets.

Reasons to invest

The Foodservice segment is a reason to invest in Hormel because it represents one of the company’s most differentiated, profitable, and resilient growth engines. Despite accounting for a smaller share of total sales, Foodservice contributes close to half of Hormel’s total profits, highlighting its structurally higher margins and strong return profile. This makes it a critical driver of overall earnings quality and long-term value creation. A major competitive advantage within Foodservice is Hormel’s direct-selling model. Unlike many competitors that rely heavily on distributors, Hormel employs a dedicated sales force that works directly with foodservice operators across restaurants, lodging, convenience stores, healthcare, education, and other commercial and noncommercial channels. These close relationships allow Hormel to understand operator challenges in real time and co-develop products that directly address labor shortages, consistency issues, and back-of-house complexity. This customer intimacy creates switching costs and makes Hormel a partner rather than just a supplier. The Foodservice portfolio is also well positioned in categories with attractive long-term demand. Premium prepared proteins, pizza toppings, bacon, turkey, and snacking products have driven growth and helped the segment outperform the broader foodservice industry, even in a challenging consumer environment. Management expects the overall foodservice market to see little growth, but Hormel’s solutions-based approach has allowed it to take share by helping operators do more with less. Another important strength is channel diversification. Hormel’s Foodservice business is spread across a wide range of customer types, from large national chains to small independent operators, and across both commercial and noncommercial channels. This diversification provides resilience during downturns, as weakness in one area can be offset by stability or growth in others. Management has emphasized that even when traffic is under pressure, operators continue to value Hormel’s partnership, quality, and reliability.

The protein-forward portfolio is a reason to invest in Hormel because it places the company at the center of one of the most durable and wide-reaching consumer trends in food. Demand for protein is not a short-term fad but a long-lasting shift driven by health awareness, aging populations, fitness trends, and changing eating habits. Hormel has built a portfolio that is uniquely positioned to capture this demand across multiple meals, occasions, and channels, giving it both growth and resilience. Unlike many food companies that treat protein as just one category among many, Hormel is fundamentally organized around it. Over time, the company has evolved from a traditional meat processor into a consumer-focused food company that consistently wins with protein. Its portfolio spans breakfast, lunch, dinner, and snacking, at home and away from home, and includes both animal-based and plant-based options. This breadth allows Hormel to serve a wide range of consumers, from those seeking lean nutrition to those prioritizing flavor, convenience, or indulgence. The strength of this approach is visible in recent performance. Top-line growth has been broad-based across premium protein offerings such as the Jennie-O turkey portfolio, branded bacon and pepperoni, Fire Braised meats, Café H globally inspired proteins, and snack nuts. These products align well with what both consumers and foodservice operators are looking for: high-quality protein, bold flavors, and easy-to-use formats. In particular, lean proteins like ground turkey continue to resonate with health-conscious consumers, making Jennie-O a long-term growth pillar. Another important aspect of the protein-forward strategy is diversification within protein itself. Hormel is not dependent on a single protein source or format. Its portfolio includes turkey, pork, beef, poultry, nuts, and plant-based options, spread across fresh, refrigerated, frozen, shelf-stable, and prepared products. This reduces reliance on any one category and helps balance the natural volatility that comes with agricultural inputs. Most importantly, protein has room to expand into more eating occasions. Hormel sees opportunities to stretch its brands beyond traditional meal times and into snacking, convenience-driven formats, and globally inspired flavors.

Innovation is a reason to invest in Hormel because it is deeply rooted in how the company understands consumers and operators and turns those insights into practical, scalable products that strengthen brands, expand usage occasions, and support long-term growth. Rather than innovation for its own sake, Hormel focuses on solving real problems in everyday food preparation, which increases adoption and reinforces brand relevance. A clear example is bacon. Hormel identified a simple but powerful insight: people love bacon and want to eat it more often, but they want it to be easier to prepare and less messy. That insight led to a series of innovations across both foodservice and retail. For operators, Hormel developed quick-prep and precooked bacon formats that save time and labor. For consumers at home, Hormel built a leading position in convenient bacon with microwave-ready formats and is now expanding into oven-ready bacon with disposable trays that virtually eliminate cleanup. These products did not create a new category through novelty but through convenience, which is far more durable and repeatable. The same approach is visible in the Jennie-O brand. Hormel recognized that many consumers struggle to balance health, convenience, and taste during busy mealtimes. By leaning into ground turkey as a lean, versatile protein, Hormel has positioned Jennie-O as a solution to that problem rather than just a product on the shelf. Marketing and product development are focused on helping consumers quickly assemble satisfying meals, which strengthens brand loyalty and expands usage beyond traditional occasions. This insight-led approach creates room for continued innovation within turkey and reinforces Hormel’s leadership in lean protein. Hormel has also shown its ability to reinvent legacy brands without diluting their identity. SPAM is a standout example. Instead of relying solely on the traditional canned format, Hormel identified new cultural and eating occasions inspired by global food trends. Introducing SPAM in sushi-style formats opened access to entirely new consumers and categories. The success in Japan, where over 100 million SPAM musubis have been sold within three years of launch, shows how thoughtful innovation can unlock growth even for century-old brands. What ties these examples together is discipline. Hormel emphasizes data-driven decision-making and closely tracks the returns on its innovation and marketing investments. This helps ensure that innovation supports mix improvement and margin recovery rather than simply adding complexity. By focusing investment behind core brands like Planters, SPAM, Jennie-O, and Applegate, Hormel uses innovation as a lever to strengthen pricing power, expand usage occasions, and improve long-term profitability.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 0,87, which is from the fiscal year 2025. I have selected a projected future EPS growth rate of 7%. Finbox expects EPS to grow by an average of 7,3% in the next 5 years. Additionally, I have selected a projected future P/E ratio of 14, which is double the growth rate. This decision is based on Hormel's historically higher price-to-earnings (P/E) ratio. Finally, our minimum acceptable rate of return has already been established at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be $5,92 We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Hormel at a price of $2,96 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 845, and capital expenditures were 311. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 218 in our calculations. The tax provision was 186. We have 550 outstanding shares. Hence, the calculation will be as follows: (845 – 218 + 186) / 550 x 10 = $14,78 in Ten Cap price.

The final calculation is referred to as the Payback Time price. It is a calculation based on the free cash flow per share. With Hormel's free cash flow per share at $0,97 and a growth rate of 7%, if you want to recoup your investment in 8 years, the Payback Time price is $10,65.

Conclusion

Hormel Foods is an intriguing company with capable management that has built a moat through a combination of strong brands, a broad product portfolio, wide distribution, and structural advantages in foodservice. The company previously delivered a high ROIC, but ROIC has declined almost every year over the past decade and is expected to recover only modestly in the future, without returning to prior peak levels. Free cash flow fell to its lowest level in a decade in fiscal year 2025, but this appears to be an outlier driven by a difficult operating environment, and free cash flow should improve as conditions normalize. Commodity prices remain a risk because Hormel depends heavily on agricultural inputs whose costs can rise quickly and unpredictably, while price increases to customers often lag behind, which can pressure margins and earnings during periods of inflation, as seen in fiscal 2025. General risks in the food industry are also relevant, as food safety incidents, mislabeling, or contamination can occur despite strict controls and may lead to recalls, legal costs, and reputational damage that hurt sales and consumer trust. Customer concentration adds another layer of risk, since a meaningful share of revenue comes from a small number of large customers with strong bargaining power, meaning changes in purchasing behavior or contract terms at a customer like Walmart could materially affect sales, margins, and production efficiency. On the positive side, the Foodservice segment stands out as a key reason to invest, as it is Hormel’s most profitable and differentiated business, generating a disproportionate share of profits through high margins, strong customer relationships, and a direct-selling model that supports resilient earnings. The protein-forward portfolio is another strength, as it aligns Hormel with a long-term shift toward higher protein consumption and allows the company to serve many meals and occasions with a diversified set of trusted brands, reducing reliance on any single product or protein source. Innovation further supports the investment case, as Hormel consistently turns consumer and operator insights into practical, scalable products that refresh legacy brands, expand usage occasions, and support sustainable growth. Despite these strengths, and even though the company may appeal to dividend-focused investors, I believe there are more attractive opportunities elsewhere in the market and will not be investing in Hormel at this time.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how I do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and to receive, you will have to give (Warren Buffett and Mohnish Pabrai are great examples). If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to Soi Dog. They rescue street dogs in Thailand by giving them food, medicine and vet care. If you have a little to spare, please donate here. Even a little will make a huge difference to save these wonderful animals. Thank you.

Comments