Clorox: Everyday Products, Steady Returns

- Glenn

- Mar 9, 2024

- 19 min read

Updated: Dec 11, 2025

Clorox is a leading household products company with a portfolio that spans cleaning, lifestyle, and health categories. From iconic names like Clorox bleach and Pine-Sol to Kingsford charcoal, Glad trash bags, and Burt’s Bees personal care, its brands are trusted staples in millions of homes. With over 80 percent of its brands holding top market positions and nearly universal household penetration in the U.S., Clorox blends brand equity with category leadership and scale. At the same time, it is investing in digital transformation and innovation to stay relevant in a shifting consumer landscape. The question remains: Does this household powerhouse deserve a spot in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in Clorox at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Clorox, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

The Clorox Company was founded in 1913 in Oakland, California, as the first commercial-scale liquid bleach manufacturer in the United States. Over more than a century, it has grown into a leading multinational manufacturer and marketer of consumer and professional products. The company operates in around 25 countries and sells its products in approximately 100 markets, reaching consumers through mass retailers, grocery outlets, warehouse clubs, dollar stores, home hardware centers, e-commerce, and professional distribution channels. Clorox organizes its business into four segments: Health and Wellness, which covers cleaning, disinfecting, and professional products marketed under brands such as Clorox, Pine-Sol, Tilex, Liquid-Plumr, CloroxPro, and Clorox Healthcare; Household, which includes everyday essentials such as Glad trash bags and wraps, Fresh Step cat litter, and Kingsford charcoal; Lifestyle, which covers food, hydration, and personal care products such as Hidden Valley dressings and sauces, Brita water filters, and Burt’s Bees natural personal care; and International, which markets products including Clorox, Poett, Pine-Sol, Clorinda, Glad, Fresh Step, Brita, and Ever Clean outside the United States. The company owns a broad portfolio of some of the most recognized consumer names, including Clorox, Pine-Sol, Tilex, Liquid-Plumr, Poett, Glad, Fresh Step, Kingsford, Hidden Valley, Brita, Burt’s Bees, and vitamins and supplements marketed under Natural Vitality, RenewLife, NeoCell, and Rainbow Light. Its long history and brand strength have made many of these products household staples, and according to the company, more than 80% of its brands hold the number one or number two market share in their categories. Clorox’s competitive moat is built on brand equity, category leadership, and distribution scale. Its bleach is virtually synonymous with disinfection in the United States, while its leadership in categories such as charcoal, where it holds about 70% market share, and bleach, where it commands around 55%, gives it pricing power and a strong competitive position. Consumer trust adds another layer of protection, with brands like Clorox and Pine-Sol regularly ranked among America’s Most Trusted Brands, allowing the company to charge a premium over private labels. Its broad distribution network, spanning mass retailers, club and dollar stores, e-commerce, and professional channels, ensures its products are widely available, and its strong retailer relationships help secure shelf priority. The company’s IGNITE strategy, which emphasizes innovation, enhancing consumer experience, evolving the way it operates, and integrating sustainability, is designed to reinforce these advantages and support long-term growth.

Management

Linda Rendle serves as the CEO of The Clorox Company, a role she assumed in September 2020 after nearly two decades of leadership positions across the organization. She joined Clorox in 2003 and advanced through a variety of senior roles in sales, operations, and general management, building a deep understanding of both the company’s portfolio and the broader consumer packaged goods industry. Prior to joining Clorox, Linda Rendle worked at The Procter & Gamble Company in sales management. She earned a bachelor’s degree in economics from Harvard University. Since becoming CEO, Linda Rendle has guided Clorox through one of the most challenging periods in its history, including navigating the global pandemic, supply chain disruptions, inflationary pressures, and cybersecurity incidents. She was instrumental in the development and execution of the company’s IGNITE strategy, which emphasizes innovation, consumer experience, digital transformation, and sustainability. Under her leadership, Clorox has accelerated its investments in digital capabilities, strengthened its e-commerce presence, and restructured its organization to become more agile. In 2024, she was appointed Chair of the Board of Directors, reflecting the confidence of the board in her ability to position the company for long-term growth. In addition to her responsibilities at Clorox, Linda Rendle serves on the boards of Visa Inc. and the Consumer Brands Association, where she contributes her expertise in consumer behavior and brand management. She is known for her values-driven leadership style and her emphasis on listening as a critical management skill. Despite describing herself as a “super-big introvert,” she has embraced the role of CEO by leveraging her ability to listen, synthesize, and act decisively. While employee ratings of her leadership on platforms such as Comparably are mixed, these assessments are based on a relatively small sample size and must be considered in the context of the significant headwinds the company has faced during her tenure. Linda Rendle’s resilience, ability to steer Clorox through complex challenges, and record of delivering results highlight her as a capable and committed leader. I believe Linda Rendle is well-positioned to continue strengthening Clorox’s competitive position and guiding the company through its next phase of growth.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Clorox has historically achieved a high ROIC because of its asset-light business model, strong brand portfolio, and pricing power. The company operates in categories where leading brands command significant shelf space and consumer loyalty. Around 80% of its portfolio holds the number one or number two position in their categories, which means Clorox can charge premium prices relative to private labels while maintaining efficient operations. Its business also requires relatively low capital intensity, as Clorox outsources part of its production and distribution, allowing it to generate strong returns on invested capital compared with more asset-heavy consumer goods companies. Clorox’s ROIC dropped in fiscal years 2022 and 2023 because profits came under unusual pressure. After the pandemic, demand became harder to predict, while the cost of raw materials, packaging, and transportation rose sharply. On top of this, Clorox was hit by a major cybersecurity attack in 2023 that disrupted its ability to produce and ship products. These challenges cut into earnings at the same time as the company had more money tied up in day-to-day operations, which together pushed ROIC below its usual level of 20% or higher. By fiscal year 2025, Clorox’s ROIC bounced back to its strongest level in years. This recovery was driven by two key factors. First, profitability improved as the company raised prices and became more efficient, which helped offset the higher costs it had faced in prior years. Second, operations returned to normal after the cybersecurity disruption, allowing earnings to recover sharply. Since the amount of capital tied up in the business stayed fairly steady, this rebound in profits translated directly into a much higher ROIC.

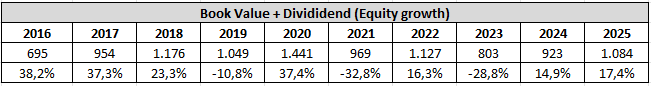

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Clorox’s equity has gone up and down over the years mainly because its profits have not always been steady. When the company earns solid profits, equity grows. But in years when costs rise sharply or unexpected problems hit the business, profits shrink, and that causes equity to fall. In the past two years, equity has increased again because Clorox’s profits have recovered. The company has managed costs better, raised prices, and returned to more stable operations, which has strengthened its earnings and, in turn, boosted equity. It’s reasonable to expect equity to keep growing as long as Clorox can maintain stable profits. The company has already shown that once short-term shocks like high inflation and the cybersecurity attack were behind it, earnings improved and equity followed. With strong brands, leading market positions, and ongoing efficiency efforts, Clorox is positioned to generate steady profitability in the coming years, which should support further equity growth.

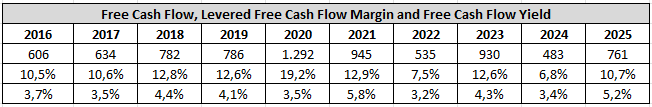

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Free cash flow increased in fiscal year 2025 because earnings recovered and operations returned to normal after the challenges of the prior years. With higher profits and fewer disruptions, more cash was generated from the company’s core business, which helped lift free cash flow compared with the weaker years before. Free cash flow is still below earlier highs because the company’s costs are higher than they were a few years ago, before inflation pushed them up. On top of that, Clorox has had to keep more money tied up in its day-to-day operations, like holding more inventory and waiting longer to collect payments. As a result, even though profits have improved, less of that money is ending up as cash available to the company. The same pattern shows up in the levered free cash flow margin. Margins have improved thanks to better profitability, but they remain lower than in the past because higher costs and greater cash needs in day-to-day operations still weigh on the amount of cash the business can convert from sales. Clorox typically uses its free cash flow in two main ways: returning money to shareholders and reinvesting in the business. The majority has historically gone to dividends, which Clorox has paid for decades and increased regularly. As free cash flow grows, investors can expect Clorox to keep dividends as a top priority since they are a core part of its shareholder return strategy. Share repurchases are more flexible and tend to come back into play when cash flow is strong and management sees room to return additional capital. In other words, higher free cash flow should support continued dividend growth, and it could also mean a return to more active buybacks if conditions stay favorable. The free cash flow yield is currently at its second-highest level in the past decade, indicating that the shares are trading at a more attractive valuation than usual. We will return to the topic of valuation later in the analysis.

Debt

Another important aspect to consider is the level of debt, as it is crucial to assess whether a business has manageable debt that can be repaid within a three-year period. This is done by dividing the total long-term debt by earnings. After performing this calculation on Clorox, I found that the company has 3,09 years of earnings in debt, which is slightly higher than what I would prefer. Still, this is not a major concern because Clorox produces steady cash flow, has a long track record of profitability, and sells products that remain in demand regardless of economic conditions. These strengths give the company the ability to handle its debt load comfortably, even if it sits just above my preferred threshold.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Risks

Macroeconomic factors is a risk for Clorox because shifts in the broader economy directly affect both consumer behavior and the company’s costs. When uncertainty rises, Clorox has seen demand in its categories slow as consumers make rapid trade-offs. Shoppers may switch to smaller pack sizes, move to discount or dollar stores, or trade down to less expensive alternatives. At the same time, consumers continue to spend on certain conveniences or experiences they value, creating a very dynamic environment where money is constantly being shifted from one category to another. This volatility makes it difficult for Clorox to forecast demand and plan effectively, as consumer behavior can change quickly from quarter to quarter. Cost pressures are another layer of risk. Inflation has increased the price of raw materials, packaging, energy, and labor, while tariffs add additional expense and uncertainty depending on trade policy. For example, tariffs on goods imported from Mexico or Canada have led consumers to adjust their buying patterns, and Clorox itself faces tens of millions of dollars in extra costs when tariffs are applied. General supply chain inflation further compounds these challenges, leaving profitability vulnerable to factors outside the company’s control. Geopolitical instability adds even more unpredictability. Conflicts, trade tensions, and shifting government policies can disrupt supply chains, raise costs, or undermine consumer confidence. In some cases, political developments could even lead to boycotts of U.S. products abroad, weighing on international sales. The combination of inflation, tariffs, and geopolitical risk creates an external environment that is highly volatile and difficult to manage, not only for Clorox but also for its suppliers, distributors, and retail partners. This uncertainty makes Clorox’s financial results more variable, as swings in consumer demand coincide with rising costs and global instability.

Competition is a risk for Clorox because most of its categories are crowded with well-known brands and cheaper alternatives. Products like bleach, cleaning wipes, trash bags, and cat litter compete not only with other multinational consumer goods companies but also with private-label products offered by retailers at lower prices. In times when consumers are under financial pressure, there is always a risk that shoppers will “trade down” to these cheaper options, which could reduce Clorox’s sales or force the company to offer deeper discounts. Clorox also faces the challenge of constantly needing to invest in innovation and marketing to stay ahead. Its brands compete on performance, reputation, and price, which means the company must spend heavily on advertising, promotions, and trade merchandising to hold market share. Some competitors are larger and better resourced, giving them the ability to outspend Clorox in advertising, promotions, or research and development. Competitors can also move more quickly in adopting new technologies to better target consumers and adapt to shifting preferences. Smaller, more agile players present risks too, particularly in niches like eco-friendly or natural cleaning products, where failing to keep up with consumer trends could make Clorox’s offerings seem less relevant. Competitive pressure is not uniform across all categories but tends to be especially intense in certain areas. For example, the trash bag and cat litter businesses have recently faced heavy promotional activity and deep discounting, which Clorox expects will continue. In the Glad business, private label has been more of a factor, in part because of retailer assortment decisions as consumers move into discount channels.

Customer concentration and retail dynamics is a risk for Clorox because a large share of its sales depends on just a few powerful retailers. Walmart alone accounts for over a quarter of revenue, and together the top five customers make up almost half of total sales. This means that if any of these retailers decide to reduce shelf space for Clorox, push harder for price concessions, or increase their focus on private-label products, the impact on Clorox’s sales and profits could be significant. The company does not have long-term contracts with these retailers, so purchasing levels can change at any time, adding another layer of uncertainty. Retail dynamics add to this risk. The rise of e-commerce, direct-to-consumer brands, dollar stores, and discounter channels has changed how consumers shop and how products need to be marketed. Online shopping in particular makes price comparisons easier, which creates additional pressure on branded products like Clorox to justify their premium. At the same time, retailers are becoming larger through consolidation, giving them even more negotiating power over suppliers. These big retailers can demand deeper discounts, special packaging, or shift shelf space toward their own brands, and Clorox has little choice but to adapt. Operational risks also tie into customer concentration. The August 2023 cyberattack showed how disruptions in Clorox’s supply chain can directly affect retail relationships. Product shortages and order backlogs during that time led to lost sales and market share, which underscores how reliant the company is on smooth execution to keep its major retail partners satisfied.

Reasons to invest

Clorox's brand portfolio is a reason to invest in Clorox because it gives the company a durable competitive edge that few rivals can match. With more than a century of history behind it, Clorox has built a portfolio of household names that have become staples in millions of homes. Over 80 percent of its brands hold the number one or number two position in their categories, meaning they are not only widely recognized but also category leaders. Clorox bleach is virtually synonymous with disinfection in the United States, while Kingsford dominates the charcoal market and Pine-Sol is one of the most trusted cleaning brands. This leadership translates into pricing power, strong retailer support, and consumer loyalty. The strength of these brands is also reflected in consumer trust. Independent surveys regularly rank Clorox and Pine-Sol among America’s Most Trusted Brands, showing that consumers are willing to pay a premium for them over private-label alternatives. In fiscal year 2025, household penetration of Clorox products grew further, and the company’s consumer value metrics remained at some of the highest levels in its history. Today, 9 out of 10 American households own at least one Clorox product, a level of reach that few consumer goods companies achieve. Management is also focused on ensuring that the company’s brands maintain superiority. In difficult times, when consumers are under stress, brand strength matters even more. Clorox continues to invest in innovation, fragrance and product quality, and digital engagement to ensure its products are perceived as superior in their categories. This focus has paid off: by fiscal year 2025, Clorox’s brands were rated superior on value in 60% of their categories, an improvement even compared with pre-pandemic levels. Taken together, this brand equity creates a moat that protects Clorox from competitors, supports premium pricing, and helps the company maintain resilience in both good and bad economic environments. For long-term investors, this enduring strength of the brand portfolio is one of the clearest reasons to own shares in Clorox.

Innovation is a reason to invest in Clorox because it allows the company to keep its brands fresh, defend market share, and drive category growth in otherwise mature markets. The company has a long track record of using new product launches and line extensions to strengthen consumer engagement, whether through new flavors in Hidden Valley dressings, improved formulations in Fresh Step cat litter, or extensions of the Burt’s Bees portfolio. These innovations not only keep existing customers loyal but also help bring in new consumers by offering improved functionality, convenience, or experiences. Innovation is also central to Clorox’s strategy of maintaining product superiority, which management views as the key to long-term success. Even in categories where Clorox already leads, such as bleach or trash bags, the company continues to raise the bar through packaging improvements, stronger performance claims, and product enhancements. In areas where Clorox has fallen behind, such as cat litter after the disruption caused by the 2023 cyberattack, new product development is being prioritized to rebuild superiority and win back consumers. The company’s innovation efforts are not only about defending its current position but also about supporting future growth. Management has been clear that in fiscal year 2025 the focus was on building from existing platforms, while in fiscal year 2026 new platforms will be launched. This pipeline is expected to play a key role in boosting both category growth and Clorox’s own market share. Importantly, innovation is backed by merchandising and promotional campaigns timed to key shopping periods, such as back-to-school or cold and flu season, to ensure consumers notice and try the new products. Examples like the continuous improvements to Glad trash bags, making them stronger, less likely to tear, and better at controlling odor, illustrate how Clorox turns everyday household frustrations into opportunities for consumer delight. By consistently delivering better experiences across its portfolio, the company reinforces brand trust and pricing power, which in turn supports profitability.

Clorox’s digital transformation is a reason to invest in Clorox because it is laying the foundation for a more efficient, data-driven, and resilient business. The company is in the middle of a multi-year program, spending hundreds of millions of dollars from fiscal 2022 through 2026 to modernize its systems and processes. At the center of this effort is the rollout of a new enterprise resource planning (ERP) system, replacing a 25-year-old platform. Unlike a simple upgrade, this is a complete rebuild, designed to connect the entire business, from supply chain to retail partners to consumer insights, on a single modern system. This transformation has short-term complexity, as seen in the recent ramp-up phase where Clorox and its retail partners had to temporarily build extra inventory ahead of the ERP launch. But once stabilized, the system is expected to unlock lasting benefits. It will give Clorox far better visibility into demand trends, allowing the company to forecast more accurately and respond faster to shifts in consumer behavior. It will also support stronger e-commerce capabilities, ensuring Clorox’s brands perform well in digital channels where search rankings, online merchandising, and real-time pricing matter more than ever. Beyond demand forecasting and sales, the digital transformation is also about efficiency. By automating processes, improving data flows, and giving managers better tools, Clorox expects to cut waste across its supply chain and reinvest the savings into marketing, innovation, and brand support. Management has described this as creating a “flywheel,” where productivity gains feed into reinvestment, which strengthens the brands and helps capture market share. The importance of these upgrades has been highlighted by past challenges. The 2023 cyberattack disrupted Clorox’s ability to process orders and hurt sales, showing how dependent the company was on outdated systems. By modernizing its digital backbone, Clorox reduces the risk of similar disruptions in the future while also putting itself in a better position to compete in a retail world that is increasingly digital, data-driven, and omnichannel.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 6,52, which is the numbers from fiscal 2025. I have selected a projected future EPS growth rate of 7% (Finbox expects EPS to grow by 7,3% annually from 2025 to 2029). Additionally, I have selected a projected future P/E ratio of 14, which is twice the growth rate. This decision is based on the fact that Clorox has historically had a higher P/E ratio. Lastly, our minimum acceptable rate of return is already set at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be $44,38. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Clorox at a price of $22,19 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company is essentially its return on investment. The minimum annual return should be at least 10%. I calculate it as follows: The operating cash flow last year was 981 and capital expenditures were 220. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated for maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 154 in our calculations. The tax provision was 254. We have 123,3 outstanding shares. Hence, the calculation will be as follows: (981 – 154 + 254) / 123,3 x 10 = $87,67 in Ten Cap price.

The final calculation is referred to as the Payback Time price. It is a calculation based on the free cash flow per share. With Clorox's free cash flow per share at $6,17 and a growth rate of 7%, if you want to recoup your investment in 8 years, the Payback Time price is $67,73.

Conclusion

I believe that Clorox is an intriguing company with strong management and a durable competitive moat built on brand equity, category leadership, and distribution scale. The company has consistently generated a high ROIC above 20% in most years, and while free cash flow in fiscal year 2025 was not as strong as in earlier years, it still improved from the prior year. Macroeconomic factors remain a risk because economic uncertainty and inflation drive consumers to trade down or shift spending, while rising costs, tariffs, and geopolitical instability put pressure on profitability. Competition is another risk, as Clorox operates in crowded categories where cheaper private labels and well-resourced global rivals force heavy spending on marketing and innovation, with areas like trash bags and cat litter facing especially intense discounting. Customer concentration adds further risk since a large share of sales comes from a few powerful retailers such as Walmart, which can demand concessions or favor their own brands, while shifts in retail channels, e-commerce, and supply chains can quickly affect shelf space, pricing, and sales. On the positive side, Clorox’s brand portfolio is a compelling reason to invest, as its household names hold leading positions in their categories, enjoy high consumer trust, and are found in nearly every American home, providing pricing power, resilience, and a durable edge. Innovation strengthens this moat by keeping brands relevant, improving products, and launching new platforms that support growth and profitability even in mature markets. The company’s digital transformation is also important, as a new ERP system and advanced analytics will modernize operations, improve forecasting and e-commerce capabilities, and create efficiencies that can be reinvested into growth. Altogether, there are many reasons to like Clorox, and buying shares below the Ten Cap price of $87 could represent a good long-term investment.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how I do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and to receive, you will have to give (Warren Buffett and Mohnish Pabrai are great examples). If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to Soi Dog. They rescue street dogs in Thailand by giving them food, medicine and vet care. If you have a little to spare, please donate here. Even a little will make a huge difference to save these wonderful animals. Thank you.

Comments