Procter & Gamble: Brands That Endure

- Glenn

- Dec 10, 2022

- 19 min read

Updated: Dec 11, 2025

Procter & Gamble is one of the world’s largest consumer goods companies, with a portfolio of leading brands that touch billions of lives every day. From household names like Tide, Pampers, and Gillette to category leaders like Oral-B and SK-II, the company combines global scale with decades of consumer trust. Its strategy centers on product superiority, portfolio focus, and targeted growth opportunities across developed and emerging markets. With a track record of strong returns and resilience in challenging environments, Procter & Gamble continues to adapt to shifting consumer habits and competitive pressures. The question is: Does this consumer staples giant merit a place in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in Procter & Gamble at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Procter & Gamble, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Procter & Gamble (P&G) is one of the world’s largest consumer goods companies, with a portfolio of trusted, market-leading brands spanning beauty, grooming, health care, fabric and home care, and baby, feminine and family care. Founded in 1837 and headquartered in Cincinnati, Ohio, P&G’s products are sold in roughly 180 countries and territories, making it a truly global household name. Its well-known brands include Tide, Pampers, Gillette, Head & Shoulders, Olay, Oral-B, Crest, Ariel, Downy, Bounty, Always, and Febreze, many of which hold the number one or number two market share position in their respective categories. The company sells through a wide range of channels, including mass merchandisers, grocery and drug stores, e-commerce platforms, club stores, and direct-to-consumer outlets. P&G’s business model centers on delivering sustainable, balanced growth by combining superior product performance, innovative packaging, compelling brand communication, strong retail execution, and competitive value. The company invests heavily in consumer insights and R&D to both improve existing products and create entirely new categories. Marketing remains a core strength, with P&G consistently ranked among the largest global advertisers. The company’s broad distribution network and relationships with leading global retailers ensure that its products are available wherever consumers shop. The competitive moat of P&G is anchored in the scale, strength, and breadth of its brand portfolio, underpinned by decades of consumer trust. Its brands are deeply embedded in daily routines, benefiting from habitual use and high switching costs for consumers who rely on them for consistent quality. P&G’s size enables significant efficiencies in manufacturing, procurement, and marketing, allowing it to invest more in product innovation and brand building than most competitors. Intellectual property, including patents covering formulations and processes, protects product differentiation, while its extensive trademark portfolio strengthens brand recognition globally. The company’s distribution capabilities, covering virtually every retail channel worldwide, further reinforce its dominance and make it a preferred partner for retailers.

Management

Jon R. Moeller serves as the CEO of Procter & Gamble, a role he assumed in 2021 after more than three decades with the company. He joined Procter & Gamble in 1988 and progressed through a series of leadership positions, including Vice President and CFO, before being appointed CEO. Jon R. Moeller holds a Bachelor of Science in Biology and a Master of Business Administration from Cornell University. Throughout his career, he has been recognized for his ability to drive growth and value creation, contributing significantly to Procter & Gamble’s long-term strategy. His leadership philosophy emphasizes expanding markets through innovation rather than competing solely for existing share, as reflected in his view: “When you can create new opportunities and create new sources of delight for consumers and clients, good things happen. When all you are doing is trying to punch your competitor in the nose, not so good things happen.” Under his tenure as CEO, Procter & Gamble has delivered strong results despite navigating inflationary pressures and shifting consumer demand. Effective January 1, 2026, Jon R. Moeller will step down as CEO and transition to the role of Executive Chairman, where he will focus on guiding the Board of Directors and supporting the company’s long-term strategic priorities. He will be succeeded by Shailesh Jejurikar, Procter & Gamble’s current COO in what the company describes as a planned and orderly leadership transition. In his new role, Jon R. Moeller’s decades of experience, deep institutional knowledge, and strategic perspective are expected to provide valuable continuity and oversight as Procter & Gamble enters its next chapter under new leadership.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Procter & Gamble has managed to consistently achieve a high ROIC for more than a decade by combining brand strength, disciplined portfolio management, and operational efficiency. The company owns a stable of category-leading brands like Tide, Pampers, Gillette, and Olay that enjoy strong consumer loyalty and pricing power, allowing it to maintain healthy margins without competing primarily on price. In the mid-2010s, Procter & Gamble streamlined its portfolio, selling or discontinuing over 100 underperforming brands to focus on its most profitable and fastest-growing ones. This sharper focus freed up resources to invest more heavily in innovation, product development, and marketing for its core brands. Its global scale is another key advantage. Because Procter & Gamble operates on such a large scale, it can buy materials at lower costs, run its factories more efficiently, and market its products to more people at a lower cost per unit than smaller competitors. This helps the company save money while keeping its brands visible and desirable. In recent years, Procter & Gamble has also focused more on premium products with higher profit margins, such as advanced detergents, high-end grooming items, and premium diapers. At the same time, it runs a capital-light business model, meaning it does not need to spend heavily on physical assets to grow, which helps keep returns high. ROIC has risen above 20% in the past two years due to a combination of factors: successful price increases that offset cost inflation without damaging demand, continued volume strength in key categories, tight capital discipline, and ongoing productivity improvements. By generating more profit from a relatively small base of invested capital, Procter & Gamble has reinforced its position as one of the most efficient and profitable companies in the consumer goods industry.

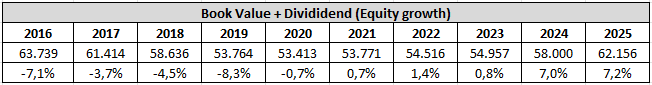

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Procter & Gamble’s equity fell each year until 2020 mainly because the company was steadily buying back its own shares while profit growth was modest. Share repurchases reduce the equity reported on the balance sheet, and during this time the increase from earnings wasn’t enough to offset that reduction. Currency movements and pension adjustments also pushed equity lower in some years. From 2021 onwards, profits grew faster and margins improved, adding more to equity than the buybacks were taking away. Some positive currency and pension effects also helped. This shift has led to equity increasing every year since.

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Procter & Gamble’s free cash flow hit a record in fiscal 2024 thanks to strong profits, tight control over costs, and good timing of payments from customers and to suppliers. In fiscal 2025, it dropped because the company earned less cash from its day-to-day operations and spent more on new factories and equipment to support future growth. The drop in operating cash was partly due to slower sales growth, higher costs for materials and shipping, and less favorable timing of when money came in and went out compared to the year before. The stronger U.S. dollar also slightly reduced the value of cash earned overseas. Since sales didn’t fall as much as free cash flow, the free cash flow margin fell to its lowest level since 2018. Procter & Gamble’s free cash flow will likely improve in the coming years. The drop in 2025 was partly due to one-off factors, such as the timing of when cash came in and went out, and heavier spending on new factories and equipment. These won’t necessarily repeat at the same level. Capital spending should return to more normal levels, which would free up more cash. At the same time, P&G’s strong brands and pricing power help keep profits and cash generation healthy, while ongoing cost-saving programs can offset rising expenses. Unless there is a sharp jump in costs or a big slowdown in sales, free cash flow should trend higher from here. As free cash flow improves, investors can expect Procter & Gamble to return more cash through higher dividends and increased share repurchases. The company has a long history of rewarding shareholders, with more than six decades of consecutive dividend increases. Management also uses share buybacks to reduce the number of shares outstanding. Free cash flow yield indicates that the shares are trading at a high valuation. However, we will revisit valuation later in the analysis.

Debt

Another important aspect to consider is the level of debt. It is crucial to assess whether a business carries a manageable amount that could be repaid within three years of earnings. By dividing Procter & Gamble’s total long-term debt by its earnings, we find that the company has debt equal to 1,7 years of earnings. This is comfortably within a manageable range, suggesting that debt should not be a concern for investors considering Procter & Gamble. In fact, the company has a long history of keeping its debt below the three-year threshold.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Risks

Competition is a risk for Procter & Gamble. The company operates in highly competitive markets, going up against global giants, nimble local players, and a growing number of private-label brands from retailers. These competitors often sell similar products at lower prices or use heavy promotions to attract customers. This can put pressure on Procter & Gamble’s sales, market share, and profit margins, especially in categories where products risk becoming commoditized and consumers are more price-sensitive. Affordability is a key challenge. In tough economic environments, consumers may “trade down” to cheaper alternatives, including private labels or lower-priced brands within Procter & Gamble’s own portfolio. While P&G manages this risk by offering products across different price points, for example, Luvs alongside Pampers in baby care, or Tide Simply alongside Tide in laundry — aggressive competitor promotions can still reduce the amount of sales revenue P&G earns in a category, even if it sells roughly the same number of units. Price competition is particularly visible in categories like fabric care, where private-label brands and mid-tier products have seen value share growth through discounts, promotions, and smaller pack sizes that better fit a shopper’s budget. While this can drive short-term sales for competitors, it can also shrink the total value of the category and make it harder for premium brands like Tide to grow. Beyond pricing, competition is also intensifying online. E-commerce and direct-to-consumer channels give smaller brands and new entrants a low-cost way to reach customers, increasing the pressure on P&G to innovate in both product and digital marketing. Maintaining leadership requires constant investment in product quality, packaging, advertising, and retail execution. If Procter & Gamble fails to keep pace with these competitive pressures, it risks losing market share and profitability in key categories.

Macroeconomic factors are a risk for Procter & Gamble because the company operates in about 70 countries and sells its products in roughly 180 markets, generating more than half of its sales outside the United States. This global reach exposes P&G to a wide range of economic, political, and currency-related challenges that can directly affect sales, costs, and profitability. One major risk comes from tariffs and trade policies. Changes in trade agreements or the imposition of new tariffs can significantly raise costs. For example, P&G expects about $1 billion in additional costs from tariffs in fiscal 2026, affecting materials from China, exports to Canada, and goods shipped from other parts of the world to the U.S. These extra costs alone could reduce earnings growth by several percentage points, and the impact is unpredictable because tariff negotiations and retaliatory measures can change quickly. Currency fluctuations are another important factor. Because P&G earns, spends, and borrows money in many currencies, changes in exchange rates can reduce the value of overseas sales when converted into U.S. dollars, raise the cost of imported materials, and increase interest expenses on foreign debt. A stronger U.S. dollar, for instance, makes P&G’s products more expensive in other markets and can hurt competitiveness. Broader economic uncertainty also weighs on demand. Factors like inflation, higher interest rates, political instability, and slowdowns in major economies such as the U.S., Europe, or China can make consumers more cautious with their spending. This often leads shoppers to trade down to cheaper products, delay purchases, or take advantage of promotions instead of buying premium brands. P&G is already seeing signs of slower category growth in the U.S. and Europe, along with shifts in buying behavior toward smaller pack sizes, club stores, and online deals. Finally, geopolitical events, such as the war in Ukraine or strained trade relations between major economies, can disrupt supply chains, force portfolio changes, and lead to the exit from certain markets. These disruptions can cause lost sales, asset write-downs, and higher operating costs, adding another layer of uncertainty to financial performance.

Slower growth in key markets is a risk for Procter & Gamble because it narrows the company’s ability to outperform the competition and limits its overall growth potential. In North America, which is P&G’s largest market, category growth rates have slowed, meaning the “pie” is growing more slowly. Even if P&G maintains its market share, slower category growth reduces the pace at which the company can expand sales. When categories are flat or growing only modestly, it becomes much harder to deliver strong revenue gains without taking significant share from competitors, a more difficult and often costlier strategy. Another factor is the shift in where consumers shop. Growth has been strongest in channels like Walmart, Amazon, and warehouse clubs such as Costco, which carry lower inventory levels than traditional retailers. This shift has led to reduced inventory orders from retailers, which directly weighs on P&G’s reported sales, even if consumer demand remains stable. The move toward these channels is ongoing and unlikely to reverse soon, meaning the inventory headwind could persist. Finally, retailer behavior can amplify the problem. In an environment of economic uncertainty or new tariff costs, retailers often free up cash by reducing orders in fast-moving categories like consumer packaged goods, since these can be replenished quickly. This behavior further lowers P&G’s sales in the short term, even if end-consumer demand has not dropped significantly. In short, when key markets slow, it creates a chain reaction, smaller category growth, lower retailer inventories, and greater competitive pressure, all of which can make it harder for P&G to grow sales, maintain market share, and protect margins.

Reasons to invest

Portfolio optimization is a reason to invest in Procter & Gamble. Over the past decade, the company has deliberately reshaped its product portfolio to focus on categories and brands with the highest potential for growth, profitability, and consumer loyalty. In the mid-2010s, Procter & Gamble sold or discontinued more than 100 underperforming brands and reduced its product categories from 16 to 10. This shift allowed the company to concentrate resources on its strongest, daily-use brands where product performance drives brand choice, such as Tide, Pampers, Gillette, and Oral-B, leading to more consistent growth across nearly all categories and geographies. This ongoing portfolio discipline is not a one-time effort. P&G continues to actively manage its mix, making targeted additions, divestitures, and market exits to free up capital and management attention for higher-value opportunities. Recent and planned moves include streamlining the Feminine Care lineup in several Asian markets, simplifying product forms in Oral Care, Fabric Care, and Grooming, and exiting operations in Bangladesh. These changes enable related supply chain improvements, cost reductions, and faster innovation. Portfolio optimization also extends to selective acquisitions that strengthen the growth and margin profile of the business. A notable example is the acquisition of the German Merck portfolio of over-the-counter health products, which has delivered strong returns, expanded P&G’s capabilities, and reinforced Personal Health Care as a growth engine. This category has achieved double-digit growth in recent years, driven by innovation and geographic expansion, and remains a priority for both organic growth and opportunistic M&A. By focusing on a streamlined, high-performing portfolio and continually refining it, Procter & Gamble has created a more agile and efficient business. This strategic clarity supports stronger brand investment, better operational execution, and higher returns for shareholders.

Investing in superiority is a reason to invest in Procter & Gamble. The company’s growth strategy is built on delivering what it calls “integrated irresistible superiority” across five areas: product performance, packaging, brand communication, retail execution, and value. The goal is not only to outperform competitors but to grow entire product categories by consistently delighting consumers. This approach is backed by deep consumer insights and continuous innovation, allowing P&G to lead across multiple price tiers, from premium products like Oral-B iO power toothbrushes and Pampers Swaddlers to value-oriented offerings like Luvs diapers and Tide Simply. Superiority is not achieved in isolation. P&G ensures that all five vectors work together, a superior product in an attractive package, supported by compelling advertising, executed flawlessly in stores and online, and priced to deliver strong value. Recent innovations like Tide evo, Pampers Platinum Protection, SK-II LXP skincare, Swiffer PowerMop, and Align’s digestive health products show how this approach can attract new consumers, create incremental sales, and lift market share. The impact is measurable: in 2024, P&G secured four of the top 10 spots in Circana’s U.S. New Products Pacesetters list and had more top-performing launches than its seven closest competitors combined. This focus on superiority also acts as a defense against commoditization. In categories like laundry care, diapers, and feminine care, a significant percentage of consumers remain dissatisfied with existing product performance. P&G sees this as a growth opportunity, if it can solve those unmet needs better than competitors, it can both expand the category and capture a larger share. Examples like Pampers’ 20% organic sales growth in China and Swiffer’s largest-ever product launch demonstrate the power of innovation-driven gains over short-term promotional tactics. By continually raising the bar on product performance, communication, and value, Procter & Gamble strengthens consumer loyalty, supports premium pricing, and drives category leadership. This creates a long-term competitive advantage that is difficult for rivals to replicate and positions the company for sustainable growth across diverse markets and economic conditions.

Growth opportunities are a reason to invest in Procter & Gamble. The company sees billions in untapped potential even within the categories it already operates in, highlighting the scalability of its current business model. In North America alone, P&G estimates up to $5 billion in additional sales simply by increasing household penetration among unserved or underserved consumers, people who do not yet buy its brands or only purchase them occasionally. The company is already allocating resources to reach these groups through tailored product formats, more targeted marketing, and expanded distribution. By doing so, P&G can capture incremental sales without relying on acquisitions or entering entirely new categories. In Europe, P&G identifies more than $10 billion in potential growth by raising consumption in developing and fast-growing markets to match the best-in-class levels already achieved in other parts of the region, while maintaining its current market share. This can be achieved through both encouraging consumers to trade up to higher-margin products and increasing usage frequency through product innovation and consumer education. Enterprise Markets, which include many emerging economies, present perhaps the largest opportunity. Here, P&G sees $10–15 billion in additional sales potential by increasing per capita consumption to the levels already achieved in Mexico. These markets often have rapidly expanding middle classes and improving retail infrastructure, creating strong conditions for P&G’s broad portfolio of daily-use products. What makes these growth opportunities compelling is that they build on P&G’s existing strengths: brand leadership, consumer trust, and category expertise. Even small gains in penetration or consumption, when applied across categories serving billions of consumers, can translate into substantial revenue and profit growth.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 6,51, which is from fiscal year 2025. I have selected a projected future EPS growth rate of 8%. Management expects to achieve mid to high single digit EPS growth. Additionally, I have chosen a projected future P/E ratio of 16, which is twice the growth rate. This decision is based on the fact that Procter & Gamble has historically had a higher price-to-earnings (P/E) ratio. Lastly, our minimum acceptable rate of return is already set at 15%. Doing the calculations, we come up with the sticker price (some call it fair value or intrinsic value) of $55,59. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Procter & Gamble at a price of $27,79 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is called the Ten Cap price. The rate of return that an owner of a company (or stock) receives on the purchase price of the company is essentially its return on investment. The return should be at least 10% annually, and I calculate it as follows: The operating cash flow last year was 17.817 and capital expenditures were 3.773. I attempted to review their annual report to determine the percentage of capital expenditures allocated for maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 2.641 in our calculations. The tax provision was 4.102. We have 2.345 outstanding shares. Hence, the calculation will be as follows: (17.817 – 2.641 + 4.102) / 2.345 x 10 = $82,21 in Ten Cap price.

The final calculation is called the Payback Time price. It is a calculation based on the free cash flow per share. With Procter & Gamble's Free Cash Flow Per Share at $5,99 and a growth rate of 8%, if you want to recoup your investment in 8 years, the Payback Time price is $68,81.

Conclusion

I believe that Procter & Gamble is an intriguing company with capable management. It has built a strong moat through its scale, the breadth of its brand portfolio, and decades of consumer trust. The company has consistently achieved a high return on invested capital, and while free cash flow declined in fiscal 2025, it is expected to improve in the coming years. Competition remains a risk as P&G faces constant pressure from global brands, local players, and private labels that compete aggressively on price and promotions, which can erode sales, market share, and margins, especially in price-sensitive categories, requiring continued investment in innovation and marketing to maintain leadership. Macroeconomic factors also pose challenges, as its global footprint exposes it to tariffs, currency swings, inflation, and economic slowdowns that can raise costs, hurt competitiveness, and weaken demand, while political instability and geopolitical events can disrupt supply chains, shift consumer behavior, and force market exits. Slower growth in key markets limits sales expansion even when market share holds steady, and shifting sales toward channels with lower inventory levels, such as warehouse clubs and e-commerce, along with retailer inventory reductions, can weigh on reported results despite steady consumer demand. Portfolio optimization is a reason to invest because P&G has streamlined its focus to its strongest daily-use brands with the highest growth and profit potential, improving efficiency, freeing resources for innovation, and supporting sustainable growth and higher shareholder returns. Investing in superiority is another strength, as P&G consistently delivers best-in-class products, packaging, marketing, retail execution, and value, using innovation to win market share and expand entire categories, which strengthens loyalty, supports premium pricing, and creates a competitive advantage that is difficult to replicate. Growth opportunities add to the appeal, with billions in potential sales from increasing household penetration, boosting consumption in developing markets, and encouraging trade-ups within existing categories, leveraging its brand leadership and expertise to scale profitably without needing acquisitions or entering new markets. While there is much to like about Procter & Gamble, I do not expect rapid growth ahead and will only consider buying shares if they reach my Ten Cap price of $82.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how I do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and in order to receive, you will have to give (Warren Buffett and Mohnish Pabrai are great examples). If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to Rolda Animal Rescue. It is an organization that is helping the animals in Ukraine, and they need all the help they can get. If you have a little to spare, please donate here. Even a little will make a huge difference to save these wonderful animals. Thank you.

Comments