Rockwell Automation: A Long-Term Winner in Industrial Automation

- Glenn

- 5 days ago

- 21 min read

Rockwell Automation is a key player in the world of industrial automation, providing the technology that helps factories run faster, smarter, and more efficiently. Its products and software are used in a wide range of industries, from car manufacturing and semiconductors to food production and warehouse logistics. With companies around the world investing in more modern and resilient factories, Rockwell Automation is well positioned to benefit from this long-term shift. The question remains: Should this industrial technology leader have a place in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in Rockwell Automation at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of Rockwell Automation, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

Rockwell Automation is a global leader in industrial automation and digital transformation whose technology powers thousands of factories and production systems around the world. The company provides the full stack of solutions that manufacturers rely on to run, control, optimize, and scale their operations. This starts with the physical layer of automation, including drives, motion systems, sensors, safety equipment, and the Allen-Bradley line of industrial controllers that serve as the brains of production lines. On top of this, Rockwell offers the software and control infrastructure that connects machines, production data, and enterprise systems. Its FactoryTalk platform supports everything from real-time visualization and data collection to simulation, digital twins, and industrial cybersecurity. The company then ties these layers together with lifecycle services that help customers design, build, operate, and maintain their systems, offering consulting, engineered-to-order solutions, remote monitoring, and long-term technical support. Because these capabilities work together as an integrated system, Rockwell can help customers improve productivity, reduce downtime, strengthen resilience, and modernize their factories in line with industry trends. What gives Rockwell its moat is a combination of three reinforcing advantages: its dominant installed base in U.S. industry, a partner ecosystem that has been built and nurtured over decades, and exceptionally high switching costs created by long-term standardization on its technology. These strengths make the company deeply embedded in customers’ operations and difficult for competitors to replace. The company is the most widely used automation platform in American industry, giving it a level of installed-base dominance that is difficult for competitors to supplant. Decades of standardization on Allen-Bradley equipment mean that switching to another vendor would be costly and disruptive for customers, creating a high degree of stickiness. This entrenched position is reinforced by a partner ecosystem built over many years, involving distributors, system integrators, and machine builders who trust Rockwell’s technology and align closely with its objectives. Management emphasizes that these relationships are built on long-standing trust and shared goals, and they represent a meaningful cultural strength within the company. Another element of the moat is Rockwell’s ability to expand far beyond its traditional control systems into higher-value opportunities. Customers already reliant on the company’s automation infrastructure are natural buyers of additional layers of value such as software, advanced analytics, mobile robots, cybersecurity, and ongoing lifecycle services. This increases the company’s relevance inside customer operations and strengthens its long-term position.

Management

Blake Moret serves as the Chairman and CEO of Rockwell Automation, a position he assumed in 2016 after spending his entire career with the company. He brings nearly four decades of experience in industrial automation, digital transformation, and operational leadership, and has played a central role in shaping Rockwell Automation’s strategic direction as it expanded from a traditional controls supplier into a global leader in integrated hardware, software, and intelligent production systems. Blake Moret joined Rockwell Automation in 1985 as a sales trainee and advanced through a wide range of commercial and operational roles with increasing responsibility. His early career took him across multiple geographies and customer segments, giving him a deep understanding of manufacturing needs and the complexities of large-scale industrial environments. Over the years he led businesses spanning components, drives, and systems, and was eventually appointed Senior Vice President of Control Products and Solutions, where he oversaw a major portion of the company’s core automation portfolio. During his tenure as Chief Executive Officer, Blake Moret has guided Rockwell Automation through a period of significant transformation, marked by investments in software, analytics, autonomous systems, and digital services. Under his leadership, the company has expanded its capabilities through strategic acquisitions and partnerships, including ventures into industrial cybersecurity, cloud-connected manufacturing platforms, and robotics. Blake Moret is known for emphasizing long-term customer relationships and for strengthening the company’s extensive partner ecosystem, which he views as essential to Rockwell Automation’s ability to deliver integrated solutions across the industrial value chain. Blake Moret holds a bachelor’s degree in mechanical engineering from Georgia Institute of Technology. His leadership style is often described as steady, customer-centric, and deeply grounded in domain expertise. He is widely regarded as a leader who understands both the technical depth of automation and the strategic imperatives required to compete in an increasingly digital industrial world. Given his long tenure with the company and his ability to navigate both legacy operations and emerging technologies, I believe Blake Moret is well-equipped to guide Rockwell Automation through its continued evolution as a global force in intelligent industrial systems.

The Numbers

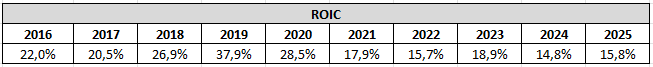

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. Rockwell Automation has historically delivered very high ROIC because the company sits at the center of customers’ production systems in a way that is difficult and costly to replace. Once a factory standardizes on Rockwell’s Allen-Bradley controllers, drives, software, and safety systems, the entire operation depends on that technology. Switching to another vendor would require retraining staff, rewriting code, redesigning equipment, and risking downtime, which makes customers highly loyal. This gives Rockwell pricing power and keeps margins high while allowing the company to grow without investing heavily in physical assets. In other words, Rockwell benefits from high switching costs, a capital-light model, and a premium position in the United States, where it has the largest installed base by a wide margin. The reason ROIC has trended lower in more recent years is not because the moat has weakened but because conditions have normalized. The peak years benefited from a perfect combination of strong industrial demand and a richer mix of software and high-margin solutions. Since then, several forces have pulled ROIC down toward more typical levels. Rockwell has invested meaningfully in acquisitions in areas like cybersecurity, digital services, and autonomous systems, which increases invested capital initially before the returns fully show up. The product mix has also shifted at times toward lower-margin hardware, and supply chain pressures during 2021 and 2022 temporarily squeezed margins. These are ordinary business-cycle effects rather than signs of structural deterioration. Looking ahead, it is reasonable to expect ROIC to improve gradually from current levels but not to return consistently to the extraordinary highs of the past. The years above 30% were outliers driven by unusually favorable conditions. Today, the company is more diversified, investing in more categories, and operating in a more competitive global environment. That naturally brings ROIC toward the mid-teens to low-20s range. Still, this remains an excellent level of profitability for an industrial business. Rockwell continues to benefit from its dominant installed base, trusted partner ecosystem, and capital-efficient model, and as software and lifecycle services become a larger share of revenue, the company should see modest upward pressure on returns over time.

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. Rockwell Automation’s equity has clearly settled at a much higher level over the past four years, and that is exactly what you would expect for a company that has become larger, more profitable, and more stable over time. Rockwell does not try to build up a huge amount of equity on its balance sheet. Instead, it tends to return a lot of its excess cash to shareholders through dividends and share buybacks. Because of that, equity usually grows slowly. The reason it has stayed in the same range lately is that the company has been earning more money while slowing down its buybacks, and it has also made several acquisitions that added to its balance sheet. Together, those factors helped keep equity at its highest level in a decade. In the future, equity will probably continue to grow, but only gradually. Rockwell’s approach is to use its cash to reward shareholders and to invest in new technologies rather than to simply let equity pile up. If profits keep rising and the company continues at its current pace with buybacks, equity should increase a little over time. But big jumps are unlikely, because that is not how Rockwell runs its business. The very low equity number in fiscal year 2019 stands out, but it was not caused by anything wrong with the business itself. That year, Rockwell spent a lot of money buying back its own shares and also recorded some one-time accounting adjustments. Share buybacks reduce the equity total automatically, so when they happen at the same time as accounting charges, the number can fall sharply even if the company is performing well. That is why 2019 looks unusual.

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins offer a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. Rockwell Automation’s free cash flow has always been one of the strengths of the business, and fiscal year 2025 stands out as its best year ever. The main reason is that the company executed extremely well across the board. Earnings were strong, margins were near the high end of the ten-year range, and Rockwell became more efficient in how it runs the business. Management highlighted during the earnings call that they have been streamlining the organization and improving productivity, and those efforts directly helped cash flow. On top of that, Rockwell returned to a very healthy cash conversion rate, meaning that profit was turning into cash at a much higher level than in the past few years. Even after making a voluntary $70 million contribution to its U.S. pension plan, the company still delivered a conversion rate of 114%, and without that contribution it would have been 119%. The question of whether this trend will continue has two sides. On one hand, Rockwell has made real improvements in efficiency and cost structure, and those changes should support strong free cash flow going forward. The shift toward more software, digital services, and recurring revenue also helps, because those parts of the business typically produce more cash relative to revenue. On the other hand, the record level in 2025 was helped by unusually strong cash conversion, which is not something that automatically repeats every year. Factors like inventory swings, customer payment timing, and pension contributions can move the number up or down. So while free cash flow should stay strong, investors should not assume every year will look like 2025. It is better to view 2025 as a very strong year driven by both operational improvements and timing factors. In terms of how Rockwell uses its free cash flow, the company follows a very consistent approach. It returns a large share of it to shareholders through dividends and share buybacks. In fiscal year 2025, Rockwell deployed about $1 billion this way, which is typical for the company. Beyond shareholder returns, free cash flow is also used to fund strategic investments and acquisitions, pension contributions, and occasional debt reduction. Rockwell prefers to keep the balance sheet steady rather than letting cash accumulate, so cash flow is continually recycled into growth opportunities and returns to shareholders. The free cash flow yield suggests that the shares are currently trading at a premium valuation. However, we will revisit valuation later in the analysis.

Debt

Another important area to investigate is debt, and we want to see whether a business has a reasonable level of debt that could be paid off within three years. To assess this, we divide total long-term debt by earnings. When applying this measure to Rockwell Automation, the result shows that it would take 3 years of earnings to pay off its long-term debt. So it sits right at the three-year threshold, which means the debt level should not be a concern if you are considering investing in Rockwell Automation. It also helps to look at how the company typically uses debt. Rockwell does not rely on heavy borrowing to run its business. Instead, it uses debt mainly to support acquisitions and long-term strategic investments, while day-to-day operations are funded by the company’s own cash flow. Because Rockwell has very steady earnings and strong free cash flow, it is well equipped to manage the debt it carries.

Upgrade Your Investment Research — Black Friday Deals Are Live

If you’ve been thinking about improving your research process or getting deeper insights into the market, now’s the time.

Seeking Alpha just launched their Black Friday offer — their biggest of the year.

These deals are available until December 10:

·Premium: $299 → $239/year (Save $60) + 7-day free trial for new users

You can try all Premium features — full access to analysis, stock ratings, and data tools — completely free for 7 days.

If you don’t like it, just cancel within the trial period and it won’t cost you anything.

·Alpha Picks: $499 → $399/year (Save $100)

This service has returned +287% vs. the S&P 500’s +77% since July 2022.

·Bundle (Premium + Alpha Picks): $798 → $574/year (Save $224)

Their best-value offer, combining in-depth research and top stock recommendations in one package.

I personally find Seeking Alpha’s Premium tools and analysis extremely helpful for company research, portfolio tracking, and discovering new investment ideas.

Take advantage of the offer while it lasts — it’s only available once a year.

Risks

Macroeconomic factors is a risk for Rockwell Automation because the company depends heavily on the health of global manufacturing and the willingness of its customers to invest in new equipment, software, and automation projects. When the broader economy weakens, companies typically respond by delaying or reducing capital spending, which directly affects demand for Rockwell’s products and services. This means that recessions, slowdowns in industrial production, or tighter credit conditions can quickly translate into fewer orders, postponed projects, and pressure on Rockwell’s sales and profitability. One of Rockwell Automation’s key exposures is that many of the industries it serves, such as automotive, semiconductors, warehouse automation, energy, and food production, are themselves sensitive to economic cycles. When these industries face uncertainty or weaker financial performance, they often scale back investments in automation. This is exactly what the company has been seeing recently, with management noting delays in customer projects and slower decisions on large automation programs as companies wait for more clarity around trade policy and the overall economic environment. Macroeconomic pressure also affects Rockwell through its distribution network. When customers and distributors try to conserve cash or reduce inventories, they place fewer orders. This creates short-term volatility even when long-term demand remains healthy. In addition, Rockwell operates in more than one hundred countries, which exposes the company to currency fluctuations. A stronger U.S. dollar can make Rockwell’s products more expensive outside the United States and reduce the value of international revenue when it is converted back into dollars. Finally, global political and regulatory uncertainty, especially in emerging markets, can make it harder for customers to commit to major investments. Issues like shifting trade policies, geopolitical tensions, or new restrictions on cross-border money flows can delay projects or reduce demand temporarily. Rockwell noted on its recent call that customers across several regions are pushing back automation projects and discretionary service spending until they have more confidence in the macro environment.

Supplier reliance is a risk for Rockwell Automation because the company depends on a steady flow of components, electronics, and materials to build its products and deliver solutions to customers. If those suppliers face problems, Rockwell feels the impact directly. Many of the parts used in automation equipment are highly specialized and not easy to replace quickly, so any disruption can slow down production and create delays for customers. One major risk is shortages. If suppliers cannot deliver key components on time, Rockwell may not be able to build products when customers need them. This can affect manufacturing efficiency and may even result in lost sales. The company experienced this during the global supply chain disruptions of 2021 and 2022, when shortages in electronic components created backlogs and delayed shipments across the automation industry. Costs are another source of risk. Supplier price increases driven by inflation, changes in currency values, tariffs, or volatile commodity prices can raise Rockwell’s own costs. While the company can sometimes pass these increases on to customers, that is not always possible, and it can put pressure on profitability. Supplier reliance also carries quality and reliability risks. If a supplier delivers parts that do not meet expected standards, the performance and reputation of Rockwell’s products can be affected. This is especially important for Rockwell, since the company’s customers rely on its systems to run critical operations with minimal downtime. Any quality issue in the supply chain can have an outsized impact. The risk is even greater in cases where Rockwell depends on single-source suppliers. Sometimes a specific component is only available from one supplier, or an existing supplier offers the best combination of quality and performance. If that supplier faces production issues or stops supplying the part, Rockwell may have no immediate alternative. Finding and qualifying a new supplier can take months, especially for complex or safety-critical components, and during that time Rockwell might not be able to ship certain products at all.

Cybersecurity risks are a risk for Rockwell Automation because the company’s products operate at the heart of its customers’ factories, production lines, and in some cases critical infrastructure. If any part of Rockwell Automation’s technology is compromised, whether through hacking, malware, ransomware, or vulnerabilities in its supply chain, the impact could be serious. This includes not just damage to Rockwell’s own systems, but the possibility of disrupting customer operations, which could cause safety issues, production downtime, or financial losses for those customers. Rockwell relies heavily on software, digital connectivity, cloud systems, and data-sharing across a global network of partners, suppliers, and customers. Even with strong security measures, large organizations like Rockwell face ongoing attempts by hackers, cybercriminals, and even state-sponsored groups to break into their systems. The rise of more sophisticated attacks, especially those enhanced by artificial intelligence, increases this risk. Rockwell has experienced cyber incidents in the past, although none have been significant, but the environment is becoming more challenging for all companies. A major part of the risk is that Rockwell cannot control every part of how its products are used. Customers often integrate Rockwell’s hardware and software into complex environments with many other systems and vendors. If a customer installs or updates something incorrectly, fails to secure their network, or delays important software patches, it can make both the customer and Rockwell more vulnerable. Human error at the customer level can also create openings for attackers, even when Rockwell’s own products are secure. Cybersecurity is also a risk for Rockwell’s internal operations. The company runs development, engineering, manufacturing, and financial systems across dozens of countries. These systems are connected to outside partners, cloud providers, and vendors who have varying levels of security. A weakness in any one of these third-party systems could expose Rockwell to risk. Confidential customer information, employee data, intellectual property, and proprietary automation technology could all be targets.

Reasons to invest

Operating in an attractive market is a reason to invest in Rockwell Automation because the company sits at the center of one of the strongest long-term growth themes in the global economy: the modernization and reindustrialization of manufacturing. Around the world, companies and governments are recognizing that manufacturing needs to become more resilient, more digital, and less dependent on manual labor. This shift creates steady demand for the automation, software, and intelligent control systems that Rockwell provides. Management expects the markets it serves to grow around 5%t per year over the next five years, and Rockwell has historically grown faster than overall industrial production because it focuses on the fastest-growing verticals and expands into new ones. Several powerful forces are driving this market. High-cost regions like the United States cannot bring manufacturing back onshore without automation, because labor alone is too expensive to remain competitive. At the same time, companies are trying to build more agile and sustainable factories that can react quickly to supply chain pressures, changing demand, and new regulatory requirements. Automation is no longer optional in this environment; it is essential. Rockwell is positioned at the center of this transition, offering the hardware, software, and services that make modern factories possible. Rockwell also benefits from strong demand in both new facilities and older ones. Many customers are not building brand-new factories but are instead upgrading and modernizing existing sites. Rockwell’s technology is suited for both situations, and the company recently highlighted major wins in energy, mining, and metals where customers are prioritizing efficiency and profitability in their current operations. This is important because it means Rockwell can grow even during periods when new construction slows. A significant advantage is Rockwell’s unique home-field position in the United States. As industries such as electric vehicles, batteries, semiconductors, life sciences, and warehouse automation invest aggressively in new capacity, Rockwell captures more of that spending than any competitor. Its large installed base and long-standing relationships create a compounding effect that reinforces future growth. The United States is currently going through one of the strongest periods of manufacturing investment in decades, and Rockwell is one of the biggest beneficiaries.

Intelligent Devices is a reason to invest in Rockwell Automation because this segment sits at the core of how modern factories operate and is one of the company’s strongest engines of growth. Unlike traditional automation equipment, which mainly executed fixed commands, today’s intelligent devices can sense conditions, adjust to changes, and communicate with other parts of the system. They are no longer passive components. They are active, data-producing, self-optimizing elements of a modern production line. Intelligent Devices includes the physical automation layer: drives, motion systems, sensors, power control equipment, industrial components, and advanced material-handling technology. These are the building blocks of every automated production line, and demand for them continues to rise as manufacturers move toward smarter, more autonomous operations. The deeper reason Intelligent Devices is so important is that it forms the foundation of the factory of the future. A clear example is Rockwell’s work with a global food and beverage manufacturer. This customer is building smart factories powered by Rockwell sensors, control architecture, and intelligent devices. These systems automate tasks like sorting, packaging, and inspection, helping the plant run more efficiently while reducing errors and downtime. Because the devices collect and share data, they allow the plant to self-adjust instead of relying solely on human intervention. Intelligent Devices also enable Digital Twins, virtual replicas of production lines that allow manufacturers to test ideas, simulate changes, and solve problems before touching real equipment. This makes operations safer, faster, and more cost-effective. Artificial intelligence makes these devices even more valuable. Rockwell’s customers use connected devices to monitor machine conditions and predict equipment failures before they happen. AI-powered vision systems inspect materials and optimize product quality in real time. Intelligent material-movement technologies, such as autonomous mobile robots and independent cart systems, deliver materials with precision and speed. All of these capabilities rely on intelligent devices that can sense, compute, and act. Another reason this segment is attractive is that many industries are still early in their transition to advanced automation. Large global manufacturers are further along, but small and mid-sized companies are only beginning their journey. This gives Rockwell a long runway for growth, because the company can support customers at any stage, from basic automation to fully autonomous operations.

Growing recurring revenue is a reason to invest in Rockwell Automation because it strengthens the company’s business model, makes results more predictable, and deepens long-term customer relationships. When Blake Moret stepped into the CEO role in 2016, Rockwell had only about $200 million in annual recurring revenue. Today, recurring revenue accounts for more than 10% of total revenue and is growing faster and with higher profitability than the rest of the company. This shift shows how Rockwell is evolving from being mainly a hardware supplier to becoming a broader technology partner embedded in customers’ daily operations. Recurring revenue at Rockwell comes from areas such as Software as a Service and recurring services. These include offerings like Plex, Fiix, FactoryTalk DesignStudio, FactoryTalk Optix, FactoryTalk DataMosaix, cybersecurity services through Verve, and consulting and digital transformation support through Kalypso. These products and services are used continuously by customers to run and optimize their factories, which means revenue arrives steadily year after year rather than depending on one-off equipment purchases. Another reason recurring revenue is so compelling is that Rockwell’s software businesses are gaining traction with new customers. Plex and Fiix continue to win new logos globally, and the company is expanding its go-to-market partnerships to accelerate adoption. This has helped Software & Control achieve strong growth. As more customers adopt Rockwell’s modern software stack, recurring revenue naturally expands. Finally, recurring revenue is central to Rockwell’s strategy for the future of automation. Many of the company’s most important innovation areas, Software Defined Automation, artificial intelligence, digital twins, virtual commissioning, plant information systems, cybersecurity, and connected services, depend on ongoing software delivery and continuous support. These are not one-time purchases; they are foundational tools that customers use every day. As factories become more connected and more autonomous, recurring revenue becomes an even larger part of how Rockwell delivers value.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 7,67, which is from the fiscal year 2025. I have selected a projected future EPS growth rate of 15%. Finbox expects EPS to grow by 17,5% over the next five years, but 15% is the highest I use. Additionally, I have selected a projected future P/E ratio of 30, which is double the growth rate. This decision is based on Rockwell Automation's historically higher price-to-earnings (P/E) ratio. Finally, our minimum acceptable rate of return has already been established at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be $230,10. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Rockwell Automation at a price of $115,05 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 1.544, and capital expenditures were 186. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 130 in our calculations. The tax provision was 168. We have 112,4 outstanding shares. Hence, the calculation will be as follows: (1.544 – 130 + 168) / 112,4 x 10 = $140,75 in Ten Cap price.

The final calculation is referred to as the Payback Time price. It is a calculation based on the free cash flow per share. With Fabrinet's free cash flow per share at $12,08 and a growth rate of 15%, if you want to recoup your investment in 8 years, the Payback Time price is $190,69.

Conclusion

I believe Rockwell Automation is an intriguing company led by strong management, with a moat built on its dominant installed base in U.S. industry, a partner ecosystem developed over decades, and high switching costs created by long-term standardization on its technology. The company has consistently achieved high ROIC and reached its highest free cash flow ever in fiscal year 2025. Macroeconomic conditions remain a risk because demand for Rockwell’s products depends on customers’ willingness to invest in new equipment and automation, which tends to decline when the economy slows or uncertainty rises. Supplier reliance is another risk, as Rockwell needs specialized components that are not easily replaced, meaning shortages, delays, or quality problems can directly affect production and customer deliveries. Cybersecurity also presents a meaningful risk because Rockwell’s technology runs critical factory operations, and weaknesses in its own systems or those of its global network of cloud providers, partners, and suppliers could disrupt customers or harm the company’s reputation. Despite these risks, Rockwell operates in an attractive market driven by the modernization and reshoring of manufacturing, the rise of smart factories, and strong investment in areas such as electric vehicles, semiconductors, and logistics, positioning the company to capture an outsized share of this growth. Intelligent Devices add further upside because these modern, data-driven components form the foundation of autonomous and highly efficient factories, and demand is growing as more manufacturers move toward advanced automation. At the same time, the expansion of recurring revenue strengthens Rockwell’s business model by making results more predictable and profitable as customers increasingly rely on its software and services to run their operations. Taken together, I believe Rockwell Automation is a high-quality company, and buying shares at an intrinsic value or margin of safety price of $230 would be a strong long-term investment.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how to do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and to receive, you will have to give. If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to Oceans Alive. It is an organization that does a lot of great work to ensure a healthy and sustainable future for our oceans that will benefit us all. If you have a few Euros/Dollars/Pounds or whatever to spare, please donate here. Even one or two Euros will make a difference. Thank you.

Comments