KLA Corporation: A market leading compounder operating in a growing sector.

- Glenn

- Oct 14, 2023

- 20 min read

Updated: Dec 11, 2025

KLA Corporation is a global leader in process control and yield management systems used in semiconductor manufacturing. Its highly specialized inspection and metrology tools are essential for detecting and preventing defects in the increasingly complex production of chips. The company plays a critical role in helping chipmakers like TSMC, Samsung, and Intel maintain efficiency and quality as they move toward smaller nodes and advanced packaging technologies. With strong recurring revenue from services, deep customer relationships, and exposure to major industry trends such as AI infrastructure and high-bandwidth memory, KLA stands at the center of the semiconductor equipment ecosystem. The question is: Does this semiconductor powerhouse deserve a place in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should mention that I do not own any shares in KLA Corporation at the time of writing this analysis. If you would like to copy or view my portfolio, you can find instructions on how to do so here. If you want to purchase shares or fractional shares of KLA Corporation, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started on investing with as little as $50.

The Business

KLA Corporation is the global leader in process control and yield management solutions for the semiconductor industry. Formed in 1997 through the merger of KLA Instruments and Tencor Instruments, the company develops highly advanced inspection and measurement tools that help chipmakers detect and analyze tiny defects during production. By identifying problems early, KLA’s systems allow manufacturers to improve yields, speed up production, and ensure that chips meet strict quality standards. Its customers include leading names such as TSMC and Samsung, and its tools are used across the entire chipmaking process, from research and development to high-volume manufacturing. The company operates through three main segments. The largest, Semiconductor Process Control, provides tools that inspect and measure wafers and chips to reduce defects and boost efficiency. The Specialty Semiconductor Process segment focuses on tools for specialized applications such as sensors, radio frequency chips, and power devices used in electric vehicles and industrial equipment. The PCB and Component Inspection segment provides systems that check the quality of printed circuit boards and other electronic components. KLA also generates stable, recurring revenue through its services business, which supports and maintains equipment that can remain in operation for decades. KLA’s competitive moat is one of the strongest in the technology industry, built on four main pillars: technological leadership, data-driven innovation, high switching costs, and deep customer relationships. It is far ahead of its competitors in inspection and metrology technology, spending billions each year on research and development to stay ahead of future chipmaking needs. With thousands of systems installed in customer factories around the world, KLA collects an enormous amount of performance data that helps it refine its tools and anticipate production issues before they occur. Its equipment is deeply embedded in manufacturing lines and takes months or even years to qualify for use, making it extremely costly and risky for customers to switch suppliers. Finally, by working closely with major chipmakers to align with their long-term technology roadmaps, KLA builds lasting partnerships and maintains early insight into future demand. In practice, KLA acts as a form of “yield insurance” for semiconductor manufacturers—its tools are essential for preventing costly production errors and ensuring that each wafer produces as many usable chips as possible.

Management

Rick Wallace serves as the CEO of KLA Corporation, a position he has held since 2005. He joined KLA Instruments in 1988 as an applications engineer and has since held a wide range of technical, operational, and executive roles across the company. Over his long tenure, Rick Wallace has been deeply involved in shaping KLA Corporation’s evolution into a global leader in process control and yield management solutions for the semiconductor industry. In addition to his role as CEO, he serves on KLA Corporation’s Board of Directors and on the Board of Directors of Splunk Inc. Rick Wallace holds a bachelor’s degree in electrical engineering from the University of Michigan and a master’s degree in engineering management from Santa Clara University. Early in his career at KLA, he was given a 90-day challenge to develop a new business plan alongside a colleague. Their work not only met expectations but uncovered a $20 million product opportunity that would have otherwise gone unnoticed. This formative experience reinforced for him the importance of focus, disciplined execution, and the willingness to commit fully to new initiatives, principles that continue to shape his leadership approach today. As CEO, Rick Wallace leads KLA Corporation with a clear set of five core values: perseverance, a drive for continuous improvement, teamwork across diverse and interdisciplinary environments, honesty and transparency, and an unwavering dedication to providing indispensable products and unmatched service to customers. Under his leadership, KLA Corporation has strengthened its position as one of the most profitable and technologically advanced companies in the semiconductor equipment industry, maintaining industry-leading margins and deep, long-term partnerships with customers such as TSMC and Samsung. His leadership style is defined by technical depth, strategic clarity, and a long-term commitment to innovation. Given his decades of experience, strong alignment with KLA Corporation’s core values, and proven ability to navigate both technological and cyclical challenges, I believe Rick Wallace is exceptionally well-qualified to continue leading the company’s success.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. KLA Corporation has consistently achieved a high return on invested capital (ROIC) thanks to its strong market position, high profitability, and efficient use of resources. The company operates in a specialized area of semiconductor manufacturing, inspection, metrology, and process control, where its products are essential and difficult to replace. This gives KLA significant pricing power and allows it to maintain high margins. Unlike chip manufacturers, KLA’s operations do not require heavy capital investment, which enables it to generate strong profits relative to the amount of money it invests in its business. Its growing service division, which now accounts for more than one fifth of total revenue, provides recurring income and improves overall efficiency. KLA’s ROIC increased in fiscal year 2025, reaching its second highest level ever, mainly because profits grew faster than the company’s overall spending and investments. Revenue rose to more than 12 billion dollars, driven by strong demand from chipmakers expanding production for advanced chips and AI infrastructure. At the same time, KLA managed its costs carefully and operated efficiently, which helped boost profitability. The company also benefited from strong pricing, high factory utilization, and growth in its services business, which generates steady, high-margin income. Together, these factors allowed KLA to earn more from the money it invests in its business, leading to another year of exceptional returns. Looking ahead, KLA’s ROIC is expected to remain very high, although further increases will depend on industry conditions. As semiconductor manufacturing becomes more complex, especially with the transition to two nanometer chips, advanced packaging, and AI focused designs, demand for KLA’s tools will continue to grow. These trends should support strong profitability and pricing power. While semiconductor capital spending can fluctuate with economic cycles, KLA’s leading position, growing service revenue, and disciplined financial management make it likely that the company will continue generating returns well above its cost of capital for many years.

The next numbers are the book value + dividend. In my old format this was known as the equity growth rate. It was the most important of the four growth rates I used to use in my analyses, which is why I will continue to use it moving forward. As you are used to see the numbers in percentage, I have decided to share both the numbers and the percentage growth year over year. To put it simply, equity is the part of the company that belongs to its shareholders – like the portion of a house you truly own after paying off part of the mortgage. Growing equity over time means the company is becoming more valuable for its owners. So, when we track book value plus dividends, we’re essentially looking at how much value is being built for shareholders year after year. KLA’s equity has moved up and down over the years, mainly because of how the company manages its cash and how the semiconductor market changes from year to year. Big increases in equity have tended to happen in strong years when profits were high and the company kept more of its earnings instead of paying them out. In fiscal year 2025, KLA reached its highest equity ever thanks to record profits and careful financial management. Strong demand for advanced chips and AI-related equipment helped lift earnings to new highs, and the company’s overall value to shareholders continued to grow. Looking ahead, KLA’s equity will likely keep rising over time, though not necessarily in a straight line. The semiconductor industry moves in cycles, so there will be years of faster and slower growth. But because KLA consistently generates strong cash flows, earns very high returns on the money it invests, and manages its finances prudently, it should continue to build long-term value for its shareholders even if results fluctuate from one year to the next.

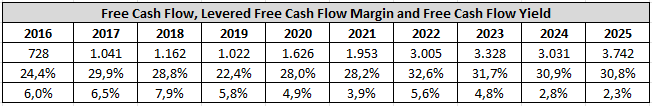

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. KLA Corporation consistently generates high free cash flow because of its strong profitability, efficient business model, and disciplined spending. The company operates in a specialized segment of the semiconductor industry where its products and services are essential to chip production, giving it pricing power and stable demand even in slower market periods. Its service business, which provides ongoing support for installed equipment, adds a steady and predictable source of income that requires little additional investment. This combination of high margins and low capital needs allows KLA to convert a large share of its earnings into free cash flow. In fiscal year 2025, KLA achieved record free cash flow of 3,74 billion dollars and a levered free cash flow margin of 30,8%. This increase was driven by strong operating performance, higher revenue from chipmakers investing in AI and advanced manufacturing, and continued strength in the company’s service business. KLA also maintained tight control over costs and capital spending, which helped more of its profits flow directly into cash. The result was one of the highest free cash flow margins in the entire semiconductor equipment industry. KLA’s free cash flow has remained consistently high over the past decade because of its efficient operations and balanced business mix. The company has a predictable revenue base from services, recurring spare parts, and upgrades, which helps offset the cyclical nature of new equipment sales. These factors make its cash generation unusually steady for a company tied to semiconductor demand. Looking forward, KLA’s free cash flow is expected to grow over time, supported by rising demand for advanced chips, expanding service contracts, and disciplined cost management. KLA uses its free cash flow primarily to reward shareholders and maintain a strong balance sheet. In fiscal year 2025, the company returned 3,05 billion dollars to shareholders through dividends and share repurchases. It also raised its quarterly dividend by 12% and approved a new 5 billion dollar share buyback program. This reflects management’s confidence in the company’s ability to continue generating robust cash flows in the years ahead. Given its track record and industry position, KLA’s free cash flow margin is expected to remain high, providing both stability and long-term value creation for shareholders. The free cash flow yield is at its lowest level in more than a decade, suggesting that the shares are currently trading at a premium. However, we will revisit valuation later in the analysis.

Debt

Another important aspect to consider is the level of debt. It is crucial to assess whether a business has manageable debt that can be repaid within a three-year period. This can be estimated by dividing total long-term debt by annual earnings. After performing the calculation for KLA Corporation, I found that the company has 1,47 years of earnings in debt. This falls comfortably within the three-year range, so debt is not a concern for me. KLA Corporation has also maintained a debt-to-earnings ratio below three years since 2016, showing consistent and careful management of its balance sheet. Given its strong earnings and reliable cash generation, I do not see debt as a risk for KLA in the foreseeable future.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Risks

Macroeconomic factors are a risk for KLA Corporation because the company’s performance is closely tied to global economic conditions and the health of the semiconductor industry. Demand for KLA’s products ultimately depends on worldwide spending on electronic devices such as smartphones, computers, and servers. When consumers and businesses cut back on technology purchases during periods of economic uncertainty, semiconductor manufacturers often reduce or delay their capital investments. Since KLA’s customers rely on these investments to buy its inspection and metrology tools, slower spending directly impacts the company’s sales and earnings. Tighter financial conditions can also pose a challenge. Many of KLA’s customers depend on access to credit to fund large capital expenditures. When interest rates rise or credit markets tighten, it becomes more difficult for them to secure financing, which can lead to postponed or canceled equipment orders. These effects can be amplified during global slowdowns, when confidence in future demand weakens and manufacturers delay capacity expansions. The semiconductor industry itself is highly cyclical, with periods of rapid expansion followed by phases of slower demand and overcapacity. When the industry enters an upcycle, chipmakers invest heavily in new equipment to expand capacity and adopt the latest technologies, which directly benefits KLA as orders for its inspection and metrology tools surge. However, these cycles are often followed by downturns when supply outpaces demand, leading manufacturers to scale back spending and delay new projects. During such periods, KLA typically experiences a slowdown in equipment sales as customers focus on using their existing capacity more efficiently instead of investing in new tools.

Export restrictions are a significant risk for KLA Corporation because of the company’s heavy exposure to China and the growing complexity of U.S. trade regulations. China is one of KLA’s largest markets, accounting for more than 40% of its revenue in some recent years. Restrictions on exporting advanced semiconductor manufacturing equipment to Chinese customers directly threaten a large portion of this revenue. When new rules are introduced by the U.S. Department of Commerce, KLA must apply for export licenses to continue selling or servicing certain products in China. If these licenses are delayed or denied, the company may be forced to postpone shipments, cancel orders, or even return deposits, all of which can harm revenue and cash flow. The U.S. government has tightened export controls multiple times through the 2022, 2023, 2024, and 2025 BIS Rules, each expanding the list of restricted technologies and Chinese entities. These rules now limit not only the sale of certain advanced equipment but also support and maintenance services for tools already installed in Chinese fabs. As a result, even existing customer relationships can be affected. The inability to provide ongoing service or updates could damage KLA’s long-term standing with key clients, while competitors within China could use this disruption to develop domestic alternatives. Moreover, if the Chinese government responds with countermeasures or tighter local regulations, KLA’s ability to operate in the country could be further constrained. Losing partial access to the Chinese market would be difficult to offset, as China remains one of the largest and fastest-growing regions for semiconductor manufacturing. While KLA can seek to expand in other markets, replacing lost Chinese revenue at the same scale and pace would be challenging. Additionally, these restrictions can disrupt global supply chains, as many components used in semiconductor tools are sourced or processed in China. This creates further uncertainty and potential delays in KLA’s production and delivery schedules.

Customer concentration is a risk for KLA Corporation because the company depends heavily on a small number of large semiconductor manufacturers for a major share of its revenue. This reliance is the result of industry consolidation, where a few dominant players, such as TSMC, Samsung, and Intel, control a large portion of global chip production. While these relationships provide KLA with stable, long-term business, they also create significant exposure to the purchasing decisions of just a handful of companies. If one or more of KLA’s key customers delay, reduce, or cancel their capital spending plans, the company’s revenue could decline sharply. Because KLA’s tools are highly specialized and tailored to individual customers’ production processes, it is difficult to replace lost orders quickly. Changes in the mix, size, or timing of orders can therefore cause large swings in quarterly results. This sensitivity makes KLA’s financial performance more volatile than that of companies with a more diversified customer base. The risk is compounded by the growing bargaining power of these large customers. As the semiconductor industry consolidates, each remaining manufacturer represents a greater share of KLA’s total sales and can exert more pressure on pricing, payment terms, or intellectual property conditions. This can affect KLA’s profit margins, especially if customers demand lower prices or more flexible payment schedules during weaker industry cycles. Technological or strategic shifts among these major customers can also have an outsized impact. For example, if a key customer changes its production technology, slows the pace of node transitions, or shifts investment toward in-house alternatives, KLA could experience a meaningful drop in demand for its inspection and metrology tools.

Reasons to invest

AI infrastructure is a reason to invest in KLA Corporation because the rapid growth of artificial intelligence is driving record demand for advanced chips and high-bandwidth memory. These AI-related chips are much larger, more complex, and more valuable than traditional ones, which makes even the smallest defect extremely costly. KLA’s inspection and measurement tools are essential for identifying and preventing these defects, helping chipmakers improve yields and reduce waste during production. As companies expand AI data centers, chipmakers are producing many different chip designs at once, which adds even more complexity to manufacturing. This means process control, the area where KLA leads, has become a bigger part of every new fab investment. More designs mean more inspection steps, higher sampling rates, and longer use of KLA’s tools across both the early ramp-up and the high-volume production phases. The memory market, which was once less dependent on inspection, is also becoming a major source of growth. High-bandwidth memory used in AI systems requires higher performance, tighter reliability, and more advanced logic, all of which demand sophisticated process control. This shift is increasing KLA’s relevance and market share in memory production. These trends are already visible in the company’s results. Strong demand for advanced process control systems used in AI-related production has been a major driver of growth. KLA’s leadership position in process control allows it to benefit directly from this AI-driven build-out, and its role will only grow as chip designs become more intricate and production standards more exacting.

Advanced Packaging is a reason to invest in KLA Corporation because it determines where yield is won or lost in modern chips, and KLA provides the inspection and control systems that make these advanced packages work at scale. In simple terms, advanced packaging is how chipmakers connect multiple chips, often of different types, inside a single product. Instead of building one large chip, manufacturers now place several smaller “chiplets” side by side or stack memory on top of logic. These are then linked with ultra-fine wiring, micro-bumps, through-silicon vias, and advanced bonding techniques. This process is far more complex, which is exactly why KLA benefits. Each new packaging step, such as bump formation, wafer thinning, die attachment, bonding, and interposer patterning, creates more chances for defects to appear. A single defect found late in the process can force manufacturers to discard the entire finished package, which can include several valuable chips. To avoid that, chipmakers now inspect more often and demand higher precision and sensitivity from their equipment. KLA’s inspection and metrology systems are designed to meet these demands. They detect particles, voids, misalignments, and other defects, while verifying dimensions across wafers, panels, substrates, and finished packages. The company also uses process tools from its Specialty Semiconductor Process segment, such as etch, deposition, and plasma dicing, which gives it a broader role beyond inspection alone. As packaging evolves from a back-end task to a critical part of chip performance, the need for precise process control is rising quickly. This trend expands KLA’s market beyond traditional wafer fabrication and strengthens its position as a key supplier for advanced packaging. Management has already reported strong growth in this area and expects KLA to become the market leader in packaging process control. For investors, the takeaway is clear: advanced packaging is now essential to keeping chip performance on track, and it requires more inspection and control than ever before. KLA is at the center of this shift, helping chipmakers ramp production faster, maintain yields, and manage increasingly complex designs, all of which supports long-term growth and profitability.

Services is a reason to invest in KLA Corporation because it is large, recurring, and high margin, and it keeps growing as KLA’s installed base expands. KLA’s service revenue has grown steadily for many years and recently increased 15% year over year. The company has now delivered fifty two consecutive quarters of year over year service growth. More than three quarters of service revenue comes from subscription like contracts, which means predictable renewals, strong visibility, and cash flow that is less volatile than tool sales. This business is high margin because customers pay for uptime, yield protection, and performance on mission critical tools. KLA’s systems run for many years in production, and as the tools become more complex the value of expert maintenance, parts, software, and performance upgrades rises. That supports premium pricing and high renewal rates. Growth should continue because the installed base keeps getting larger with each system shipment and because each tool tends to stay in use for a long time, often beyond its original node. The shift to AI, high bandwidth memory, and advanced packaging also increases service intensity, since customers push tools harder and expect higher availability. Every new fab ramp adds service contracts. Every extension of tool life adds years of revenue. Data from thousands of connected tools feeds KLA’s analytics and predictive maintenance offerings, which further improves uptime and creates opportunities to sell higher value contracts and software. This means a durable engine of recurring, high margin revenue that supports strong free cash flow through industry cycles. Services smooths results when systems are lumpy, amplifies growth when shipments rise, and deepens customer relationships that make KLA’s position even harder to displace.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 30,37, which is the one from fiscal 2025. I have selected a projected future EPS growth rate of 15%. Finbox expects EPS to grow by 17% in the next five years, but 15% is the highest number I use. Additionally, I have chosen a projected future P/E ratio of 30, which is twice the growth rate. This decision is based on the fact that KLA Corporation has historically had a higher P/E ratio. Lastly, our minimum acceptable rate of return is already set at 15%. Doing the calculations, we come up with the sticker price (some call it fair value or intrinsic value) of $911,10. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy KLA Corporation at a price of $455,55 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is called the Ten Cap price. The rate of return that an owner of a company (or stock) receives on the purchase price of the company is essentially its return on investment. The return should be at least 10% annually, and I calculate it as follows: The operating cash flow last year was 4.082 and capital expenditures were 340. I attempted to review their annual report to determine the percentage of capital expenditures allocated for maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated for maintenance purposes. This means that we will use 238 in our calculations. The tax provision was 583. We have 132,2 outstanding shares. Hence, the calculation will be as follows: (4.082 – 238 + 583) / 133,2 x 10 = $334,87 in Ten Cap price.

The final calculation is called the Payback Time price. It is a calculation based on the free cash flow per share. With KLA Corporation's Free Cash Flow Per Share at $28,29 and a growth rate of 15%, if you want to recoup your investment in 8 years, the Payback Time price is $446,58.

Conclusion

I believe KLA Corporation is an intriguing company with strong management. The company has built its moat on technological leadership, data-driven innovation, high switching costs, and deep customer relationships. It has consistently achieved a high ROIC and delivered record free cash flow in fiscal year 2025, while maintaining a high free cash flow margin for more than a decade. Macroeconomic factors are a risk for KLA Corporation because its business depends on global spending on electronic devices and the investment cycles of semiconductor manufacturers. When the economy slows, demand for electronics weakens, financing becomes harder to obtain, and chipmakers reduce capital spending, which can lead to fewer equipment orders and lower earnings. Export restrictions are another risk because China represents a large share of KLA’s revenue, and tightening U.S. trade rules limit the company’s ability to sell or service advanced equipment there. If export licenses are delayed or denied, KLA could lose sales, damage customer relationships, and weaken its position in one of the world’s largest semiconductor markets. Customer concentration is also a risk, as a significant portion of revenue depends on just a few major chipmakers. If any of these customers cut or delay spending, KLA’s sales and profits could decline, and their bargaining power may pressure margins. On the positive side, AI infrastructure is a strong reason to invest because the surge in demand for advanced chips used in artificial intelligence requires greater manufacturing precision. KLA’s inspection and measurement tools are essential for maintaining quality and yield, allowing it to benefit directly from AI-driven chip production and new factory investments. Advanced packaging is another growth driver, as it is becoming vital to improving chip performance and requires much more inspection and precision. KLA’s tools play a key role in detecting tiny defects and ensuring quality in these complex chip designs, placing it at the center of a fast-growing part of the semiconductor industry. Services provide another advantage, generating steady, recurring, and high-margin revenue that grows as more KLA tools are installed around the world. This business adds predictable cash flow, smooths results through industry cycles, and deepens long-term customer relationships. Overall, I believe KLA Corporation is a high-quality company, and buying shares around the intrinsic value of the Ten Cap price of $670 would represent a strong long-term investment opportunity.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how I do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and to receive, you will have to give (Warren Buffett and Mohnish Pabrai are great examples). If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to Soi Dog. They rescue street dogs in Thailand by giving them food, medicine and vet care. If you have a little to spare, please donate here. Even a little will make a huge difference to save these wonderful animals. Thank you.

Comments