Inditex: Investing in Fast Fashion

- Glenn

- Aug 24, 2024

- 18 min read

Updated: Dec 11, 2025

Inditex is one of the world’s largest fashion retailers, known for its vertically integrated supply chain, fast fashion model, and globally recognized brands such as Zara, Pull&Bear, and Massimo Dutti. With a strong presence across 214 markets, the company combines efficient store management, rapid inventory turnover, and a growing omnichannel platform to maintain its competitive edge. As Inditex continues to invest in logistics, expand into new markets, and strengthen its operational capabilities, the question is: Should this retail giant have a place in your portfolio?

This is not a financial advice. I am not a financial advisor and I only do these post in order to do my own analysis and elaborate about my decisions, especially for my copiers and followers. If you consider investing in any of the ideas I present, you should do your own research or contact a professional financial advisor, as all investing comes with a risk of losing money. You are also more than welcome to copy me.

For full disclosure, I should start by mentioning that at the time of writing this analysis, I do own shares in Inditex. If you would like to see the stocks in my portfolio or copy my portfolio, you can do so on eToro, You can find instructions on how to do this here. Thus, I do have a personal stake in Inditex. If you want to purchase shares (or fractional shares) of Inditex, you can do so through eToro. eToro is a highly user-friendly platform that allows you to get started with investing with as little as $50.

The Business

Industria de Diseño Textil, S.A. (Inditex) is one of the world’s largest fashion retailers, founded in 1985 by Amancio Ortega and headquartered in Arteixo, Spain. The company operates a global portfolio of brands - including Zara, Pull&Bear, Massimo Dutti, Bershka, Stradivarius, Oysho, and Zara Home - offering clothing, footwear, accessories, and household products. As of January 2025, Inditex had 5.563 stores, with 4.429 company-owned and 1.134 franchised. Its sales are geographically diversified, with Europe excluding Spain contributing 50,6% of revenue, the Americas 18,6%, Asia and the rest of the world 15,7%, and Spain 15,1%. Inditex is best known for pioneering the fast fashion model through Zara. This allows the company to move from design to store shelves in as little as four weeks, significantly faster than the industry average of 8 to 12 weeks. This speed enables the company to catch trends early, reduce markdowns, and maintain higher margins. Central to this ability is Inditex’s vertically integrated supply chain, which offers end-to-end control from design to production and distribution. It uses a mix of sourcing models, relying on nearby production in countries like Portugal and Morocco for flexibility and speed, and offshore production in Asia for cost efficiency. Inditex’s business model emphasizes small batch production and frequent product refreshes, which reduces inventory risk and creates urgency among shoppers. The company discounts only 15–25% of its products, capturing full-margin sales early in the product lifecycle. Its reputation as a trendsetter, rather than a fast follower, helps Zara stand apart from competitors like H&M and Shein. This brand positioning supports premium pricing relative to typical fast fashion and contributes to sustained consumer demand. In addition to its supply chain advantage, Inditex benefits from a diversified brand portfolio, with its younger concepts like Bershka and Stradivarius contributing meaningfully to performance and helping to expand its customer base. The group’s disciplined approach to costs is also notable - operating expenses consistently grow more slowly than revenue, reflecting a lean and scalable structure. Inditex’s competitive moat lies in its uniquely integrated and flexible supply chain, its speed-to-market advantage, and the brand strength of Zara, which allow it to consistently outpace rivals in trend responsiveness, pricing power, and inventory efficiency. In a fragmented and fast-moving industry, this combination of operational agility, cost discipline, and brand relevance gives Inditex a durable edge that is difficult for competitors to replicate.

Management

Óscar García Maceiras serves as the CEO of Inditex, a position he has held since late 2021. He originally joined the company earlier that year as General Counsel and Secretary of the Board of Directors before quickly ascending to the top leadership role. Óscar García Maceiras holds a Bachelor's degree in Law from Universidade de A Coruña and earned a PhD in Law from Universidad CEU San Pablo. His professional background spans both public service and the financial sector. He began his career as a State Attorney in his hometown, where he served from 2001 to 2005. He later joined Banco Pastor as Chief Legal Officer and went on to serve as its General and Board Secretary. In 2012, he took on the role of Deputy Secretary of the Board and Head of the Corporate Legal Department at Banco Popular, before being appointed Managing Director of Corporate Development and Legal Affairs at SAREB—the Spanish asset management company created to handle assets arising from the banking crisis. He later joined Banco Santander in 2016, where he served as Group General Counsel and Deputy Secretary of the Board of Directors. Since becoming CEO, Óscar García Maceiras has overseen a period of strong growth at Inditex, marked by record sales and consistently high free cash flow per share. He attributes the company’s continued success to three enduring values: humility, caution, and ambition. Humility, in his view, means maintaining an unwavering focus on understanding and serving the customer. Caution reflects the company’s readiness to adapt to changing market dynamics and economic uncertainty. Ambition represents a commitment to continuous learning and long-term progress. His leadership style emphasizes execution, discipline, and a clear strategic vision, all while staying grounded in the company’s culture and history. Óscar García Maceiras is not a typical fashion industry executive - his legal and financial background brings a unique perspective to Inditex’s operational and governance model. Yet his approach to leadership aligns closely with Inditex’s identity: flexible, fast-moving, and focused on execution. I believe Óscar García Maceiras is well-suited to lead Inditex through its next chapter. His broad experience, commitment to the company’s core values, and strong early track record as CEO give me confidence in his ability to guide Inditex’s continued growth.

The Numbers

The first number we will look into is the return on invested capital, also known as ROIC. We want to see a 10-year history, with all numbers exceeding 10% in each year. It should be noted that Inditex’s fiscal year ends on January 31. Therefore, the figure for 2025 covers the period from February 1, 2024, to January 31, 2025. Inditex has consistently delivered a high ROIC, with the exception of fiscal year 2021, which was affected by the pandemic. Excluding that year, ROIC has remained above 15% throughout the period, which is very encouraging. While post-pandemic ROIC has not quite reached the peaks of the pre-pandemic period, it’s worth noting that recent years have been shaped by both lingering pandemic effects and broader macroeconomic headwinds. Despite that, Inditex has managed to increase ROIC each year since 2021, with the 2024 figure marking the highest level since 2019. Inditex doesn’t report ROIC as a key performance indicator, but it does focus on return on capital employed (ROCE), even breaking it down across each of its concepts. I mention this because I personally like when companies emphasize ROIC or ROCE - both are important financial metrics for assessing whether a company can be a long-term compounder. Overall, I’m very impressed with the returns Inditex has achieved and expect the company to continue delivering high ROIC in the years ahead.

The following numbers represent the book value + dividend. In my previous format, this was referred to as the equity growth rate. It was the most important of the four growth rates I used in my analyses, which is why I will continue to use it in the future. As you are accustomed to seeing numbers in percentage form, I have decided to provide both the actual numbers and the year-over-year percentage growth. Inditex has managed to grow its equity every year over the past ten years, with the exception of fiscal 2021, which was impacted by the pandemic. This is a strong sign of the company’s ability to consistently retain earnings, reinvest in the business, and create long-term value for shareholders. Steady growth in equity, especially when accompanied by dividends, reflects a healthy and sustainable business model. These numbers are very impressive, and I expect that Inditex will continue growing its equity annually moving forward.

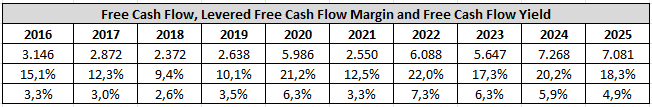

Finally, we will analyze the free cash flow. Free cash flow, in short, refers to the cash that a company generates after covering its operating expenses and capital expenditures. I use levered free cash flow margin because I believe that margins provide a better understanding of the numbers. Free cash flow yield refers to the amount of free cash flow per share that a company is expected to generate in relation to its market value per share. It is not surprising that Inditex has delivered positive free cash flow every year over the past decade. There have been periods where free cash flow declined, most notably in fiscal year 2021 due to the pandemic. In fiscal year 2025, free cash flow and the levered free cash flow margin also decreased slightly. However, this can be explained by a more than 50% increase in capital expenditures compared to fiscal year 2024. For that reason, the dip in 2025 does not concern me. Capital expenditures are expected to decrease slightly in fiscal year 2026, which should support improvements in both free cash flow and the levered free cash flow margin. The elevated spending in fiscal years 2025 and 2026 is primarily due to investments in new distribution centers aimed at expanding Inditex’s logistics capacity - an initiative that should strengthen the business over the long term. Inditex remains committed to returning capital to shareholders through its attractive and predictable dividend policy, which consists of a 60% ordinary payout plus additional bonus dividends. As the company grows its free cash flow, shareholders can reasonably expect rising dividends over time. The free cash flow yield is currently at its lowest level since 2021, but this is largely a result of the increased capital expenditures. Therefore, it may not indicate that the shares are more expensive than usual. We will revisit valuation later in the analysis.

Debt

Another important aspect to consider is debt. It is crucial to assess whether a business has a manageable level of debt that can be repaid within a period of three years, which is determined by dividing the total long-term debt by earnings. Upon analyzing Inditex’s financials, it is evident that the company has no debt. Therefore, debt is not a concern when considering an investment in Inditex. In fact, Inditex hasn’t had a debt-to-earnings ratio above zero at any point over the past decade. This consistent track record suggests that debt is unlikely to become a concern for Inditex in the future either.

Support the Blog

I want to keep the blog free and accessible for everyone. If you enjoy the content and would like to support it, you can buy me a cup of coffee through PayPal. Every little bit helps and is truly appreciated!

Risks

Macroeconomic factors is a risk for Inditex. The company operates globally and is therefore exposed to a wide range of economic conditions that can directly impact both its cost base and consumer demand. Inditex has noted that the costs of some goods and services in its value chain have not yet returned to pre-inflationary levels. In addition, several markets have experienced pressure on labor costs due to inflation and challenges in hiring and retaining workers, making it more expensive to operate in certain sourcing and retail locations. Foreign exchange risk is another important consideration. Inditex earns and spends money in multiple currencies, and fluctuations in non-euro currencies - particularly the U.S. dollar and Turkish lira - can have a meaningful effect on reported financial performance. Turkey, in particular, is a key sourcing hub for Inditex, and significant depreciation of the lira adds volatility to input costs. Other important production countries, such as Morocco, Portugal, China, and Bangladesh, also carry macroeconomic risks, including inflation, regulatory uncertainty, and currency instability. On the demand side, the economic outlook in many of Inditex’s key markets remains fragile. Economic and geopolitical uncertainty has created volatility in financial markets and consumer sentiment. When consumers feel less confident about their personal finances, they may reduce discretionary spending, which directly affects Inditex’s sales, especially in more trend-driven concepts like Zara and Bershka. While the company is highly flexible and has proven capable of adapting to a dynamic environment, these macroeconomic factors - rising costs, foreign exchange volatility, and weaker consumer demand - represent ongoing risks to both profitability and growth.

Competition is a significant risk for Inditex. The company operates primarily in the fast fashion segment, where it faces both traditional and digital-native competitors. Global players like H&M and Uniqlo continue to challenge Inditex with similar strategies focused on scale, affordability, and rapid product turnover. However, the competitive landscape has become even more intense with the rise of online-only retailers such as Shein, Boohoo, ASOS, and Zalando. Digital-first brands represent a particularly serious threat. Unlike Inditex, which operates a vast network of physical stores, online-only competitors benefit from lower overhead costs and greater operational flexibility. Companies like Shein use data-driven strategies, highly targeted marketing, and social media engagement to respond to consumer trends with remarkable speed. Shein, in particular, has been cited by industry executives as a notable threat due to its ability to replicate new fashion styles - including Zara’s - with ultra-fast turnaround times and significantly lower price points. Its business model allows it to avoid inventory risk and capitalize on viral fashion moments more effectively than traditional retailers. This digital agility gives online competitors an edge in trend responsiveness, pricing, and customer engagement. In contrast, Inditex must balance digital expansion with the ongoing costs of managing a global store footprint. While Zara and its sister brands are well established and continue to perform strongly, there is a risk that these emerging rivals could erode Inditex’s competitive advantage over time.

Supply chain disruptions pose a significant risk to Inditex, given the company’s heavy reliance on a tightly integrated and highly efficient sourcing and distribution system. The fast fashion model that underpins Inditex’s competitive advantage depends on rapid production cycles, short lead times, and consistent product flow. Any disruption in this system - whether upstream in raw material sourcing or downstream in logistics - can directly impact the company’s ability to deliver new collections quickly and profitably. Inditex sources from a network of strategically chosen regions, including Turkey, Morocco, Portugal, China, and Bangladesh. While this geographic spread supports flexibility and cost optimization, it also exposes the company to geopolitical risks. Trade tensions, sanctions, political unrest, or changes in import/export regulations in any of these countries could delay or restrict the movement of goods. For example, controversies around cotton sourcing from China’s Xinjiang region have raised regulatory and ethical concerns, highlighting how geopolitical developments can affect raw material availability and brand reputation. Another critical area of vulnerability is raw material availability. Inditex’s ability to consistently deliver new trends to market depends on the steady supply of inputs such as cotton, fabrics, dyes, and trims. Poor harvests, supplier bottlenecks, or global shortages in any of these inputs could lead to higher costs or production delays. In addition, Inditex’s supply chain is built on long-term, often exclusive relationships with specialized suppliers. While this structure enhances quality control and operational efficiency, it also creates a high degree of mutual dependency. If any key supplier encounters financial difficulties, operational setbacks, or capacity issues, the resulting disruption could quickly ripple through Inditex’s supply chain and hinder its ability to fulfill demand on time and at scale.

Reasons to invest

Operational excellence is a key reason to invest in Inditex. The company’s ability to consistently execute at a high level across both physical and digital channels has been central to driving store productivity, enhancing the customer experience, and sustaining strong financial performance. Rather than expanding aggressively for the sake of growth, Inditex takes a disciplined and strategic approach to its store network. It continues to open new locations in high-traffic areas, while closing underperforming stores and refurbishing or enlarging others to increase efficiency. Between 2019 and 2024, sales per square meter (excluding online sales) rose by 28%, reflecting the success of its store optimization program. Inditex plans to grow gross store space by around 5% annually from 2024 to 2026, with expectations that this will contribute positively to overall sales. But what truly sets Inditex apart is its integrated approach that combines physical retail with digital capabilities. Its omnichannel model allows customers to move seamlessly between online and in-store shopping, supported by innovations like automated pickup points, self-checkout terminals, and streamlined returns. The company’s operational strengths extend well beyond store management. Zara’s average four-week lead time from design to shelf enables Inditex to consistently deliver fresh, on-trend inventory, keeping stores relevant and encouraging frequent customer visits. Supplier integration is another core strength. By assigning significant responsibility to a network of trusted suppliers - while maintaining oversight on design and quality - Inditex ensures fast, flexible, and high-quality production. This reduces delays, improves inventory flow, and keeps stores stocked with timely merchandise. Quality control further reinforces customer trust. Zara performs up to 35 tests per fabric to ensure safety and consistency, helping to reduce returns and build loyalty over time. Ultimately, Inditex’s operational excellence translates into capital efficiency, customer satisfaction, and long-term brand strength. The company is not only boosting productivity across its footprint, but also reinvesting gains from technology and logistics to enhance the overall shopping experience. This disciplined execution, supported by smart investments and a deep focus on responsiveness and quality, positions Inditex well for continued long-term value creation.

Logistics investments are a compelling reason to invest in Inditex. The company’s competitive advantage in fast fashion relies not only on trend responsiveness and product quality, but also on its ability to manage inventory and deliver products with exceptional speed and efficiency. To reinforce this strength, Inditex is making substantial long-term investments in its logistics infrastructure to expand and upgrade its global distribution capabilities. This includes the construction of new distribution centers and the expansion of existing ones - facilities designed with the latest technology and high sustainability standards. These upgrades enable Inditex to improve inventory flexibility, enhance quality control, and streamline product flow from suppliers to stores or customers. This directly supports the company’s ability to deliver on its core promise: getting the right product to the right place at the right time. Logistics excellence is especially important in the fast fashion industry, where speed is a major source of competitive advantage. Inditex’s logistics investments are closely tied to its unique inventory model, which includes pre-ordering uncolored fabric and finalizing designs close to the selling season. Enhanced logistics capacity allows the company to dye, print, finish, and ship garments more quickly in response to emerging trends. This not only supports frequent product refreshes in stores and online, but also strengthens Zara’s reputation for fashion relevance and immediacy. These investments also reinforce Inditex’s regional sourcing strategy. The company sources from key regions such as Turkey, Morocco, and Portugal - locations chosen for their proximity to core markets. By strengthening logistics hubs near these sourcing regions, Inditex can reduce lead times, avoid bottlenecks, and increase the frequency of replenishment. This makes the entire supply chain more agile, efficient, and resilient, even in the face of macroeconomic or geopolitical disruptions.

Growth potential in fragmented markets is a strong reason to invest in Inditex. While the company already operates across 214 markets worldwide, it holds a relatively low market share in many of them. This highlights the significant headroom that still exists for expansion, even in regions where Inditex is already present. The global fashion retail industry remains highly fragmented, with market share split across numerous small or regional players. This creates a favorable environment for Inditex to continue scaling - by gaining share from less efficient competitors and expanding into untapped or underpenetrated areas. In emerging markets, rising middle-class populations and increasing demand for affordable, fashionable clothing make these regions particularly well-aligned with Inditex’s business model. In more developed markets, there is still room for growth by targeting underserved customer segments, launching new concepts, and enhancing omnichannel offerings. The company’s diverse brand portfolio - including Zara, Pull&Bear, Massimo Dutti, and others - enables it to appeal to a wide range of consumers and adapt to local preferences. Zara’s strong brand reputation as a trendsetter, especially among younger consumers, further strengthens Inditex’s position. In crowded, fragmented markets where many brands lack clear differentiation, Zara stands out. This visibility supports pricing power, customer loyalty, and deeper market penetration. Ultimately, the combination of low market share, high industry fragmentation, and Inditex’s scalable advantages creates a compelling long-term growth opportunity. As the company continues to expand its physical footprint, enhance its digital presence, and leverage its global supply chain, it is well-positioned to consolidate share in a market where no single player dominates.

Unlock Exclusive Seeking Alpha Discounts – Level Up Your Investing With Zero Risk

If you’ve been thinking about improving your investing process, this is the easiest way to start. These offers are only available through my links, and the Premium plan even comes with a 100% risk-free 7-day trial. Try everything for a week, and if it’s not for you, just cancel. You lose nothing.

1) Seeking Alpha Premium — Try It Free for 7 Days

Access the tools I personally use every day:

• Earnings transcripts

• Stock screeners

• Deep-dive analysis

• Portfolio tracking

• Market news with context that actually matters

Special Price: $269/year (normally $299) + 7-day free trial (for new users only)

Try Premium Free for 7 Days → HERE

(Explore everything — cancel anytime during the trial and pay $0.)

2) Alpha Picks — Proven Stock Ideas

This stock-picking service has delivered +287% returns vs. the S&P 500’s +77% (July 2022–Nov 2025).Great for investors who want curated, long-term picks backed by data.

Special Price: $449/year (normally $499)

Get Alpha Picks → HERE

(Although Alpha Picks doesn’t offer a free trial, its historical outperformance means the subscription can often pay for itself quickly if results persist. For many investors, the potential return far outweighs the upfront cost).

3) Premium + Alpha Picks Bundle — Best Value

Get both services together and save $159.Perfect if you want both broad tools and high-conviction stock ideas.

Special Price: $639/year (normally $798)

Get the Bundle → HERE

(This bundle doesn’t include a free trial, but it gives you both services at a $159 discount. You get Premium’s in-depth research plus Alpha Picks’ high-performing recommendations, making it the most comprehensive option for serious investors.)

Valuation

Now it is time to calculate the share price. I perform three different calculations that I learned at a Phil Town seminar. If you want to make the calculations yourself for this or other stocks, you can do so through the tools page on my website, where you have access to all three calculators for free.

The first is called the Margin of Safety price, which is calculated based on earnings per share (EPS), estimated future EPS growth, and estimated future price-to-earnings ratio (P/E). The minimum acceptable rate of return is 15%. I chose to use an EPS of 1,88, which is from fiscal year 2025. I have selected a projected future EPS growth rate of 8%. Finbox expects EPS to grow by 8,4% in the next five years. Additionally, I have selected a projected future P/E ratio of 18, which is twice the growth rate. This decision is based on Inditex's historically higher price-to-earnings (P/E) ratio. Finally, our minimum acceptable rate of return has already been established at 15%. After performing the calculations, we determined the sticker price (also known as fair value or intrinsic value) to be €16,05. We want to have a margin of safety of 50%, so we will divide it by 2. This means that we want to buy Inditex at a price of €8,03 (or lower, obviously) if we use the Margin of Safety price.

The second calculation is known as the Ten Cap price. The rate of return that a company owner (or stockholder) receives on the purchase price of the company essentially represents its return on investment. The minimum annual return should be at least 10%, which I calculate as follows: The operating cash flow last year was 9.288, and capital expenditures were 2.207. I attempted to analyze their annual report to calculate the percentage of capital expenditures allocated to maintenance. I couldn't find it, but as a rule of thumb, you can expect that 70% of the capital expenditures will be allocated to maintenance purposes. This means that we will use 1.545 in our calculations. The tax provision was 1.700. We have 3.115 outstanding shares. Hence, the calculation will be as follows: (9.288 – 1.545 + 1.700) / 3.115 x 10 = €30,31 in Ten Cap price.

The final calculation is called the Payback Time price. It is a calculation based on the free cash flow per share. With Inditex's Free Cash Flow Per Share at €2,27 and a growth rate of 8%, if you want to recoup your investment in 8 years, the Payback Time price is €26,08.

Conclusion

I believe that Inditex is an intriguing company with great management. The company has a moat through its uniquely integrated and flexible supply chain, its speed-to-market advantage, and strong brand recognition. Inditex has consistently delivered a high ROIC, with the exception of the pandemic period. Free cash flow decreased slightly in fiscal year 2025, but if not for elevated capital expenditures, it would have reached a new all-time high. Macroeconomic factors remain a risk, as rising costs, currency volatility, and fragile consumer sentiment across key markets can affect both profitability and demand. As a global retailer exposed to inflation, labor pressures, and foreign exchange fluctuations, Inditex is vulnerable to external shocks despite its operational flexibility. Competition is also a risk. Inditex faces pressure from both traditional rivals like H&M and fast-moving, online-only players such as Shein and ASOS. These digital-first competitors benefit from lower costs, quicker trend responsiveness, and aggressive marketing, which could erode Inditex’s market share over time. Supply chain disruptions pose another challenge, given Inditex’s dependence on a tightly integrated supplier network and rapid inventory turnover. Geopolitical tensions, raw material shortages, or operational setbacks at key sourcing hubs could delay production, increase costs, and disrupt delivery schedules. Operational excellence is a key reason to invest in Inditex, as the company consistently executes well across both physical and digital channels. Disciplined store management, short lead times, and effective supply chain coordination all contribute to strong performance and customer satisfaction. Investing in logistics further strengthens this edge. By expanding and modernizing its distribution network, Inditex improves inventory flexibility, reduces lead times, and supports more frequent product refreshes - crucial advantages in the fast fashion space. Growth potential in fragmented markets is another compelling reason to invest. Despite operating in 214 markets, Inditex still holds relatively low market share in many of them. With a scalable business model and strong brands, the company has significant room to expand both in developed and emerging markets. Overall, I believe Inditex is a great company, which is why I own shares. Buying at €42, which represents a 30% discount to the Ten Cap price, could be a solid long-term investment.

My personal goal with investing is financial freedom. It also means that to obtain that, I do different things to build my wealth. If you have some extra hours to spare each month, you can turn a few hours a week into a substantial amount of money in a few years. If you are interested to know how I do it, you can read this post.

I hope you enjoyed my analysis! While I can’t post about every company I analyze, you can stay updated on my trades by following me on Twitter. I share real-time updates whenever I buy or sell, so if you’re making your own investment decisions, be sure to follow along!

Some of the greatest investors in the world believe in karma, and in order to receive, you will have to give. If you appreciated my analysis and want to get some good karma, I would kindly ask you to donate a bit to ADEPAC. It is a charity I know first hand and I know they do a great job and have very little money. If you have a few Euros to spare, please donate here by clicking on the Paypal icon. Even one or two Euros will make a difference. Thank you.

Comments